Blackstone Readies An IPO For Vivint — WSJ

Blackstone Readies An IPO For Vivint — WSJ.

Blackstone recently invited investment banks to pitch for a so-called dual-track process that could lead to an IPO or sale of Vivint, people familiar with the matter said.

A deal could value Vivint at more than $3 billion, or $6 billion including debt, some of them said.

The latter would be about three times what Blackstone paid for the company five years ago.

Home security has been a lucrative niche for private-equity firms lately.

Apollo Global Management LLC last year bought Vivint competitor ADT Corp. in a nearly $7 billion deal, and is already preparing an IPO that could value the company at well over $15 billion including debt, The Wall Street Journal has reported.

Two years after it bought Vivint in 2012, Blackstone took sister company Vivint Solar public.

Last year, the maker of solar panels terminated a planned merger with SunEdison Inc. after SunEdison’s board began investigating claims from both a former and a current employee challenging the accuracy of SunEdison’s financial disclosures.

Private-equity firms often run a dual-track process when they are ready to exit an investment, in part because it can give them more leverage with potential acquirers.

Write to Dana Mattioli at dana.mattioli@wsj.com (END) Dow Jones Newswires September 12, 2017 02:47 ET (06:47 GMT)

Typeform, a platform for ‘conversational’ data collection, raises $35M

Today, a startup called Typeform has raised a significant round of capital to help fund its mission to change all that, with a platform that the startup claims gets its customers much better results because the interactive experiences created on it are more intuitive and thus easier to engage with.

The startup, based out of Barcelona, is today announced a Series B of $35 million led by General Atlantic as it drives deeper into international markets, specifically the US; and expands its tools for developers with more analytics and artificial intelligence features to personalise the experience more.

“We are proud to be the first company to transform the online data collection space by creating conversational forms.

“We had no intention of building a startup out of this.” Today, creating basic online forms is nearly a commoditised business, with companies like Google offering products like Forms free of charge, and social media platforms like Facebook and Twitter letting people create free polls and other services, and so on.

At the same time, the startup has very much pushed into making its service something that one can use in any scenario where a user might need to enter data: from basic information entry like job application and contact forms; through to surveys; registration forms; shopping and order forms; online learning and tests; and invitations.

Its success is also playing out in user numbers.

Typeform’s today describes its form-filling platform as “conversational”, but its original concept behind that pre-dates a lot of the talk we hear today about conversational AI, and bots.

That being said, today, the startup does not use any AI in its platform, although that is very much something that it is considering, either by growing it in-house (today the company has around 170 employees, including engineers), or by partnering with an existing firm, or potentially through an acquisition.

We want to help our customers generate more conversations, and we think our products could help with that.” The focus on creating an interactive platform based around natural language is one reason why investors were interested in helping fund the startup to grow.

“And the solution that Typeform has developed can be easily integrated and managed by the product, not the tech, team.” Caulkin is joining Typeform’s board with this round.

Typeform, a platform for ‘conversational’ data collection, raises $35M

Typeform, a platform for ‘conversational’ data collection, raises $35M.

The startup, based out of Barcelona, is today announced a Series B of $35 million led by General Atlantic as it works on expanding its tools for developers and to drive deeper into international markets.

“We are proud to be the first company to transform the online data collection space by creating conversational forms.

(I’m asking around to see if I can get a more current number and will update when and if I learn more.)

Other notable investors in Typeform include Anthony Casalena, CEO of Squarespace; Javier Olivan, VP of growth at Facebook; and Jay Parikh, Facebook’s VP of engineering.

It sometimes happens that the most successful startups are founded in response to an enterpreneur’s frustration with an existing product or service.

Co-founder Robert Muñoz and David Okuniev are both designers — specifically with focuses on interaction, UX, and UI — and running their own agencies back in 2011, they found themselves working jointly on a single brief (for a toilet company of all things).

In that work, they found themselves unable to find any templates or platforms to build online forms that could help their client not only get users to fill out their information with reliable regularity (no pun intended to the toilet company) but provide details that could be used for sales in the future.

That focus on creating an interactive platform based around natural language is one reason why investors were interested in helping fund the startup to grow.

The interactivity and square focus on sales and customer relationships also makes the company a prime target for acquisition, in my opinion, with companies such as Salesforce, Google, Facebook, Microsoft/LinkedIn and many others all looking at better ways to help businesses interface with users, particularly across platforms with more tricky interfaces, like mobile.

Going To The IPO Route: Mobile Gaming Company Nazara Technologies To Offer $156.5 Mn Public Offering Early Next Year

Going To The IPO Route: Mobile Gaming Company Nazara Technologies To Offer $156.5 Mn Public Offering Early Next Year.

Mobile gaming studio Nazara Technologies has announced plans to offer an IPO towards the end of FY18, making it the first public listing in the Indian gaming space.

As per reports, the Mumbai-based company has mandated ICICI Securities and financial services firm Edelweiss for the proposed initial public offering.

According to sources, the public offering is expected to raise a total of $156.5 Mn (INR 1,000 Cr) at a valuation of somewhere between $469.7 Mn-$548 Mn (INR 3,000 Cr-INR 3,500 Cr).

At present, Nazara is working to capture the mobile gaming market in India, Africa, and a few Middle Eastern nations.

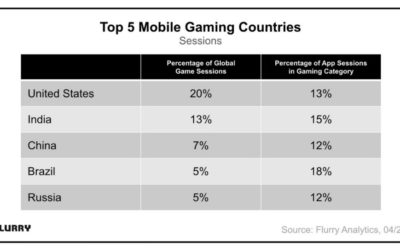

What’s Been Happening In The Mobile Gaming Market According to Inc42 Datalabs, India currently ranks among the top five countries in the world for online mobile gaming.

The funding was raised against a 30% stake in the startup.

As per the report, a total of 10 tech startups in the country have opted for initial public offerings in 2017, of which six took place in June and July.

Internet-based search company Just Dial launched its IPO back in 2013.

As per reports, Matrimony is looking to issue up to 3,767,254 equity shares in exchange for a total of $20.3 Mn (INR 130 Cr), which will , in turn, e used to fund advertising activities in the future.

In the age of Tinder, India’s most popular website for arranged marriages is going public

Dating apps like Tinder and Woo may be trendy, but when it gets serious, it is India’s matrimonial websites that still rule the roost.

As a testament to that, one of India’s oldest matchmaking portals is all set to launch its initial public offering (IPO) on Indian bourses today (Sept. 11).

The 17-year-old Matrimony.com, which operates websites such as BharatMatrimony.com, CommunityMatrimony.com, and EliteMatrimony.com, is looking to raise Rs500 crore ($78.3 million).

Chennai-based Matrimony.com is the country’s largest matchmaking company by number of visitors, according to media analytics firm comScore.

This is the company’s second attempt at going public, after it scrapped its earlier plans in December 2016, citing unfavourable market conditions.

And while dating apps are gaining traction, Matrimony.com’s founder and CEO Murugavel Janakiraman believes arranged marriages are still the norm, meaning there’s still room for his business to grow, especially as internet access expands.

To set his company apart, Janakiraman decided to focus on making it easy for users to search for partners from a wide range of religions, castes, languages, and other categories.

Now, Janakiraman said, online matchmaking portals account for around 10% of the market in India.

“We have been tracking data since 2006, and since then, we have had 26 million users of our sites,” Janakiraman said.

Janakiraman’s dating app, Matchify, didn’t have many takers either and was discontinued within a year of its launch in 2015.

Saudi Arabia’s vague economic shift leaves huge oil IPO on track

Saudi Arabia’s vague economic shift leaves huge oil IPO on track.

Saudi Arabia is still planning to sell part of its giant oil company on the stock market next year despite changes to the kingdom’s economic revival plan. “The IPO process is well underway and Saudi Aramco remains focused on ensuring that all IPO-related requirements are completed on time and to the very highest standards,” the Saudi information ministry said.

The partial sale of Aramco is part of Vision 2030, an ambitious plan to overhaul the Saudi economy and reduce its dependence on oil.

The Saudi government gave few details about the changes and did not state whether new targets would be introduced.

It said the revisions would “improve efficiency and effectiveness of delivery across institutions.” “It is tough to judge the impact of the redrafting without knowing the changes to be made,” Jean-Michel Saliba, an economist at Bank of America Merrill Lynch said in a research note on Sunday.

Some progress has been made to stabilize the economy since the overhaul was announced last year.

And much more work is needed to open the kingdom to foreign investors, develop other areas of the economy, and wean Saudis off lavish state support.

Saudi officials have said they expect the IPO to value Aramco at around $2 trillion.

Saudi Arabia Says Aramco IPO on Track as It Redrafts Reform Plan

Saudi Arabia Says Aramco IPO on Track as It Redrafts Reform Plan.

IPO process “well underway,” government says in a statement Revision of NTP reform plan represents “learning and progress” Plans to sell a stake in Saudi Arabian Oil Co. are “well underway,” the government said on Saturday, as the kingdom redrafts one of its key economic blueprints to eliminate overlap with other reform programs.

The government’s privatization program “continues to gain traction,” the Ministry of Culture and Information said in a statement.

It said more than half the objectives under the previous version have been assigned to different entities or programs.

The plan, however, was overshadowed by the prince’s Vision 2030, a broader blueprint for life after oil that calls for selling shares in Saudi Aramco and creating the world’s largest sovereign wealth fund.

Consultants and civil servants began redrafting the NTP in July, calling the effort “NTP 2.0.”

The document outlines a 16-week schedule to develop the program.

A final report is due to be delivered to the government by the end of October.

“It is important to adjust and adapt to unexpected situations, and to use new circumstances in ways that reinforce and strengthen underlying strategic objectives,” the ministry said in its statement.

“Such flexibility should not undermine the stability and predictability needed to allow private sector to plan its new investments and expansions.” The statement cited several “early successes” for the kingdom’s program, such as “a faster than anticipated reduction in the budget deficit, energy price reform” and the introduction of an excise tax on soda and tobacco products.

The Democratisation Of Startups

Now is an amazing time to be an entrepreneur.

Startup communities are being built all over the world.

You can sell to customers anywhere in the world from anywhere in the world.

The Lean Startup, and methodologies like it, gives us a formalized road map to go from an idea to a startup.

Instead of building things in secret, founders are instructed to go to market early with a minimally viable product, test it with users, and then iterate continuously.

Access to Capital While the cost of getting started has dropped dramatically, access to capital has increased equally significantly.

Today, a person starting a new business has access to individual high net worth investors, angel investors, and venture capital funds created for the sole purpose of investing in new ideas and new companies.

Accelerator programs, which provide a small amount of capital and a lot of mentoring, help founders hone their early ideas and get positioned to raise additional capital.

Online crowdfunding resources, such as AngelList, create an entirely new pool of capital for founders to access.

More people than ever are starting companies.

China’s UrWork invests in Indonesia’s ReWork via $3M deal as WeWork rivalry heats up

China’s UrWork invests in Indonesia’s ReWork via $3M deal as WeWork rivalry heats up.

UrWork, the unicorn that is competing with WeWork in China, is following its American rival’s lead by extending its reach in Southeast Asia after it took part in a $3 million funding round for Indonesia-based ReWork.

That’s just as WeWork doubles down on China, where it recently launched a local business that is aimed at rapidly growing the eight spaces it currently operates across the Greater China region.

Just as we have witnessed Chinese tech firms moving rapidly into Southeast Asia to grab a slice of the fast-growing startup ecosystem, so the co-working unicorns have taken aim at the region, and Indonesia — its largest economy — in particular.

Already, UrWork has a location in Southeast Asia via Singapore in addition to a presence in the U.S., but now it is looking to expand into Indonesia, the world’s fourth most populous country, through this deal.

We see it as a very strategic destination and are working with Rework to further open up the market and support local and overseas companies grow through the development of collaborative work spaces,” Mao Da Qing, who is CEO and founder URWork, told TechCrunch in a statement.

While of course UrWork will help with its experience and know-how.

“We can be the landing platform for Chinese companies wanting to come to Indonesia and be plugged into the ecosystem.” Left to right: Amanda Shi, executive partner at URWork, Adrian Li, founder and managing partner at Convergence Ventures, Vanessa Hendriadi, founder and CEO at Rework, Mao Da Qing, founder and CEO at URWork, Josh Zhang, chief strategy officer at URWork ReWork currently operates two locations in Indonesian capital Jakarta, a city with over 10 million inhabitants that’s known as a global social media hotspot.

There’s no immediate plan for regional expansion, but the it is looking at possible moves into the Philippines and Malaysia next year.

“All you want to do is go to your office and close the door, but sometimes it doesn’t even have windows!” It’s going to get interesting when WeWork moves into Indonesia via SpaceMob, which is working on entering the country, while Naked, another massive competitor to WeWork from China, is also casting glances at Southeast Asia.

In World of Supposed Bubbles Here’s What Investors Fear Most

In World of Supposed Bubbles Here’s What Investors Fear Most.

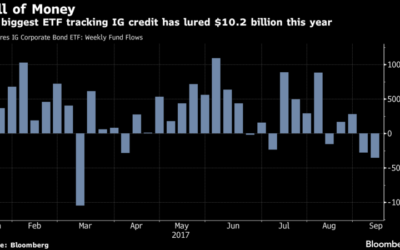

An exchange-traded fund for betting on low volatility has more than doubled in size this year.

And let’s not get started on the bitcoin rally.

“The average U.S. pension plan is still trying to generate a return of 7.5 percent,” Olu-Pitan said.

“They can’t put everything in equities to generate that return, so there’s a wall of money going into debt to get that extra yield.

He points to European companies, where yields are trading near record lows.

Money managers overseeing about $1.1 trillion have said in the recent past that they are cutting exposure to the asset class.

“That’s where you’ve got low liquidity, low visibility and greater investor propensity to panic.” Down Risk Ladder Christian Hille, Deutsche Asset Management’s global head of multi-asset, doesn’t think that fixed income is in a bubble zone.

It doesn’t mean that we are seeing that risk now, but there’s a potential black swan there.” Made in China Like many investors before him, Legal & General Investment Management’s John Roe sees China as the biggest threat.

Stabilizing economic growth this year has helped allay most, but not all, concerns.

Credit scoring platform CreditVidya bags $5 mn from Matrix, Kalaari

Mumbai-based InfoCredit Services Pvt.

Ltd, which operates credit scoring platform CreditVidya, has raised $5 million (Rs 32 crore) in a fresh round of funding led by Matrix Partners, the company said.

While Matrix put in Rs 23.81 crore, Kalaari accounted for the rest.

“Every bank and NBFC has now embraced technology-based sourcing and underwriting to help bridge the credit gap for first-time borrowers.” CreditVidya was founded in 2013 by former Experian Credit Information Company India Pvt.

CreditVidya leverages big data analysis for credit underwriting, and helps its customers assess borrowers, especially first time borrowers, more accurately.

A VCCircle analysis had showed that since January, more than 25 fintech startups have raised funds from venture capital investors across the payments, digital lending, personal finance and payment gateway space, and the number is growing.

The same month saw Bengaluru-based fintech firm Innoviti Payment Solutions Pvt.

Ltd raising $18 million in a Series B round led by the SBI-FMO Fund, Bessemer Venture Partners LP, and existing investor Catamaran Ventures.

Ltd, had raised an undisclosed amount of seed funding.

credit scoring platforms CreditVidya funded Indian fintech startups Kalaari Capital Matrix Partners VCC Startups Abhishek Aggarwal Rajiv Raj Leave Your Comment

Venture capital firm Tempus Partners is targeting B2B software startups with a new $40 million venture fund

Early-stage B2B-focused software startups will now be able to seek investment from Sydney-based venture capital firm Tempus Partners, which is looking to invest in globally scaleable startups with a new $40 million fund.

The early stage venture capital limited partnership (ESVCLP) fund will focus on startups undertaking Series A or seed funding rounds, and is Tempus Partners’ second fund since the venture capital firm was founded in 2013.

Its first fund, launched in 2015, contributed to a $1.6 million Uptick raise and invested in sports media startup Forever Network, bill analysing platform ExpenseCheck, feature management startup Feature Flow and the “Rotten Tomatoes for financial planners”, AdviserRatings.

Coleman also co-founded Software-as-a-Service startup ShippingEasy, which was later sold to Stamps.com for $80 million in 2016, and says his past experience as an entrepreneur has helped him become a more empathetic investor.

“Any investor who has been a founder has a lot of empathy for the journey, and is able to identify the founders and founding teams that are going to crawl over gravel for years in order to succeed,” he tells StartupSmart.

Coleman is not the only startup founder now on the Tempus Partners investment team: Conrad Yiu, who co-founded former Smart50 finalists Temple & Webster and Fluent Retail, as well as logistics startup Parcel Point, is also part of the team.

Coleman says the fund will be used to continue Tempus Partners’ involvement and support for Australia’s startup ecosystem by “invest[ing] in Australia’s brightest tech talent and most promising B2B [business-to-business] and globally scalable software companies.” Coleman says that these types of startups have over the last eight years created $14 billion of shareholder value, yet are often overlooked by many people outside the startup sector.

Investing in early stage ventures is something Coleman believes VC firms need to do more of, observing that “there are a lot of firms that have launched funds, but there are still not enough funds that are closed and investing [in startups]”.

Despite record-high levels of venture capital investment in Australian startups, a recent report from the Australian Private Equity and Venture Capital Association noted that Australia is still struggling to keep pace with world standards.

“As the capital flows into the sector, more companies will be founded, and ultimately we are investing in that growth.” he says.

ICICI Lombard IPO: Price band set at Rs651-661 per share

Mumbai: ICICI Lombard General Insurance Co. Ltd has set a price band of Rs651-661 per share for its initial public offering (IPO), according to a filing with the stock exchanges on Thursday.

Founded in 2001, ICICI Lombard is the first non-life insurance company to file for an IPO.

The initial share sale, a pure offer for sale, will see stakeholders ICICI Bank Ltd and Fairfax Financial Holdings Ltd sell around 86.24 million shares.

At the upper end of the price band, the share sale will fetch the two institutions a total of Rs5,700 crore.

The ICICI Lombard IPO will see a dilution of over 19% stake—7.15% of ICICI Bank and 12.27% of Fairfax.

ICICI Lombard offers a range of insurance products such as motor, health, crop/weather, fire, personal accident, marine, engineering and liability insurance, through multiple distribution channels.

Last year, ICICI Prudential Life Insurance Co. Ltd raised Rs6,000 crore in an initial share sale, the first public offering by an Indian life insurance company.

Several insurance companies, including state-owned ones, are queuing up to launch IPOs.

Insurance companies that have filed their draft IPO prospectus with markets regulator Securities and Exchange Board of India (Sebi) include SBI Life Insurance Co. Ltd, HDFC Standard Life Insurance Co. Ltd, General Insurance Corp. of India and New India Assurance Co. Ltd. First Published: Thu, Sep 07 2017.

09 47 PM IST

The company behind the burger chain that Kanye West and Nicki Minaj are obsessed with is planning to raise $24 million in its IPO

The company behind the burger chain that Kanye West and Nicki Minaj are obsessed with is planning to raise $24 million in its IPO.

Facebook/Fatburger A burger chain with a cult following is ready to claim the “FAT” ticker on the Nasdaq Stock Exchange.

On Wednesday, FAT Brands Inc. — the parent company of Fatburger, as well as Buffalo’s Cafe and Buffalo’s Express — announced that it plans to raise $24 million in its initial public offering, offering two million shares at $12 per share.

The company has applied to list its shares on the Nasdaq, under the ticker FAT.

FAT Brands also announced on Wednesday that it entered into a $10.5 million agreement to acquire Homestyle Dining LLC, the parent company of two steakhouse brands, Ponderosa and Bonanza.

With the acquisition, FAT increased its IPO price from the $20 million it announced in August.

Fatburger, which has 200 restaurants in 18 different countries, is currently the best-known of FAT Brands’ restaurant concepts.

The chain already has a cult following on the West Coast, with celebrity fans such as Justin Bieber and Nicki Minaj.

Kanye West went so far as to become a franchisee with the rights to open 10 locations in Chicago.

Sexism and Sisterhood: The Yin And Yang Of Being A Woman In Tech

Silicon Valley has recently been rocked by a series of sexism scandals and some very senior heads have rolled.

As a female tech entrepreneur I have had my share of undesirable experiences, and have heard appalling stories from my fellow tech women.

When I was raising our first round of funding, I met an angel investor who expressed an interest in the company.

A female friend who runs a deep tech start-up, which has some impressive clients, told me she spent three months in Silicon Valley attempting to raise a funding round.

She went to meetings with one identikit investor after another but, she said, ‘it’s like they couldn’t get over the fact that a woman was talking so they didn’t hear anything I said.’ She left Silicon Valley and has since successfully closed her round elsewhere.

An institutional investor I met recently says he does not mind the sexual harassment scandals coming out of tech companies because ‘we are not a social impact investor.

This has had a positive impact on the business I co-founded and on my mental wellbeing.

Our biggest investment came from a woman I met years ago, when we were both trying to escape a band of drunk bankers.

Me and the remaining woman quickly became friends so we could protect each other from unwanted attention.

While I do not support the behaviour of the men who put us in this position, that situation gave me a great friend and supporter.

WuXi NextCODE aims for the genomics database “gold standard” with new $240 million

WuXi NextCODE aims for the genomics database “gold standard” with new $240 million.

We tend to hear very little about this company in the tech industry but Chinese tech billionaire Jack Ma is one of its many backers and WXNC is counted among the largest genetic database outfits in the world, offering B2B products for research and B2C products for the Chinese consumer market.

The company was founded in 2013, as a spinoff of deCODE genetics in Iceland.

In 2015 WXNC was acquired by WuXi AppTec, the Chinese and US open access R&D platform.

WuXi AppTec then merged the company with its Cambridge, Massachusetts-based sequencing laboratory to create WuXi NextCODE.

WXNC is on track to have more than 2 million genomes in its information database by 2020, more than any other database in the world, according to the company.

“Only a platform with millions of genomes can provide the network effect and knowledge base that enable everyone to derive greater benefit, continually attracting more users, more data, and delivering ever more powerful health insights to serve people and patients everywhere,” said WuXi NextCODE chairman and WuXi AppTec founder Dr. Ge Li.

The company announced it had raised $75 of the $240 million back in June from Temasek and the Jack Ma-backed Yunfeng Capital.

Other participants in the round include Amgen Ventures, 3W Partners, and “other existing long-term partners.” WXNC had previously raised $30 million, bringing the total now raised to $270 million.

Featured Image: PASIEKA/SCIENCE PHOTO LIBRARY/Getty Images

LiDAR maker Innoviz raises $65M from Delphi, Magna and more

LiDAR maker Innoviz raises $65M from Delphi, Magna and more.

Innoviz, a company making LiDAR sensors to support the development and deployment of autonomous driving, has raised a new $65 million in Series B funding, from strategic partners and leading auto industry suppliers Delphi Automotive and Magna International, along with other investors.

The vote of confidence from Magna and Delphi is especially noteworthy, however, because both stand ready to supply automakers with core autonomous driving components and systems as top-tier suppliers.

The new funding will help Innoviz continue to push towards mass production of their LiDAR solution, which uses a solid-state design for greater reliability over time (thanks to a lack of moving parts) and which also claims better sensing capabilities across different weather conditions, including in typically challenging conditions for LiDAR like bright sunlight.

Innoviz previously announced that it would be offering InnovizPro, a development-focused version of its tech, in 2018, and it says it’s on track to begin delivering those to automakers starting in the first quarter of next year.

InnovizOne, the company’s automotive-grade LiDAR sensor designed for production vehicles, is still set to be available sometime in 2019 in a manufacturing sample capacity.

The company’s strategic partners in this round are already working with Innoviz through partnerships to bring autonomy to automotive OEMs, and to create integrations with self-driving systems targeted at the mass market.

With this funding, it can continue to work towards mass production of its new LiDAR modules, while also building out its computer vision work and making new partnerships, the company says.

Innoviz expects a second closing of the round with new partners and funding to follow, too.

With the amount of interest in self-driving vehicles, and the need to secure reliable, cost-effective LiDAR sensors to fuel their roll out, it’s not surprising the company is garnering a lot of attention and investment.

PE-backed Dixon Tech’s IPO sails through on day 2; BRNL still tepid

PE-backed Dixon Tech’s IPO sails through on day 2; BRNL still tepid.

The public offering of 2.37 million shares, excluding the anchor allotment, received bids for a little over 2.47 million shares, stock-exchange data showed.

The qualified institutional buyers’ category was covered 1.34 times the 6.79 million shares on offer.

The retail portion, in which bids cannot exceed Rs 2 lakh, was covered nearly 1.3 times the 1.18 million shares on offer.

The Noida-based company, which counts Motilal Oswal as its private equity backer, had on Tuesday raised Rs 179.78 crore ($28.04 million) by selling 1.01 million shares to a bunch of institutional investors at the upper end of the Rs 1,760-1,766 price band.

Dixon Technologies is seeking a valuation of as much as Rs 1,946.01 crore (around $305 million) through the IPO.

The public offering of 29.3 million shares received bids for a little more than 7.1 million shares, stock-exchange data showed.

The retail book was covered 1.08 times the 2.93 million shares on offer.

To be updated… Like this report?

Sign up for our daily newsletter to get our top reports.