Shasta announces Camera Fund for AR and computer vision companies

. Shasta Ventures today announced a new Camera Fund that’s designed to provide an early infusion of cash for those companies.

Jacob Mullins, a principal at the firm, said Shasta is moving away from its traditional focus on series A and B rounds for the Camera Fund because companies in these spaces are largely too new for Shasta to invest in.

The idea for the fund came about through Mullins’s work with AR Kitchen and VR Tuesday, two series of events designed to bring people working in those spaces together for conversation and learning.

“Categorically, the feedback around the table — this is for people who are building on early ARKit — was really cool, but we can’t invest in it because it’s too early,” Mullins said.

In addition to the cash infusion, Mullins said that companies working with the Camera Fund will be able to tap into Shasta’s network of experts.

Shasta benefits from getting involved this early because it can use information from the startups to help inform its future investments in the space.

“Ideally, out of this set of early developers, we’re able to learn a really critical set of user interactions that kind of become what photo-sharing or location-based ordering of things was for mobile,” Mullins said.

SBI Life’s $1.3 billion IPO opens tomorrow

. SBI Life Insurance, a subsidiary of the country’s largest lender SBI, will hit the market on to raise up to Rs 8,400 crore.

The initial share sale offer will open on September 20 and close on September 22, SBI said in a regulatory filing to the stock exchanges last week.

The IPO, which has a price band of Rs 685 to Rs 700 per share, is expected to be the largest in the insurance space as on Tuesday.

This IPO includes an initial public offer of up to 120 million equity shares of face value of Rs 10 each through an offer for sale by State Bank of India and BNP Paribas Cardif where each will be selling up to 80 million equity shares and up to 40 million equity shares, respectively.

In FY17, SBI Life’s embedded value was Rs 16,537.9 crore as of March 31, 2017. Their value of new business was Rs 1,037 crore while annualised premium equivalent stood at Rs 6727 crore for FY17.

It made a debut last year with a Rs 6000 crore IPO.

This Jack Ma-Founded Startup Is Set to Have a Major IPO This Year

ZhongAn, China’s first online-only insurance company, announced an initial public offering in Hong Kong in which it plans to raise up to $1.5 billion for a potential valuation of $10 billion.

The share sale will begin Monday morning with SoftBank Group (sftby, +0.70%) as a cornerstone investor with a 5% stake.

The listing is expected to be one of the year’s largest technology offerings in Hong Kong.

Ant Financial Services, an affiliate of Alibaba Group Holding, is among the company’s biggest shareholders.

Few other technology platforms are backed by both Ant and Tencent.

In a recent online sale, the company sold 13,000 policies per second.

Despite large sales volumes, the company has not yet demonstrated large profits, netting $1.4 million on earnings of $488 million in 2016.

They expect a net loss in 2017, which they attribute to growth costs, which resulted in a $31 million net loss in the first quarter.

More than 60% of ZhongAn’s customers are aged 20 to 35.

Shares are expected to begin trading on the Hong Kong stock exchange on September 28.

Cambridge-based CarGurus files to raise up to $100M in IPO

Cambridge-based CarGurus files to raise up to $100M in IPO.

It’s the only Massachusetts tech company to file for an IPO so far in 2017.

The company hopes to be listed on the Nasdaq exchange under the symbol “CARG.”

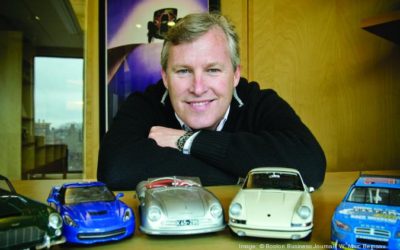

Langley Steinert, chief guru at CarGurus.

Revenue for the first six months of 2017 was $143.3 million, a 70 percent increase from the same period last year.

The company raised only $5 million in outside capital through 2014, but then raised $68 million in 2015 and another $60 million in August 2016.

The 2016 round was from Winslow Capital Management, Foxhaven Asset Management, T. Rowe Price Associates, and Fidelity Brokerage Services.

Langley Steinert, who co-founded travel reviews website TripAdvisor (Nasdaq: TRIP), started CarGurus in 2006.

The official IPO documents come several months after it was reported in March that CarGurus had chosen Goldman Sachs and Allen & Co. to underwrite a public offering.

RBC Capital Markets is also listed as an underwriter on the official documents.

Roots Files For Initial Public Offering

Roots Files For Initial Public Offering.

Roots, the Canadian lifestyle apparel chain, has filed for an initial public offering in order to ramp up its expansion efforts in North America and Asia.

The amount of shares sold the projected prices have not yet been disclosed.

The retailer is seeking to raise about Canadian $200 million in the share sale and could have a market value of about C$700 million ($574 million) after listing, sources told Bloomberg.

Established in 1973, Roots sells a wide range of premium apparel, leather goods, accessories and footwear.

As of July 29, the company had 116 corporate retail stores in Canada, 4 corporate retail stores in the U.S., 109 partner-operated stores in Taiwan, 27 partner-operated stores in China and a global e-commerce platform that shipped to 54 countries during its most recently completed fiscal year.

According to its prospectus, it plans to up to 10 stores in Canada, up to 14 in the U.S. by the end of its 2019 financial year.

It also plans to add up to 25 new locations between Taiwan and China, enter Singapore and Malaysia and is exploring other international markets.

The company has applied to list on the Toronto Stock Exchange under the symbol ROOT.

The offering is being co-led by TD Securities Inc., Credit Suisse Securities (Canada), Inc. and BMO Capital Markets, together with Jefferies Securities, Inc., RBC Dominion Securities Inc. and Scotia Capital Inc., as joint bookrunners, and CIBC World Markets Inc., Canaccord Genuity Corp. and National Bank Financial Inc., as underwriters The offering contemplates a secondary offering of common shares of Roots by investment funds managed by private equity firm Searchlight Capital Partners, L.P., and an entity indirectly controlled by the founders of Roots, Michael Budman and Don Green.

ICICI Lombard IPO opens today: Valuation a bother, but analysts recommend long-term subscription

ICICI Lombard IPO opens today: Valuation a bother, but analysts recommend long-term subscription.

Mumbai: Although analysts are upbeat about the prospects of general insurer ICICI Lombard General Insurance Co. Ltd’s initial public offering (IPO), some have concerns that the offering to raise up to Rs5,700 crore may have been steeply priced.

The ICICI Lombard IPO, a pure offer for sale, will see ICICI Bank and Fairfax Financial Holdings Ltd sell around 86.24 million shares.

The sale fetched Fairfax around $383 million (around Rs2,372.5 crore then).

“While the valuation looks higher compared to other listed financial companies, we believe premium valuations are justified in context of huge growth potentials of non-life segment, leadership positioning, strong solvency margins and consistent return on equities (ROE),” Motilal Oswal analyst Yogesh Hotwani said.

The brokerage recommended subscribing to the issue with a long-term perspective.

According to brokerage firm Prabhudas Lilladher Pvt.

Ltd. “For life insurance companies, embedded value is used as a relevant valuation measure, which is prescribed by the regulator.

ICICI Lombard General Insurance is the second insurance company from the ICICI group to go public.

Last year, ICICI Prudential Life Insurance Co. Ltd raised Rs6,000 crore in an initial share sale, the first public offering by an Indian life insurer.

Quick-charging battery startup StoreDot gets $60M on $500M valuation led by Daimler

Quick-charging battery startup StoreDot gets $60M on $500M valuation led by Daimler.

As we continue to see a proliferation of wireless connected devices make their way into the mainstream consumer electronics market, there has been growing attention on a key issue that will be central to making all these devices work: efficient power supplies, and specifically practical battery systems.

StoreDot, a startup out of Israel that is developing a new kind of quick-charging (five minutes or less) battery to replace the lithium-ion components largely in use today in phones, electric cars and other un-wired devices, has raised $60 million in funding led by carmaker Daimler with participation also from Samsung Ventures and Norma Investments, an investment firm linked to the Russian tycoon Roman Abramovich.

Daimler and Samsung have been prolific investors in autonomous car and other transportation-related startups (Samsung just earlier today signalled a new fund for this purpose; Daimler announced a round in Via just last week.)

“Our focus is to get the mobile batteries to market next year.” He also said that while Daimler’s trucks might be first in line, the plan is to integrate StoreDot’s batteries across other vehicles from the carmaker and its competitors.

Half a billion dollars in value is a big leap forward for a startup that has raised $108 million to date.

That brings various challenges to the tech world around computing power and network connectivity, but also how these devices will be powered, which is the challenge that StoreDot is addressing.

In fact, we’ve seen some very high-profile examples of just how dangerous it can be to try to quickly charge batteries that exist today: The Note 7 fiasco at Samsung (which tellingly is an investor in StoreDot) highlighted how graphite, one of the key materials in lithium-ion batteries, overheats when charged too fast.

“The tech allows for it, but it’s a question of practicality because one minute requires a very large charger, for a phone it would need a 750-watt charger.” This, he said, would look like a brick, and “it doesn’t make commercial sense to carry a small phone and big brick next to it to charge it.” It would be even worse for a car, which would need a one-megawatt station to charge a car to run for 300 miles.

“This is why we are engaged with the process of trying to open and accelerate the adoption of new standards for charging, which includes the connector, the charging station, and what runs in the car [or other device].” He noted that this is another reason why the investment from Daimler and Samsung is so critical: “For a startup to push those regulatory bodies is a challenge, but if you have a large player you have better chances to get this done in a reasonable timeframe.” Still, Myersdorf remains realistic about what StoreDot has already solved, and what lies ahead.

Eaze is moving into recreational marijuana delivery with $27 million in new funding

But the weed delivery startup has come under scrutiny recently for burning through at least $1 million in cash per month.

In contrast, other software-based pot delivery startups like Meadow have played it lean, focusing more on improving the software and logistics.

New CEO of the company Jim Patterson, who took over the role in December 2017 explains his approach as just part of the Silicon Valley cycle to get ahead, “We are a tech startup…we’re investing in growth,” he told TechCrunch when asked about the high burn rate.

“We’re investing the money now it what’s clearly going to be a very big market.” Part of the pop in the pot delivery industry is due to tech finally meeting the needs of the medical marijuana community in the the state of California, where Eaze operates.

Colorado, a state where recreational use of the drug has been legal for a couple of years now, is reportedly pulling in nearly $100 million in pot sales per month and the marijuana industry is slated to balloon to a $24 billion dollar business by 2025.

Eaze is making the bet on high growth now to cash in on a good piece of those profits later, telling TechCrunch this was the reason for the Series B raise.

We should note that its conceivable other larger tech companies in the delivery logistics space like Amazon could just as easily decide to get into the space, crushing little startups like Meadow and Eaze in the process.

“If you’re doing anything in retail and not thinking about Amazon at this point you’re crazy,” he said.

Recreational use is legal in eight states, though, as mentioned above, certain licensing provisions don’t take effect in California until the new year.

It may not be so complicated as more states adopt marijuana legalization for both medical and recreational use in the years ahead and Patterson doesn’t count out future competition from the Everything Store.

RealtyShares raises $28 million for commercial real estate investing

RealtyShares raises $28 million for commercial real estate investing.

That’s the idea behind RealtyShares, a platform which pools together debt and equity investments for apartments, office buildings and retail centers.

The startup says it has deployed over $500 million across more than 1,000 properties since it was founded in 2013.

Although once considered a site for crowdfunding, Athwal says he’d like to move beyond that label.

These days, RealtyShares is focused on institutional investors and accredited high net worth individuals.

RealtyShares makes money from placement fees and asset management fees.

Basically, it earns a commission at the time of the investment and also over time.

Athwal claims that these fees are lower than the industry average.

Tyler Christenson, managing director at Cross Creek Advisors, sent us a note saying his team led the investment round because he believes “RealtyShares is positioned to become the leading marketplace for sub-institutional debt and equity commercial real estate investment.

These commercial investment opportunities in multifamily, retail, industrial, and office properties have historically been limited to large institutions, and RealtyShares has been able to break down many of the barriers investors have faced.” John Jarve, partner emeritus at Menlo Ventures says he invested because “creating an online marketplace for funding middle-market commercial real estate development projects is an enormous opportunity.

India’s Biggest Online Matchmaker Opens Its IPO

India’s Biggest Online Matchmaker Opens Its IPO.

India’s biggest online matchmaker opened its initial public offering Monday, selling shares in Matrimony.com Ltd. for about $15 apiece.

Backed by Silicon Valley investor Bessemer Venture Partners, Matrimony.com expects to raise as much as 5 billion rupees ($78 million) with the IPO closing on Wednesday.

The startup has already raised funds from Goldman Sachs India Ltd., BNP Paribas Arbitrage and Baring Private Equity India AIF.

In a socially conservative nation where marriages are often arranged by relatives, the startup matches brides and grooms within the country as well as Indian expatriates.

Profiles can be uploaded on behalf of a son or daughter, brother or sister, indicating that many Indian families are using technology to cast a wide net.

“We provide an abundance of choice and thousands of matches to suit every criterion, all at the tap of a key.” The shares are being offered in a price band of 983 to 985 rupees each.

Wedding Services While a basic listing is free, the company offers a variety of premium packages from $65 for three months, with additional privileges like instant chats with prospects and priority listing in search results.

While the company derives 90 percent of revenue from paid profiles, it has added connections to wedding services such as a directory of photographers, decorators and caterers in what is estimated to be a $50-billion industry.

While these apps don’t specify marriage as an end goal, weddings of those who first met on dating apps are becoming more common.

Saudis may delay Aramco’s estimated US$100 billion initial public offer to 2019

Saudi Arabia is preparing contingency plans for a possible delay to the initial public offering of its state-owned oil company by a few months into 2019, according to people familiar with the matter.

Saudi Aramco said in statement the IPO “remains on track.

The IPO process is well underway and Saudi Aramco remains focused on ensuring that all IPO related work is completed to the very highest standards on time.” It didn’t give a time frame.

The comment was echoed by a Saudi government source Wednesday.

Officials have previously said the most likely schedule is the second half of next year.

For example, Saudi Arabia has yet to announce where it will sell shares in Aramco other than the domestic stock exchange in Riyadh.

Saudi Arabia is also contending with weaker oil prices, which will help determine the value of Saudi Arabian Oil Co., as Aramco is formally known.

Should Saudi Arabia achieve its valuation of US$2 trillion, the 5 per cent stake it plans to sell would raise about US$100 billion.

The share sale is the cornerstone of Vision 2030, a much wider plan conceived by Crown Prince Mohammed bin Salman to reshape the Saudi economy and diminish its dependence on oil.

Saudi Aramco has hired JPMorgan Chase & Co., Morgan Stanley, HSBC Bank Plc, Moelis & Co. and Evercore Partners Inc. to advise on the IPO.

Ex-Sequoia Asia partner Yinglan Tan closes $25M fund and makes first investment

Ex-Sequoia Asia partner Yinglan Tan closes $25M fund and makes first investment.

More details about former Sequoia venture partner Yinglan Tan’s new fund have emerged after an SEC filing confirmed that it has raised $25 million for its maiden fund, and it made its first investment.

Tan, who was with Sequoia’s Singapore office for five years in a role supporting operations before leaving this summer, is thought to be starting Insignia Venture Partners to focus on Southeast Asia’s fast-emerging startup scene.

Tan did not respond to requests for comment.

There isn’t a tonne of detail in the filing — which was first spotted by Deal Street Asia — but it looks like Tan has teamed up with fellow Singaporean Lin-Hong Wong to start the new venture.

Tan wrote two books — one on innovation in China and another on general venture capital — while Wong’s title covers venture capital fund management.

Sequoia is one of the few investment funds that operates in the Series A and Series B spaces in Southeast Asia.

Despite that and growing interest in the region from major tech companies, with recent deals from Alibaba, Tencent, SoftBank and Expedia, it doesn’t have a dedicated fund.

Instead, its Southeast Asia deals are covered by the Sequoia India fund.

Earlier this summer, Sequoia secured $4 billion in fresh financing, including $2 billion for its growth funds, according to a U.S. filing.

Exam prep startup Unacademy raises $11.5 mn from Sequoia, SAIF, others

Online learning platform Unacademy, run by Sorting Hat Technologies Pvt.

Ltd, has raised $11.5 million (Rs 73 crore) in a Series B round led by Sequoia Capital India and SAIF Partners, the company said in a statement on Wednesday.

The startup will utilise the funds to enhance its product and technology, and to scale to other categories including personality development, new languages and job interviews.

Munjal and Singh were previously running Flatchat, which was acquired by CommonFloor in 2014.

Recently, billionaire and serial entrepreneur Bhavin Turakhia joined Unacademy’s board.

In January, Unacademy raised $4.5 million (Rs 30 crore) in Series A funding led by Nexus Venture Partners and existing investor Blume Ventures.

In August 2016, the startup raised $1 million (Rs 6.7 crore) from a clutch of investors including Flipkart co-founders Sachin Bansal and Binny Bansal and Paytm founder Vijay Shekhar Sharma, with Blume Ventures leading the round.

Blume also led the company’s $500,000 (Rs 3.3 crore then) angel round in May 2016.

Unacademy competes with Byju’s, India’s best-funded ed-tech startup that raised fresh funding from China’s Tencent Holdings in July.

Like this report?

Pirelli Is Said to See $10.8 Billion Value in IPO Matching Peers

Price range said to be announced as early as this week Tire maker’s IPO could be the biggest in Europe this year Pirelli & C. SpA , the tire maker that supplies Formula One race cars, is seeking an equity valuation of as much as 9 billion euros ($10.8 billion) in its initial public offering, implying a trading multiple in line with Finnish peer Nokian Renkaat Oyj, people familiar with the matter said.

Pirelli has said it’s planning to sell a 40 percent stake in the listing next month.

Nokian trades at an enterprise value, which includes debt, of about 11.3-times expected 2017 earnings before interest, tax, depreciation and amortization, according to data compiled by Bloomberg.

Pirelli reported first-half adjusted Ebitda of 546.4 million euros.

As part of a Chinese-led takeover in 2015, Pirelli combined its industrial truck business with ChemChina’s tire unit to focus on high-end tires for consumer vehicles and to boost profit margins.

Pirelli may also encourage investors to value the firm at comparable levels to other luxury Italian companies, such as handbag maker Salvatore Ferragamo SpA and apparel firm Moncler SpA, one of the people said.

A representative for Pirelli declined to comment.

A group led by China National Chemical Corp. bought Pirelli for about 7.4 billion euros in 2015, delisting the firm after nine decades on the stock exchange.

The Chinese company and its partners plan to reduce their holding from 65 percent to below 50 percent in the IPO.

Pirelli Chief Executive Officer Marco Tronchetti Provera will stay at the helm of the firm, which makes tires for luxury auto brands including Ferrari, McLaren and Bentley, until mid-2020 and will have a leading role in choosing his successor, the company has said.

Made in heaven: Matrimony.com’s IPO

Made in heaven: Matrimony.com’s IPO.

The Indian online matchmaker is expected to raise $78m when its initial public offering closes today.

The site operates in 15 languages, permitting users to upload their profile—or, given that parents still play a big part in matchmaking, their child’s profile—and an algorithm matches horoscopic details with potential suitors filtered by caste, education and income.

Though Matrimony dominates the market, it faces growing competition as it tries to seduce the 90% of the country’s “active seekers” who don’t yet search online for a partner.

Some sites, discovering the scourge of fake profiles, are tightening up by requiring government-issued identification credentials.

Others aim for quite specific slices of the marriage market: an elite matrimony site for rich suitors, one for “non-resident Indians” and IITIIMShaadi.com, just for those graduating from prestigious universities such as IIT and IIM.

For a market flush with young folk and ever-cheaper phones, love is in the air.

ADES profit falls as IPO costs offset revenue rise

Revenue was up 46% to $87.8 million.

The company attributed the fall in profit to the one-time cost of its May IPO totaling $4.6 million.

ADES said that new contracts won in the first half of the year will not begin until 2018, as a result of which the company expects the second half of the year to be broadly in line with first-half results.

ADES International Holding Ltd. (ADES.LN) on Tuesday reported an 11% fall in pretax profit for the first half of 2017 and lowered its guidance, after contracts it won in 2017 were delayed to the beginning of 2018.

The provider of oil-and-gas drilling and production services for the Middle East and Africa made a profit of $16.6 million for the six months ended June 30, compared to $18.7 million in the year-before period–a fall attributed to the one-time cost of its May IPO totaling $4.6 million.

The company now expects the second half to be broadly in line with the first, instead of higher as previously expected.

The company also expected to close a number of competitive tenders in new regions like Iraq and the United Arab Emirates, although it would be operating through integrated service companies, said Dr. Farouk.

Shares at 0945 GMT were down 6.66 pence, or 0.7%, at 965.76 pence.

They floated on May 9 at 16.50 pence.

More from MarketWatch

Defence Startup Tonbo Imaging Gets $17 Mn Boost From WRV Capital, Others

Bengaluru-based defence startup Tonbo Imaging has raised $17 Mn in Series B funding led by WRV Capital.

The company was reportedly valued at about $62.5 Mn (INR 400 Cr).

Lead investor WRV Capital is one of the largest private venture investment in the domestic defence technology space.

Nicholas Brathwaite, Managing Director, WRV Capital said, “Based on our experience in building and investing in imaging businesses globally, we believe that Tonbo is very well-positioned for rapid growth in both military and commercial markets.

We will work closely with Tonbo to expand the use of their imaging platform into new market opportunities including surveillance and automotive applications.“ Tonbo was initially set up in 2003 as a subsidiary of Sarnoff Corporation and Stanford Research International to further research and development in next generation imaging, optics and computer vision systems.

Later it emerged as an independent entity after a management buyout.

Tonbo Imaging designs, builds and deploys advanced imaging and sensor systems to sense, understand, and control complex environments.

It also provides imaging products and intellectual property cores that can be licensed by OEMs and systems integrators.

Tonbo Imaging’s last funding round was in 2012, wherein the company raised Series-A funding from Silicon Valley-based VC firm Artiman Ventures.

With this round of funding from WRV Capital and other, defence startup Tonbo will look to expedite its international expansion.

Zilingo raises $18M for its fashion e-commerce service in Southeast Asia

Zilingo raises $18M for its fashion e-commerce service in Southeast Asia.

Southeast Asia-based fashion marketplace Zilingo has closed an $18 million Series B funding round led by Sequoia Capital India and Burda Principal Investments.

The startup had existed largely under the radar until it raised $8 million around one year ago.

“There’s no other comparable fashion brand, so we probably have a window of about a year to make to big before others follow.” Zilingo expanded into Indonesia earlier this year after Bose relocated to Jakarta to learn more about the market.

Some six months into operating there, she’s impressed by the opportunities of the country.

“I’ve never seen a market that’s so ready to consume consumer internet products,” she said.

“We are seeing 85 percent growth each month, that’s not something anyone has seen in other Southeast Asia markets.

People spend a bit less on every transaction, but the behavior is crazy and they shop more times.” “We were initially really worried about logistics, because Indonesia is an archipelago, but it hasn’t been that hard.

If your expectations are correctly set, it’s a great market,” the Zilingo CEO added.

Bose added that she’s particularly excited to work with Burda, which has emerged as one of the few traditional Series B investors in Southeast Asia after hiring ex-GREE investor Albert Shy to head up the region.