- Cross-asset investors concerned about credit, Bitcoin, China

- BAML says price gains are getting ‘more bubbly’ than in past

From Alan Greenspan and the current Federal Reserve staff to fund managers hoarding cash, people feel queasy about asset prices.

Euro high-yield debt is trading in line with U.S. Treasuries for the first time ever. Tajikistan is selling Eurobonds as yields on the junkiest emerging markets drop below 6 percent. An exchange-traded fund for betting on low volatility has more than doubled in size this year. And let’s not get started on the bitcoin rally.

Asset prices are getting “more bubbly” than in past periods of effervescence, analysts at Bank of America Merrill Lynch warn. The fault, they say, lies with central banks, which have plied markets with almost $14 trillion of stimulus and pushed investors further out the risk spectrum to generate returns. Fed staff in August said asset prices have increased from “notable to elevated.”

European Central Bank President Mario Draghi attempted to alleviate concerns on Thursday, telling journalists that there is “no systemic danger” from bubbles.

With so many bubble-like scenarios to analyze, we asked multi-asset fund managers to tell us which ones they dislike the most.

Nowhere to Hide

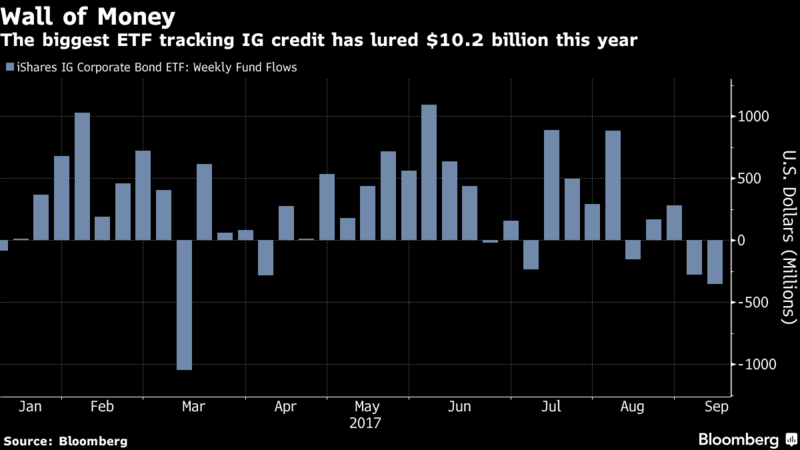

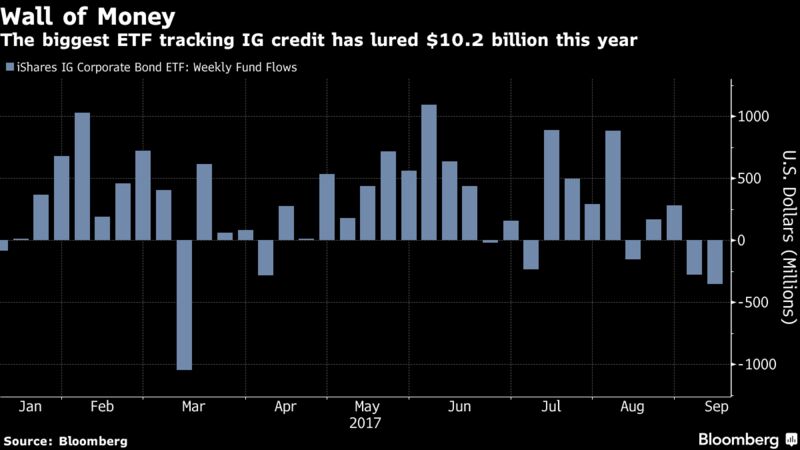

Schroder Investment Management’s Remi Olu-Pitan agrees with Greenspan’s comments last month that there’s a bubble growing across fixed-income markets. The most dangerous spot, she says, is high-grade credit because that’s where funds turn to for returns when they can’t make them in sovereign debt.

“The average U.S. pension plan is still trying to generate a return of 7.5 percent,” Olu-Pitan said. “They can’t put everything in equities to generate that return, so there’s a wall of money going into debt to get that extra yield. If that starts to unravel, everything unravels and there’s nowhere to hide.”

Junk Danger Zone

The fact that junk-rated bonds no longer reward investors for all the risk they take on puts them in clear bubble territory for Ben Kumar, a money manager at Seven Investment in London. He points to European companies, where yields are trading near record lows.

Kumar isn’t alone….