Early-stage investment fund Microtraction launched in Nigeria

Early-stage investment fund Microtraction launched in Nigeria.

Early-stage investment platform Microtraction has launched in Nigeria, planning to invest US$65,000 in startups at the very earliest stage of their development.

Initially it will offer startups US$15,000 for a 7.5 per cent equity stake, followed by an additional US$50,000 convertible note at a US$1 million valuation cap in companies that show significant progress.

Bademosi said Microtraction hopes to directly or indirectly fund 1,000 startups per year at scale with this model.

“Microtraction is built to solve this problem, on one hand we have a sizeable number of startups in Nigeria and Africa that possess high growth and innovative potentials but often fall short of the investment prerequisite of VC funding, due to the reduced instances of angels funding and mentors for these startups.

It will then work closely with the startups, providing pre-seed funding and professional and advisory services to them, and assisting in getting startups to a point where they can raise an institutional round of funding from VCs or join world-class accelerators like Y Combinator, 500 Startups or Techstars.

“We believe our principal role at Microtraction is to increase the number of venture bankable startups across the continent, creating the market for venture and growth stage capital to follow on and ultimately bridging the pre-seed funding gap that currently exists,” Bademosi said.

“Microtraction will back founders at the earliest stages of the venture.

We won’t consider anyone or project “too early”.

We are biased towards technical founders due to our own experience as founders.

What’s in a name? Aussie founders weigh in on whether a startup’s name directly influences investment

Aussie founders weigh in on whether a startup’s name directly influences investment.

The research is based on a two-part study conducted by researchers from Stony Brook University, Drexel University, and Villanova University, who examined 131 crowdfunded projects and 1681 initial public offerings, reports Business Insider.

Uniqueness is only a virtue with early-stage investors, however, with the study finding that since very little is known about a startup in its early stages, unique names give the impression that there is something special about the company.

StartupSmart spoke to three uniquely-named Australian startups to find out how they chose their names, whether this affected their efforts to secure investment, and what entrepreneurs should know before settling on a brand.

“Startups can be covered by the same rules that we made up one night back in the music industry: avoid fancy and tricky combinations of letters and upper/lower case that nobody will spell right,” Ryan advises.

Ryan also emphasises the role branding plays in the perception of a startup, noting Corilla’s distinctively simple pencil on a bright yellow background has been instrumental in promoting brand recognition since the startup launched in 2014.

“People often come up to us at conferences and tell us that they love the logo, or walk up pointing, ‘you’re the ‘yellow pencil’!’.

“The most important thing is picking a name that you can move in to, that doesn’t tie you in to one thing.” Michael Jankie, co-founder and chief executive of PoweredLocal Michael Jankie, co-founder and chief executive of Melbourne-based social Wi-Fi startup PoweredLocal, advocates the virtues of generic names for startups, but admits that despite securing more than $500,000 in funding, the PoweredLocal name is still “one we struggle with”.

“I’m sure certain names appeal to different people, but when we named our company PoweredLocal, we did not necessarily think we would be doing just Wi-Fi, so we wanted it to be generic,” Jankie says.

With this in mind, Jankie advises startups should “pick a name relevant to your industry and speak to investors that are also relevant to your industry”.

Carrefour’s Brazil Unit Prices I.P.O. at Low End of Range

at Low End of Range.

RIO DE JANEIRO — The Carrefour Group, a French retailing giant, said on Wednesday that its Brazilian subsidiary had priced an initial public offering of stock at the bottom of its expected price range, a sign of the uncertainty plaguing Latin America’s largest economy.

The initial public offering of Atacadão, the parent company of Carrefour Brasil, is the biggest in Brazil in recent years, and it is the first since President Michel Temer was implicated in an continuing corruption investigation in May, unnerving investors.

While the pricing showed that investors remain cautious, that the offering was moving forward was seen as a benefit for a nation bedeviled by prolonged political and economic upheaval.

Including an overallotment of shares, Atacadão raised roughly $1.6 billion in the offering, which was priced at 15 reais a share, or $4.73, at the bottom of a previous range of 15 to 19 reais.

The market debut comes at a time when President Temer’s survival is very much in question.

As he is being investigated, economic reforms are moving slowly.

But Atacadão is the first on the Brazilian exchange since the airline company Azul’s offering in April.

The corruption accusations in May led to a market sell-off and prompted some companies to suspend their plans to go public.

Carrefour acquired Atacadão in Brazil in 2007.

TPG RE Finance Trust, Inc. Announces Pricing of its Initial Public Offering

TPG RE Finance Trust, Inc.

NEW YORK–(BUSINESS WIRE)–TPG RE Finance Trust, Inc. (“TRTX”) today announced the pricing of its initial public offering of 11,000,000 shares of its common stock at $20.00 per share.

TRTX has granted the underwriters a 30-day option to purchase up to an additional 1,650,000 shares of its common stock at the initial public offering price less the underwriting discount.

The offering is being made through an underwriting group led by BofA Merrill Lynch, Citigroup, Goldman Sachs & Co. LLC and Wells Fargo Securities, who are acting as joint book-running managers for the offering.

TPG Capital BD, LLC and JMP Securities are acting as co-managers.

The offering of these securities may be made only by means of a prospectus.

TRTX is externally managed and advised by TPG RE Finance Trust Management, L.P., an affiliate of TPG Global, LLC.

Cautionary Statement Regarding Forward-Looking Statements The information contained in this press release contains “forward‐looking statements.” These forward‐looking statements are subject to various risks and uncertainties, including, without limitation, statements relating to the performance of our investments and our financing needs and arrangements.

Forward‐looking statements are based on certain assumptions, discuss future expectations, describe existing or future plans and strategies, contain projections of results of operations, liquidity and/or financial condition or state other forward‐looking information.

We do not undertake any obligation to update any forward-looking statements contained in this press release as a result of new information, future events or otherwise.

China And Others Are Funding Huge International Development Projects, But What Happens When They Fail?

China And Others Are Funding Huge International Development Projects, But What Happens When They Fail?.

Not long ago, few governments or companies would dream of building large-scale infrastructure in another country.

China is building new cities in Georgia, Egypt, Malaysia, and Sri Lanka; a German company built an entirely new town in China; an American company built a state of the art new city from scratch in South Korea; a developer from Abu Dhabi is building a new district in Belgrade; Japan is pumping hundreds of billions of dollars into rail lines, metro systems, bridges, and ports in places like India, Bangladesh, the Philippines, and Cambodia.

What’s more, as China advances across Asia and Africa with its Belt and Road initiative, a competitive dynamic has been established as other regional powers appear to be scurrying to land as many big ticket international infrastructure projects as they can — before China swipes them all up.

What happens when big dreams and solid plans are sabotaged by local competitors?

The government administration that signed the deals with China to fund and build the Hambantota projects got voted out of power in 2015 in exchange for rivals who ran on a platform of opposing such Chinese investment — claiming that it was riddled with corruption and didn’t favor Sri Lanka.

Working with a country that was fast becoming financially and politically bankrupt, China agreed to a debt-for-equity swap where the China Merchants shipping company would pay off $1.1 billion of Sri Lanka’s $8 billion worth of Chinese-owned debt in exchange for an 80% share of Hambantota port.

This deal, which has been largely interpreted as Sri Lanka selling itself out to China, provoked a huge amount of public outcry and discontent, which has occasionally boiled over into violent demonstrations, and is still not settled.

The A2 Highway Project When you bring up Chinese investment in Poland, you will almost invariably provoke a story of the ill-fated A2 highway project.

The Chinese firm halted work in protest; Poland sued.

As DC venture funding dollars go up, number of deals dips down

As DC venture funding dollars go up, number of deals dips down.

D.C. is posting big-money venture deals lately, but the Washington Post points out that doesn’t mean the number of companies getting funded is increasing.

Looking at deals for the second quarter of 2017 culled from Pitchbook investment data analyzed by the National Venture Capital Association, the Washington Post notes EverFi’s $190 million raise as the latest in a series of big venture raises that accounted for a big portion of the quarter’s total amount raised in the region.

And the $435 million total venture funding is strong compared with four years ago.

That’s a far cry from a few years ago, when the number of deals per quarter tended to come in above 60.” Framebridge’s $16.7 million Series B showed that companies are still getting funded.

And D.C. isn’t alone, as this latest quarterly report mirrors national trends.

But it’s worth watching to see if this gap has an impact on how companies approach funding, especially as we see startups continuing to seek new ways of raising capital.

Stephen Babcock is Market Editor for Technical.ly Baltimore and Technical.ly DC.

A graduate of Northeastern University, he moved to Baltimore following stints in New Orleans and Rio Arriba County, New Mexico.

His work has appeared in The New York Times, Baltimore Fishbowl, NOLA Defender, NOLA.com/The Times-Picayune and the Rio Grande Sun.

4 Lessons U.S. Entrepreneurs Can Learn From Latin American Startup Culture

Startup investments are on the rise in Latin America, and there’s now more capital available than ever before.

Startups in Latin America have to be extra scrappy to build their ventures, and many of these startups are proof that it can be quite advantageous to grow a business this way.

Whether it’s bootstrapping, hiring only when necessary or focusing on revenue first, there are plenty of lessons U.S. entrepreneurs can learn from Latin American startups.

Because there tends to be less later-stage funding available outside of the U.S, startups in regions like Latin America, whether they’re building products for the Latin American or U.S. market, must focus instead on generating revenue much earlier on to keep their companies alive.

This focus on real, sustainable growth forces a startup to build something that actually works and generates money.

At the same time, investors in Latin America are traditionally more risk-averse, therefore generating revenue is often the only way for startups to prove their concept or business model and raise VC funding.

They usually raise funding to battle their way into a new country, one at a time, and then hit a number of roadblocks due to language barriers, cultural differences or poor attempts at adapting their products for the local market.

Economic uncertainty is a part of life in Latin America, however, companies that can quickly adapt to market changes are the ones who find the most success when replicating their operations.

There is plenty of bilingual, top talent in Latin America what can work with U.S. companies in real-time, due to limited time zone restrictions.

And there are plenty of other startups like Alegra in Latin America.

Nauto raises $159M to fuel expansion of its autonomous driving data platform

Nauto raises $159M to fuel expansion of its autonomous driving data platform.

Nauto, a Palo Alto company focused on retrofitting existing vehicle fleets with networked safety camera-equipped devices, has raised $159 million in a Series B round led by SoftBank (which has been quite spendy lately).

The company’s products focus on gathering data about human drivers and their behavior in order to improve safety practices right now, but their platform also has a second, potentially more lucrative purpose: building a huge data set that can prove very valuable in the development of self-driving cars.

That’s where SoftBank’s interest lies, according to CEO Masayoshi Son, who noted in a statement that “Nauto is generating a highly valuable dataset for autonomous driving, at a massive scale,” in addition to establishing itself as a telematics business that can produce revenue right now, while simultaneously amassing a library of data from a huge cumulative pool of real-world driving hours.

The potential value of this data for autonomous driving is a big reason why a number of automakers have also made strategic investments in Nauto, including General Motor Ventures, Toyota AI Ventures and BMW iVentures.

This funding will help really accelerate the pace of that data gathering effort, giving Nauto the ability to “more rapidly… gather the billions more miles of real driving experience and data required to get a precise understanding of how the best drivers behave behind the wheel,” according to Nauto CEO Stefan Heck.

Nauto’s tech uses a dual-camera windshield-mounted device, with one camera facing inward tracking driver behavior and the other facing outward to monitor the road.

The company employs deep learning and computer vision to process the data collected by its units in the cloud, and provide insights and coaching services to counter things like driver distraction and fatigue.

One of the big advantages of Nauto as a stepping stone to autonomy, however, is the cost of deployment — its hardware is relatively inexpensive and can be used immediately with vehicles on the road today, following a simple installation process.

One of self-driving’s biggest challenges remains a simple issue of volume, and Nauto is positioned well to help address that because of its low friction, low cost and immediate returned value to fleet operators.

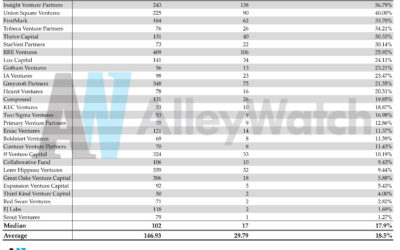

These are the NYC Venture Capital Firms That Lead Funding Rounds Most Often

These are the NYC Venture Capital Firms That Lead Funding Rounds Most Often.

This signals validation to other potential investors and can introduce a sense of urgency.

Today, I take a look at the rate at which a number of New York-based venture capital firms lead funding rounds using some data from our friends at Crunchbase.

While examining the data, it is important to keep the following in mind as these factors do have an impact on the data:.

Only venture capital firms that are headquartered in NYC were considered.

This data does not include angel nor accelerator investments.

Only venture firms that have made 50+ investments were considered.

The data does not take into account the stage preferences for the venture firms.

Only venture firms that are active were considered; meaning that the venture firm has made at least one investment in 2017.

The data is current of 7/16/17.

Mangrove raises $170M for its new fund to invest in Europe and Israeli startups

Mangrove raises $170M for its new fund to invest in Europe and Israeli startups.

Mangrove has been one of Europe’s most successful VCs, backing hits such as Skype (sold twice and now part of Microsoft) and Wix.com (which is now publicly traded).

So far the firm has invested in more than 130 companies since 2000.

We prefer to invest in unproven or unusual technologies rather than chase the latest fad.” Compared to much bigger fund raises from other European VCs in the last year or so, including EQT Ventures (over €500 million), Atomico Ventures (latest fund: $765 million) and Index Ventures (latest fund: $1.25 billion), $170 million seems relatively modest.

Mangrove is also famous for being the first investor in Skype, turning a $2 million investment into $200 million.

Mangrove now has more than $1 billion under management and a team of 12, which includes partners in Berlin and Tel Aviv.

Its investments include WalkMe, Lesara, JobToday, FreedomPOP, Wallapop, Kang and Happify.

Partner Michael Jackson, who was previously COO at Skype, is on the board of AXA and Blockchain.

Mangrove also is among the guard that is pushing for more evolution in investing.

Other VCs have launched similar initiatives, including LocalGlobe and Accel Partners in London.

Godrej Agrovet files IPO papers with Sebi

Godrej Agrovet files IPO papers with Sebi.

Godrej Industries arm Godrej Agrovet on Wednesday filed draft papers with markets regulator Sebi to raise an estimated Rs 1,000-1,200 crore through an initial public offering.

The public issue comprises fresh issue of shares worth Rs 300 crore besides an offer for sale of scrips of up to Rs 300 crore by Godrej Industries and up to 1.23 crore shares by V- Sciences, as per the Draft Red Herring Prospectus (DRHP).

Besides, the company is considering a pre-IPO placement of up to 5.6 lakh equity shares worth up Rs 252 crore.

Godrej Industries owns 60.81 per cent in Agrovet, which is in businesses such as agri-inputs, animal feeds, palm oil manufacturing, dairy and poultry.

Proceeds of the IPO will be utilised towards repayment of loans and for other general corporate purposes.

According to merchant banking sources, the company is expected to garner an estimated Rs 1,000-1,200 crore through the initial public offer (IPO).

Kotak Mahindra Capital Company, Axis Capital and Credit Suisse Securities (India) Pvt Ltd will manage the company’s public issue.

The equity shares of the company are proposed to be listed on BSE and NSE.

Last month, Godrej Industries had announced that its board ‘has decided to participate in the IPO of equity shares by Godrej Agrovet Ltd’.

India’s Rentomojo raises $10M from Bain Capital and Lending Club founder

India’s Rentomojo raises $10M from Bain Capital and Lending Club founder.

It’s nearly one year to the day that Rentomojo raised $5 million, and since then the three-year-old company has expanded its focus from renting out home appliances and furniture into motorbikes, a potentially lucrative segment.

The idea of the company is to cater to India’s migrating workforce.

It is currently active in eight cities in India, including Bangalore, Mumbai and Delhi.

All told, Rentomojo CEO and founder Geetansh Bamania told TechCrunch he believes the total market is worth $60 billion per year.

For the expansion into bikes, Bamania the goal is to “offer something that’s less than the cost of Uber or Ola.” He estimates that many in urban areas spend upwards of $100 per month on such apps, whereas a Rentomojo bike typically costs $30-40 per month.

He said the company is evaluating another new transportation product which could launch in the next three to four months, though he declined to provide specific details at this time.

Besides that potential expansion, the goal is really increase awareness of Rentomojo among its services among its target audience.

“Our eight cities cover a good 60-70 percent of online commerce [shoppers in India] right now, we are now looking to go into a lot more depth in the cities we exist in,” he said.

“We are looking for leadership, ideally those in senior leadership roles that we’d love to join with experiences in fintech, finance and consumer lending.” Already, though, Rentomojo is getting a healthy injection of experience as Laplanche, who helped pioneer peer-to-peer lending with Lending Club, and Bain Capital Ventures MD Salil Deshpande have taken seats on the startup’s board.

Fintech beats e-commerce in funding in the first half of 2017

And as data from YS Research shows, in the last six months, startups in the financial technology space have even managed to surpass even the most glamorous of all sectors, e-commerce, in terms of funding raised.

Together fashion companies have raised more than $50 million in H1 2017, but even including that, the gap between fintech and e-commerce remains wide.)

Money involved in Series A, B, and C will depend on the maturity of the startup.” Surprise entrant A distant third in line is cleantech, which raked in almost $700 million, the bulk of which went to wind energy company ReNew Power which raised about $690 million across three rounds.

The sector, however, seems to have great potential, with India and China having beaten the US in attracting investment into the sector, according to a recent EY report.

Fall from 2016 At number seven, the logistics sector got together just $250 million, a major decline from $680 million last year.

Delhivery’s $100 million Series E round accounted for the biggest chunk, followed by Blackbuck with $70 million, Rivigo with $15 million, Let’s Transport with $4 million and Blowhorn for $3.7 million.

Leading the way was Practo with $55 million in a Series D round, and Healthcareathome’s $40 million.

Others that raised funding included IGenetic Diagnostics ($20 million), Pharmeasy ($16 million), Sigtuple ($5.8 million), Sastasundar ($5 million) and Curefit (3 million).

Funding in edtech also slid to $90 million this year from $104 million in H1 2016 – this included Byju’s $30 million in March, Cuemath’s $15 million from Alphabet, Eruditus’ $8.2 million, Unacademy’s $4.5 million, Testbook’s $4 million, Toppr’s $3.2 million, and Inurture’s $1.5 million, among others.

Among the prominent ones were the $80 million in Series E that food delivery service Swiggy raised, the $25 million in ID Fresh, $20 million in Zomato, $10 million each in Milk Mantra and Licious, $6.8 million in Wow!Momo, $6.3 million in Faasos, $5 million in HolaChef and $1 million in debt for Box8.

BP is thinking about an IPO for its US pipeline assets

BP is thinking about an IPO for its US pipeline assets.

Thomson Reuters (Reuters) – BP Plc is considering spinning off certain U.S. pipeline assets in the U.S. Gulf and Midwest in an initial public offering, the company said in a statement on Tuesday.

The potential IPO would structure the assets as a master-limited partnership (MLP), a frequently used corporate structure for pipeline companies.

Both BP and its underwriters have retained advisors to explore the sale, the person said.

Media reports in 2015 said BP America was trying to sell North American pipelines and gas storage assets.

Last year, BP approached Enbridge Inc in an effort to sell some of BP’s offshore Gulf of Mexico pipeline network, known as the Mardi Gras Transportation System, without success, according to a person familiar with the matter.

If successful, the deal would be one of the largest initial public offerings of the year, the person said, speaking on the condition of anonymity as the talks were private.

BP did not comment on the details or valuation of the potential transaction beyond the press release.

(Reporting By Jessica Resnick Ault; Editing by Cynthia Osterman and David Gregorio) Get the latest Oil WTI price here.

Copyright 2017.

Venture capital is key to modern Alaska economy

Venture capital is key to modern Alaska economy.

If completed, the plan will expand Alaska’s economic base, create tens of thousands of high-paying jobs across all regions of the state, and generate new, diversified revenue for state budget needs.

Alaska’s economy (and your paycheck) exists because people in the Lower 48 and foreign countries send money here; mostly for our oil.

To reverse Alaska’s economic decline we need to do three things: We can achieve these objectives by giving Alaskans the resources you need to create and own your own large companies that sell goods and services to customers in the Lower 48 and foreign countries; companies across a diverse set of industries that draw money to Alaska and expand the corporate income tax base in the state.

Most Alaskans can’t afford to launch a startup.

To create startups, Alaskans need the type of funding used by entrepreneurs in the Lower 48.

This type of funding is called equity financing, and it comes in three stages: Angel money helps you get organized, venture capital helps you get going and grow, and private equity is there when your startup gets big.

Alaska has no venture capital.

How many of you would leave your job or other responsibilities to launch a startup if most of the money needed to succeed — venture capital — doesn’t exist in Alaska?

I would like to build a venture capital organization in Alaska that helps other Alaskans launch and grow your own startups, creates additional growth and liquidity opportunities for angel portfolios, and expands the pipeline for private equity investors in the state.

Federal Street Acquisition Corp. Announces Pricing of $400,000,000 Initial Public Offering

Announces Pricing of $400,000,000 Initial Public Offering.

BOSTON–(BUSINESS WIRE)–Federal Street Acquisition Corp. (the “Company”), a newly organized blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses, today announced the pricing of its initial public offering of 40,000,000 units at a price of $10.00 per unit.

Once the securities comprising the units begin separate trading, the Class A common stock and warrants are expected to be listed on the NASDAQ Stock Market under the symbols “FSAC” and “FSACW,” respectively.

Citigroup Global Markets Inc. and BofA Merrill Lynch are acting as joint book-running managers of the offering.

The offering is being made only by means of a prospectus.

When available, copies of the prospectus may be obtained from Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, Telephone: (800) 831-9146, Email: prospectus@citi.com or BofA Merrill Lynch, Attention: Prospectus Department, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte NC 28255-0001, dg.prospectus_requests@baml.com.

A registration statement relating to the securities has been declared effective by the Securities and Exchange Commission (“SEC”) on July 18, 2017.

This press release contains statements that constitute “forward-looking statements,” including with respect to the proposed initial public offering and the anticipated use of the net proceeds.

Copies are available on the SEC’s website, www.sec.gov.

Contacts Sard Verbinnen & Co. Matt Benson, Robin Weinberg or Devin Broda, 212-687-8080

Federally funded programs help boost innovation

Federally funded programs help boost innovation.

However, the Small Business Innovation Research Program (SBIR) and the Small Business Technology Transfer (STTR) initiatives are not among those.

SBIR/STTRs provide a critical source of funding for research and development and technology commercialization in startup companies.

Federal agencies with specific scientific and technological goals release SBIR/STTR solicitations to tap into the many private sources of innovation that exist across the U.S.

The government views the resulting scientific innovation and the social and economic benefits they bring about as ample “consideration” for its investment.

There is extensive peer review and vetting.

Angels and VCs often wait to invest until there’s at least a prototype or clinical trials given the high risk of the discovery phase.

That’s why we have developed the Oklahoma Small Business Research Assistance program, a partnership between the Oklahoma Center for the Advancement of Science and Technology and i2E that is focused on helping more Oklahoma innovators identify and compete for federal research funding.

SBIR/STTR funding is not quick money.

Any entrepreneur who is building a company based on developing a new technology should look into the Small Business Research Assistance program.

What data tells us about the future of India’s tech startup ecosystem

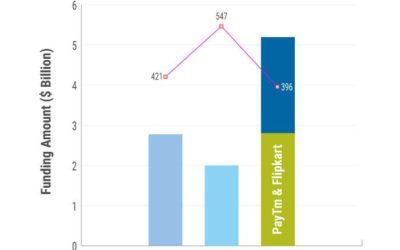

VCs weigh in on the Series B and C crunch; healthtech and fintech are the sectors to watch out for Over $5.19bn was raised by India’s tech startup ecosystem during the first half of 2017, according to data provided by startup intelligence firm Tracxn.

However, the deal count is down year-on-year (YoY) by 27%, with only 396 tech startups getting funded, as compared to 547 in H1 2016.

There were 68 Series A rounds in H1 2017, compared to 77 and 79 in H1 2015 and H1 2016 respectively.

There were only 10 Series C deals in H1 2017, the lowest since 2015 in terms of deals and dollars raised.

Only two Series D stage deals were done in H1 2017, again signalling a crunch in mid-stage venture capital.

All kinds of ad-hoc things were getting funded, and so on,” said Somani.

This Coimbatore-based startup tells us how Consumer tech startups, ie startups focused on online retail, home improvement, transport, foodtech, and travel sectors, accounted for close to $2.6bn in funding in 2017.

If the delta between the two years is just Flipkart and Paytm, is that really representative of the broader market?” Somani asked.

A lot of notable exits happened in the secondary market, Dhol said. “A lot of early VC funds around the 2006-07 time frame — the moment of truth for those funds is now.