VCs weigh in on the Series B and C crunch; healthtech and

fintech are the sectors to watch out for

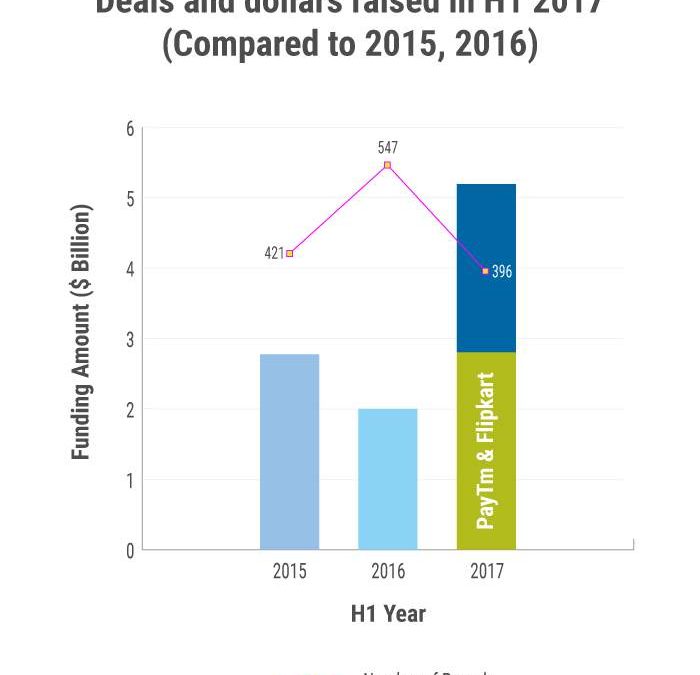

Over $5.19bn was raised by India’s tech startup ecosystem during the first half of 2017, according to data provided by startup intelligence firm Tracxn. While this counts as a solid fundraising H1 as compared to 2015 and 2016, over 53% of the total capital raised went to just two companies — Flipkart and Paytm, which went on to bag $1.4bn each in April and May respectively this year.

However, the deal count is down year-on-year (YoY) by 27%, with only 396 tech startups getting funded, as compared to 547 in H1 2016. Here’s a quick analysis of the data, with some industry inputs on the current funding climate for tech startups in India.

While H1 2017 has seen solid fundraising compared to 2015 and 2016, over 53% of the total capital raised went to just two companies — Flipkart and Paytm — which went on to bag $1.4 bn each

Series C rounds are a lot tougher to crack

Breaking down the rounds stage-wise, the angel funding stage appears healthy, with 113 deals, as compared to 100 rounds in 2016.

However, there were 156 seed rounds in H1 2017, a significant fall from H1 2016, where 281 companies raised funding.

There were 68 Series A rounds in H1 2017, compared to 77 and 79 in H1 2015 and H1 2016 respectively. However, these companies collectively raised just $191.6M, which indicates a trend of smaller average ticket sizes, from the highs witnessed in 2015 ($412M) and 2016 ($262M).

There were only 10 Series C deals in H1 2017, the lowest since 2015 in terms of deals and dollars raised.

Only two Series D stage deals were done in H1 2017, again signalling a crunch in mid-stage venture capital.

“The timelines for Series B and Series C have increased significantly. The hurdles, the questions asked, the people dropping out at the last moment. It’s much harder”

“I think it is becoming tighter and tighter, the scrutiny is going up. It’s probably the lowest level it should go down to, but I don’t expect it to go down further. It’s a bloody tough time; Series B and Series C is tough,” said Parag Dhol, managing partner at Inventus Capital Partners, an early stage technology fund focused on Internet, software, mobile, and IoT sectors.

“The timelines for Series B and Series C have increased significantly. The hurdles, the questions asked, the people dropping out at the last moment. It’s much harder,” he said. Reading into data from research firm Venture Intelligence, Dhol said VC activity was down 25% this year, and seems to be settling at a level that is 30%-35% higher compared to 2010/13.

“I like to classify various years as signal and noise, so 2014 and 2015 were clearly noisy years, and in 2016, it (VC activity) had tempered down; now the noise has disappeared. It’s the signal now, so to speak,” he said, adding that there’s still a lot of capital available in the seed and Series A stages. “I don’t think the tap is closed,” he added.

“With a lot of ‘hot’ money departing, I think Series B or Series C is where there’s a lot more of a crunch,” said Amit Somani, managing partner at Prime Ventures, a Bengaluru-based early-stage VC firm, in a phone chat with FactorDaily. “At the macro level, the crunch is in Series B. Series A is also kind of okay, beyond the 2015 binge that some of the larger VCs had,” he said.