This article was written by Sonny Singh, CCO of Bitpay.

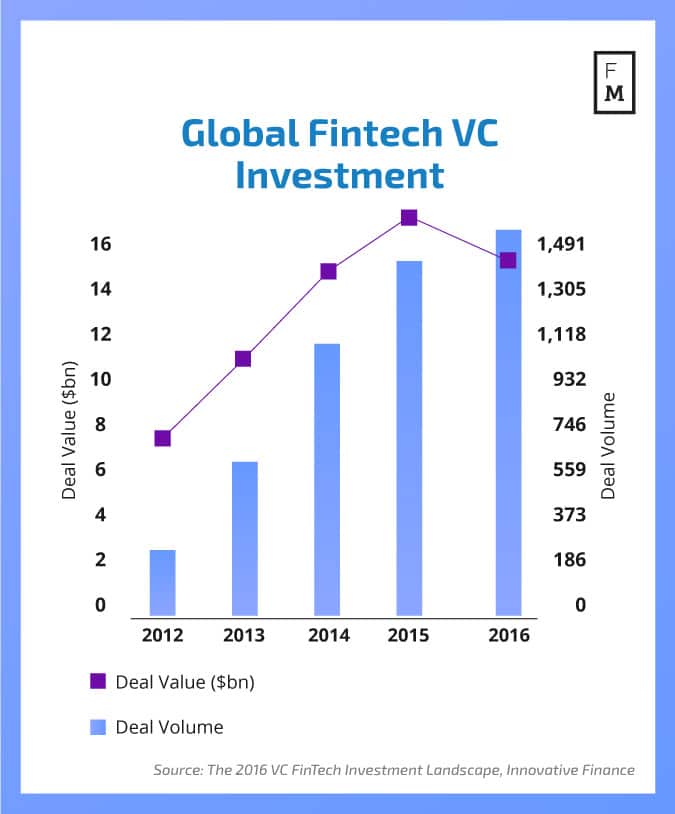

The recent high profile fundings of Robinhood and Stripe have led many to believe it’s very easy for companies to raise venture capital. Unfortunately, this does not always seem to be the case, especially for fintech companies.

In 2016, the total number of funded deals dropped to 1,436 from its previous-year high of 1,617. According to CB Insights, seed investments made up 29 percent of the deals in 2016—down from 35 percent the year before —while Series D investments rose to 7 percent.

Over the last year, I’ve met with several fintech founders who attested to the trouble they’ve been having trying to raise a seed round. I started to see many common trends and problems the founders were encountering.

1. First Time Founders

Most founders I met with were first time founders from large financial institutions that have limited experience in technology, venture capital, or even the Silicon Valley ecosystem. This type of founder was new to the concept of raising venture capital. They want to set up meetings with the large traditional Silicon Valley VCs and assume it would be easy to get funding with just a powerpoint presentation. They are surprised to learn that VCs invest in about 1-2% of the companies they meet with.

I need to explain that normally the first money in a seed round comes from friends and family, and former employers or advisors. I also encourage them to look at joining fintech incubators like 500 Startups, Wells Fargo, Plug and Play, and Yodlee, as these incubators provide great training for first time founders.