The snap judgment on Snap (SNAP), sponsor of the disappearing-message social network that is all the rage among teens, is that it is a hit — for its first day as a public stock.

Yet questions linger about the stock’s long-term prospects, given Snap’s weaknesses and the uninspiring record of newly public shares lately.

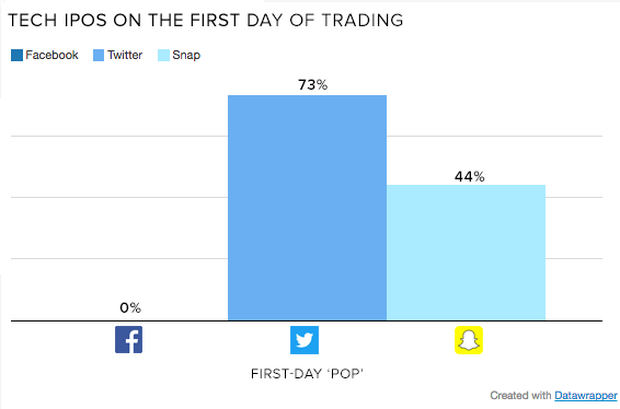

Up more than 44 percent on Thursday, Snap’s stock gave heart to investors amid a languid market for initial public offerings. Only 26 tech companies went public in 2016. Overall, 105 IPOs took place last year in the U.S., way down from 170 the year before. IPO issuance has dipped since the financial crisis, and low interest rates have made it easier for startups to attract private capital from venture investors, delaying their need to go public.

On average, IPOs underperform the market in the three years after going public, according to Jay Ritter, a University of Florida professor who studies new share offerings. Since the March 2009 market bottom, after the financial crisis, the S&P 500 has climbed 254 percent, while the Bloomberg IPO index rose 165 percent. What’s more, eight of the 10 biggest tech IPOs dropped by between 25 percent and 71 percent in their first 12 months post-IPO, a recent Reuters analysis found.

A debate swirls around why IPOs are such investment laggards. One reasonable explanation is that a lot of them are simply not ready to go public, but their founders want to cash in. Big IPOs create a lot of instant billionaires, especially in Silicon Valley. The ongoing stock rally, which has picked up speed since President Donald Trump’s election, may coax more to take the plunge.

The fear is that Snap, like too many IPOs before it, will fizzle as well. One key date to watch out for is six months from now, in September, when the stock’s lockup expires. A lockup is the period after a stock sale when company insiders are forbidden to sell their holdings. This is meant to thwart insiders, who got shares for much less than the IPO price, from flipping the stock for an instant profit.

When they do sell after the lockup, and if there’s a rush for the door, the price can take a pounding and regular investors can get hurt. To lessen that threat, Snap has imposed a year-long lockup for a quarter of the stock it sold, allocated to existing investors. On the other hand, that means there’s another date to watch out for, in March 2018.