Jeff Bezos, the billionaire founder and chief executive officer of Amazon.com Inc., doesn’t spend much time schmoozing with investors. He takes just a handful of meetings with the fund managers who own Amazon’s shares each year. And when he comes to the U.K., there’s just one investor he regularly meets with: Baillie Gifford.

Baillie who? The 109-year old asset management firm, which manages 159 billion pounds and is based in Edinburgh, Scotland, isn’t exactly a household name, even in the U.K.

And yet in the past decade, Baillie Gifford has emerged as one of the world’s most active technology investors, and one of a tiny number of European investment houses that matter in Silicon Valley and Shenzhen. Besides Amazon, Baillie Gifford owns significant stakes in Facebook Inc., Alphabet Inc., Netflix Inc., salesforce.com Inc., NVIDIA Corp.. and Tesla Inc. as well as Baidu Inc., Tencent Holdings Ltd and Alibaba Group Holding Ltd.

So how has an old-line Scottish investment manager located far from the world’s leading tech centers become a top-ranked tech investor?

The firm got its start in 1907 as law partnership between Colonel Augustus Baillie and T.J. Carlyle Gifford. The duo switched to investment management the following year when they saw an opportunity to lend money to Malaysian and Sri Lankan rubber plantations providing tires for Ford’s new Model T. The firm soon branched out, backing U.S. railroads in the 1920s, and then automakers and steel mills – the growth stocks of mid-20th Century America. It was one of the first international investment companies to venture into Japan in the 1960s. But Baillie Gifford remained rooted in Edinburgh, where most of its 43 partners are based.

In the past five years, the Scottish firm has joined a handful of U.S. asset managers, like Fidelity and T. Rowe Price, in backing fast-growing private tech companies with globe-spanning ambitions. Its stable of “unicorns” – private companies with valuations north of $1 billion — now includes Airbnb Inc., Spotify Ltd., Dropbox Inc., Palantir Technologies Inc., Indian e-commerce giant Flipkart Ltd. and Indian Uber-rival Ola, and U.K. peer-to-peer lender Funding Circle Ltd., among others.

In mid-April, it added another: Baillie Gifford was one of a half-dozen investors in a $600 million funding round for the ride-hailing service Lyft Inc. that valued the Uber Technologies Inc. competitor at $7.5 billion.

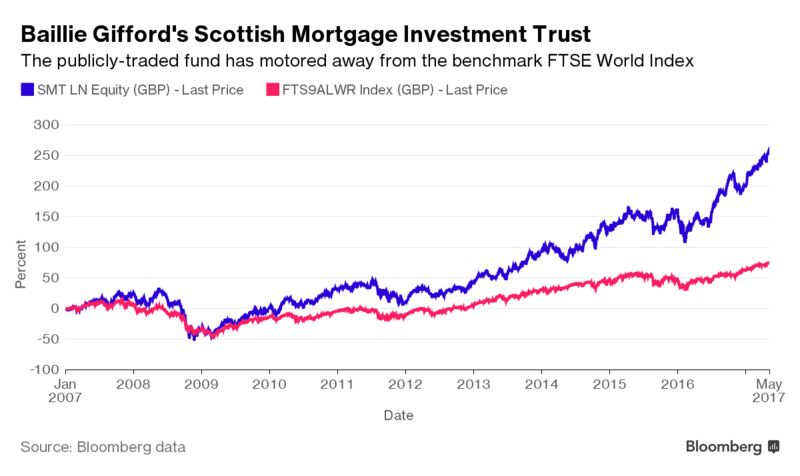

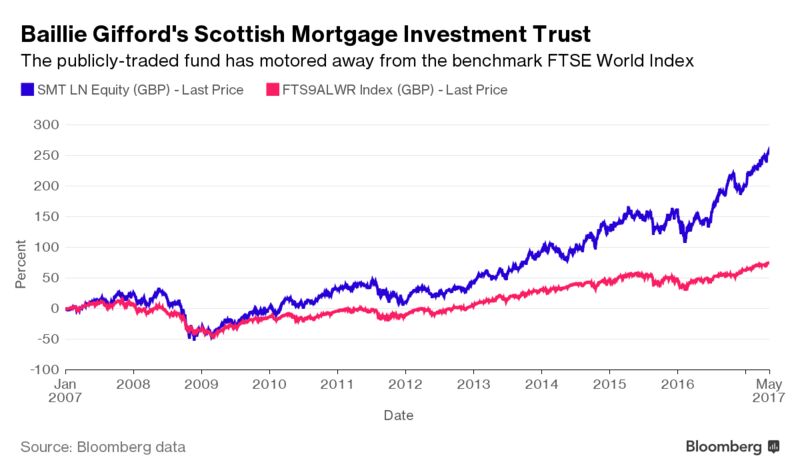

These tech investments have helped boost Baillie Gifford’s signature fund, the Scottish Mortgage Investment Trust PLC — a publicly-listed, closed-end investment fund that has a market value of 5.1 billion pounds — to annualized average return before expenses of 14.6 percent in the decade through the end of April, according to Bloomberg data. That compares to just about 9 percent for other global equity funds and the benchmark FTSE World TR Index, according to fund research company Morningstar.

Not everything Baillie Gifford has invested in has done well. The Scottish firm is a major backer of Rocket Internet SE, the controversial Berlin-based technology incubator run by entrepreneur Oliver Samwer and his brothers that are famous for copying the business models of Silicon Valley startups. Baillie Gifford is Rocket’s fourth largest shareholder, holding 6.5 percent of the incubator’s stock across several portfolios. It has also been a leading investor in individual funding rounds for some of Rocket’s bigger portfolio companies, such as meals delivery business HelloFresh and online furniture seller Home24.

Rocket shares have fallen 58 percent since the company’s initial public offering in October 2014. Tom Slater, who co-manages the Scottish Mortgage Investment Trust, defends Baillie Gifford’s involvement with the German “startup factory,” saying the firm believed Berlin could become a tech hub to rival Silicon Valley and that investing in Rocket was a good way to get a slice of the Berlin tech scene.

David Holder, a senior analyst at fund research firm Morningstar Inc., warns that Baillie Gifford’s Scottish Mortgage Investment Trust “is not a fund for widows and orphans.” The fund was hammered during 2008 financial crisis, losing almost 45 percent of its value, and also lost more than 15 percent in 2011 due to poor performance of its holdings in biotech firm Illumina Inc., Spain’s Banco Santander SA, farm equipment maker Deere & Co., and several mining companies, like Vale SA and KGHM Polska Miedz SA. In 2016, despite double-digit gains, it trailed the benchmark by more than seven percentage points and its peers by more than 5 percentage points. “But if you hold it over the long-term you have a pretty good chance of making money,” Holder said.

Slater, who in addition to his role at the Scottish Mortgage Investment Trust is one of the decision makers for Baillie Gifford’s tech-heavy Long-term Global Growth Fund and runs the firm’s North American investment desk, said the firm has always been tech-focused in a way: from the Model T to the Tesla Model 3 is not such a leap, he argues. (Baillie Gifford is Tesla’s third largest shareholder, with an 8 percent stake.)

Baillie Gifford’s contemporary interest in tech investing stems from a revamp of the firm’s portfolio in 2004, following…