Venture funding for startups is looking a little more promising–but only a little.

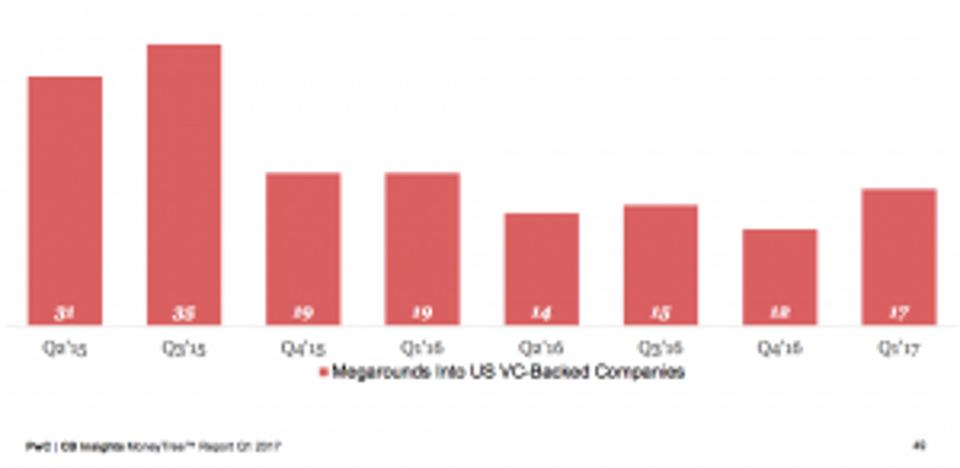

The quarterly MoneyTree Report on investment in venture-backed companies, issued by PricewaterhouseCoopers and CB Insights, released early Wednesday, marked a slight uptick in the first quarter, thanks to a rising number of megarounds of more than $100 million. Venture capitalists and corporate investing arms invested $13.9 billion into startups, up 15% from the fourth quarter. The number of deals rose more modestly, up 2% to 1,104 companies, the first increase several quarters, according to PwC.

“We’re still seeing a lot of money coming into the system,” said Tom Ciccolella, PwC’s U.S. venture capital leader. But that’s about as positive a spin as could be put on the numbers.

A lot of the 15 percent jump in funding came from 17 megadeals of more than $100 million, up from 12 in the fourth quarter, which doesn’t necessarily signal a broad-based recovery in investing. Worse, that $13.9 billion is down 11% from first-quarter 2016, for the second-lowest quarterly total in the past year two years. And the number of deals fell 15% from a year ago.

All this is despite a seemingly favorable environment for investing: a rising stock market, falling unemployment and upward revisions in gross domestic product numbers. “We’re taking a pause,” said Bob Ackerman, founder and managing director of Allegis Capital.

In particular, although three new unicorns–companies with a valuation of a billion dollars or more–were minted in the first quarter, that’s way down from the teens in 2015. Given the concern among many investors that funding of unicorns was getting overheated, that may actually be healthy. Either way, it’s a big change that indicates money is harder to come by, even by some of the largest companies.

Page 1 / 2 Continue

Venture funding for startups is looking a little more promising–but only a little.

The quarterly MoneyTree Report on investment in venture-backed companies, issued by PricewaterhouseCoopers and CB Insights, released early Wednesday, marked a slight uptick in the first quarter, thanks to a rising number of megarounds of more than $100 million. Venture capitalists and corporate investing arms invested $13.9 billion into startups, up 15% from the fourth quarter. The number of deals rose more modestly, up 2% to 1,104 companies, the first increase several quarters, according to PwC.

“We’re still seeing…