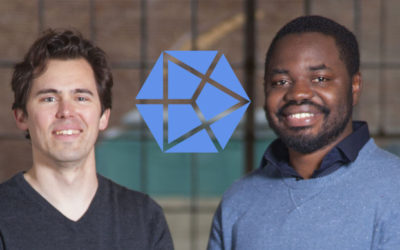

Cowboy is a new e-bike startup from founders of Take Eat Easy

Cowboy is a new e-bike startup from founders of Take Eat Easy.

Dubbed Cowboy, the company is building a new electronic bicycle that it claims will address issues that have historically stopped e-bikes from becoming a “fully fledged mobility solution”.

“We are still entirely focusing on product development.

We will keep iterating on the product in the coming months, with the objective to launch early Spring 2018”.

Key features include what Roose says is an intuitive and automatic motor assistance, a removable semi-integrated “smart battery,” and an app to turn the bike on and off and support theft detection, including GPS tracking.

In addition, Cowboy plans to offer remote troubleshooting and software updates.

The startup says it will sell the e-bike through direct channels, allowing for “disinter-mediated” pricing of €1,399.

“As a digital native vertical brand, we’ve developed our own technology, allowing us to control both product design and production cost.

To develop a connection with our customers, and lower prices, we will only distribute our product through direct sales channel,” adds Roose.

Cowboy’s other founders are Karim Slaoui, who along with Roose previously co-founded Brussels and London-based Take East Easy, an early Deliveroo competitor, and Tanguy Goretti, who was previously co-founder and CEO of Djump, an early competitor to Uber Pop in Europe.

Same-day delivery startup Deliv expands to 1,400 cities, rivalling Amazon’s Prime Now

As Amazon continues to expand its retail muscle beyond its own e-commerce portal, there’s been some activity among startups and businesses hoping to develop systems that can help others compete better with it.

Deliv, a “crowdsourced” same-day delivery startup that currently partners with some 4,000 retailers to help them offer same-day delivery services to rival those of Amazon, today announced that it has expanded its service to 33 markets and 1,400 cities, up from 19 markets previously.

This is a notable market expansion: Deliv says that is now covers a footprint the same size as Prime Now, the same-day delivery service that Amazon provides to its Prime subscribers, one of the bigger selling points for people signing on to Prime and buying from Amazon.

Deliv squarely addresses one aspect of the commerce retail chain: getting delivery of goods purchase online, and getting them quickly — a service and expectation that has become a norm for many in today’s on-demand world.

“As retailers look to offer a consistent experience nationwide, they need a proven, trusted, national partner.

UPS in fact is doing more than just working with them: the company led Deliv’s last funding round of $28 million, which also included participation from a couple of other strategic investors that face a lot of pressure from Amazon: retail property and mall operators GGP and Simon Property Group.

The expansion announced today will help Deliv scale the services that it has already built out — which include Deliv Fresh for groceries, meal services and other perishable foods, and an alchohol delivery service — as well as the footprint to build out new verticals.

Deliv not the only one going after individual segments of Amazon’s longer business chain.

Others include the likes of Postmates and DoorDash, while others like Bringg are looking build and provide an Amazon-rivalling platform to manage delivery operations more efficiently, whatever courier you happen to be working with (or using your own).

Others like Dote are trying to build alternatives to Amazon’s marketplace, without the own-brand coopetition that Amazon brings to the table.

Why Uber should accelerate initial public offering

by The Lex Column Uber’s new chief executive says the company might go public between 2019 and 2021.

He should go sooner.

In Dara Khosrowshahi’s first meeting with employees on Wednesday he told them that – although public life “sucks” because of investors’ short-term focus – the ride-hailing app would eventually do an initial public offering.

In reality, Uber has helped repudiate the idea that venture-backed companies should defer IPOs indefinitely.

Employees have been left demoralised – or just left – as Uber’s sexual harassment scandal spiralled out of control.

An ineffective board failed to impose discipline on executives and then indulged in damaging lawsuits.

Not every public company imposes strong governance but it is hard to imagine that a traditional shareholder base would have allowed the situation to fester.

Public enemies aver that Uber’s share price would have fallen on the scandals.

But this has happened anyway.

From what is visible from the company’s skimpy financial releases, however, Uber is on course to make about $US8bn a year in “adjusted” revenues, net of the portion paid to the drivers, and heavy, though diminishing, losses.

Uber CEO: Company could go public in 18 months

Uber CEO: Company could go public in 18 months.

Uber’s newly minted CEO, Dara Khosrowshahi, says that the company could go public in as soon as 18 months.

In remarks given during his first appearance in front of Uber employees on Wednesday, Khosrowshahi said that the company could do an initial public offering in 18 to 36 months, reports the Wall Street Journal who spoke with a person in attendance.

Khosrowshahi reportedly noted that this timeline wasn’t firm and could be extended.

Khosrowshahi was offered the position of Uber’s CEO on Sunday, which he accepted Tuesday.

Investors value the company at roughly $50 billion.

The company is still recovering from a damaging sexual harassment scandal that saw more than 20 employees fired in June after more than 200 cases of sexual harassment were reported.

In March, reports revealed technology that Uber was using to circumvent laws against it in some cities.

Kalanick didn’t do the company any favors when a video of him yelling at an Uber driver surfaced on the internet in February.

Khosrowshahi said on Wednesday that Kalanick will still have a role at the company, but has not offered specifics yet.

Deal Street: Indian Startups Raised Nearly Rs 1,100 Crore Last Week

Six companies raised nearly Rs 1,100 crore in angel, seed and venture capital funding, across areas like financial technology, retail and digital lending.

Digital lending firm Capital Float raised $45 million to scale up operations in a round led by Palo Alto-based fintech investor Ribbit Capital, taking its total equity investment in the Bengaluru-based company to $87 million (Rs 555 crore).

“We aim to enable loans to small mom-and-pop shops, medical stores, salons and small restaurants,” he added.

Mobile payments firm Ezetap raised $16 million (Rs 102 crore) in a round led by U.S.-based JS Capital Management, the investment fund of Jonathan Soros, a company statement said.

Existing investors – Palo Alto-based Social Capital and Li Ka-Shing’s Horizons Ventures – also participated in the round.

It’s the third round of funding raised by the company.

The investment will be used to expand the company’s operations in Gurugram.

Delhi-based male grooming startup Bombay Shaving Company raised about $2.3 million (Rs 15 crore) in a round led by Fireside Ventures.

Existing investors S Ramadorai, former managing director and chief executive officer at Tata Consultancy Services; Pankaj Gupta, supply director at United Spirits Ltd., and senior executives at McKinsey & Co. also participated in the round.

EasyGov, a Noida-based software-as-a-service startup that helps users avail social welfare benefits, raised an undisclosed amount in angel funding led by Tata Trusts-backed Social Alpha, the company said in a statement.

Shareholders ok DoubleDragon’s P7.5B “re-IPO”

Shareholders ok DoubleDragon’s P7.5B “re-IPO”.

Fast-growing property developer DoubleDragon Properties Corp. obtained on Wednesday approval from shareholders to raise as much as P7.5 billion in fresh capital through a re-initial public offering (IPO).

Unlike the P1.16-billion IPO conducted in April 2014 – which was entirely taken up by domestic retail investors because the company was much smaller then – the new follow-on offering aims not just to raise fresh capital but attract foreign institutional investors, DoubleDragon chair and chief executive officer Edgar Sia II said.

“For the last two years, we’ve been joining different conferences and met about 300 (foreign institutional) investors.

That’s the group that we want to tap.

DoubleDragon is now talking to a few foreign and local banks to tap for the re-IPO, which the company hopes to pursue within this year.

An underwriting arrangement is expected to be firmed up soon.

During the annual meeting on Wednesday, shareholders of DoubleDragon ratified a plan to issue up to 150 million common shares from the company’s authorized but unissued capital stock.

The follow-on stock offering is likewise in line with DoubleDragon’s upgrading of its 2020 net profit goal to P5.5 billion from P4.8 billion as it expects its leasable portfolio to become bigger than originally projected by that time.

DoubleDragon now expects its 2020 leasable portfolio to reach 1.2 million square meters compared to the old target of one million square meters.

Homelike, a German startup that lets business travellers find an apartment, picks up €4M Series A

Homelike, a German startup that lets business travellers find an apartment, picks up €4M Series A.

One growing sector we can add to the travel accommodation list is long term stays for business travellers.

The German startup targets business travellers who need “long-stay” accommodation of a month or more and for which a hotel doesn’t really cut it.

“Furnished apartments were more comfortable, flexible and also significantly cheaper than hotel rooms.

We both liked it way more than hotels!

However, it was anything but easy to find a suitable apartment and book it online from a remote location.

At the same time, companies increasingly require employees to relocate temporarily as part of their work for weeks if not months on end.

“Also companies themselves are trying to cut accommodation costs rapidly these days,” he adds.

To take advantage — and feed — this trend, Homelike offers an entirely online and “no friction” booking experience for furnished apartments for long stays.

“Similar to the shifts we are experiencing in transport and mobility, we believe that the rental market will develop towards a ‘living-as-a-service model’,” says Figge.

Homelike, a German startup that lets business travellers find an apartment, picks up €4M Series A

Homelike, a German startup that lets business travellers find an apartment, picks up €4M Series A.

One growing sector we can add to the travel accommodation list is long term stays for business travellers.

The German startup targets business travellers who need “long-stay” accommodation of a month or more and for which a hotel doesn’t really cut it.

“Furnished apartments were more comfortable, flexible and also significantly cheaper than hotel rooms.

We both liked it way more than hotels!

However, it was anything but easy to find a suitable apartment and book it online from a remote location.

At the same time, companies increasingly require employees to relocate temporarily as part of their work for weeks if not months on end.

“Also companies themselves are trying to cut accommodation costs rapidly these days,” he adds.

To take advantage — and feed — this trend, Homelike offers an entirely online and “no friction” booking experience for furnished apartments for long stays.

“Similar to the shifts we are experiencing in transport and mobility, we believe that the rental market will develop towards a ‘living-as-a-service model’,” says Figge.

How does IPO allotment to retail investor happen? Here is cutting through the confusion

How does IPO allotment to retail investor happen?

All four had made two applications in the IPO under Retail Individual Investors (RII) category.

One of them did not get any allotment, one got allotment against both applications, and the other two got allotment in one out of two applications.

Cap on retail individual investors The cap for RII is `2 lakh and each IPO must have reserved quota for this category.

And the process of proportionate allotment may work against small retail investors.

That means, one could apply for minimum of 30 and maximum of 480 shares under RII category.

By allotting only 30 shares to all applicants, only about 3.94 lakh applicants got the allotment.

The basis of allotment was decided as 86:423, which means one in every five applicants would get allotment.

It can happen in an IPO, where the number of applications is more than the maximum number of RII that can be issued the smallest lot.

No wonder, the four friends with different allotment outcomes got equal number of shares allotted despite different application size.

Oaktree plans multimillion euro bonus ahead of IPO

Oaktree plans multimillion euro bonus ahead of IPO.

New housebuilder being prepared for flotation has been named Glenveagh Proprties Three directors behind a new Irish housebuilding company being prepared for a €350 million initial public offering by US private equity group Oaktree are set to benefit from a multimillion-euro share incentive scheme, The Irish Times has established.

A company called Glenveagh Properties, which was established in recent weeks, is the vehicle that is being lined up for flotation, according to sources familiar with the plan.

Oaktree, among the most active buyers of distressed Irish property loans and assets in recent years, has been working for some time with Maynooth-based builder Bridgedale, led by Stephen Garvey, on a plan to combine assets in a vehicle and float it on the stock market to take advantage of a shortage of homes in the Republic.

Filings for Glenveagh Properties with the Companies Registration Office show that Mr Bickle and Mr Garvey have each been awarded 90 million so-called founder shares in the company and Mr Mulcahy a further 20 million.

The exact objectives have not been outlined.

Rather than take money at the time, Cairn’s three founders – chief executive Michael Stanley, his brother Kevin and Scottish accountant Alan McIntosh – received 100 million founder shares in the company, entitling them to receive 20 per cent of total shareholder returns over seven years.

To date, almost 53 million founder shares have been converted into ordinary stock, worth about €87 million.

Oaktree and Bridgedale’s decision to go down the IPO route comes as the latest data from the Central Statistics Office shows that home price inflation was running at an annual rate of 11.6 per cent in June.

However, industry sources say that banks, rattled by the financial crisis, are demanding that builders provide much more equity to deals than during the boom.

Michael Jordan funds mercenary dev hub Gigster’s $20M enterprise pivot

Michael Jordan funds mercenary dev hub Gigster’s $20M enterprise pivot.

That’s why Redpoint is leading Gigster’s $20 million Series B joined by previous investor Andreessen Horowitz, and basketball legend Michael Jordan making one of his first tech investments.

“Since the invention of computers, new technologies have made programming languages exponentially higher level,” Gigster co-founder Roger Dickey tells me.

“These shifts, combined with the ‘future of work’ accelerants such as freelancing and AI, have changed software engineering dramatically and will continue to do so.” Freelance-fueled rocketship When Gigster raised its 2016 Series A, it had just three enterprise clients.

Since then it’s scaled up to more than 40, with project size up 10X and revenue up 3.5X to the double-digit millions per year.

Gigster claims to have 93 percent client satisfaction, with 94 percent of projects within budget and 96 percent of milestones hit on schedule.

At its core, Gigster is fusing teams of freelancers with advanced project management tools and artificial intelligence to ensure gigs get done on time and on budget.

He started Gigster with co-founder Debo Olaosebikan to make it easy for anyone to pay to get software designed, coded and delivered.

“I think now is the right time to start this company as there’s structured data on work.

These tools and more like its Team Builder, PM Assistant and Code Librarian could be invaluable to companies working on lots of projects, and give Gigster a SaaS-subscription revenue stream where it doesn’t have to pay out a big chunk to its freelancer teams.

The Worst-Case Scenario for Passive Investing (Part II)

Innovation Competition is what academics worry about when they worry about passive investing.

But academic studies have shown recently that index funds or horizontal ownership, where the same investors own a good percentage of the shares in rival companies, can also stifle competition.

In 2014, two economic consultants, Jose Azar and Isabel Tacu, and a Michigan economics professor, Martin Schmaltz, found that in the airline industry, where common ownership had risen to 70 percent, prices were as much as 12 percent higher because of common shareholders.

At roughly 20 percent of the market, passive investing, by Philippon and Gutierrez’s calculations, at least in part, could be holding down corporate investment by $125 billion a year.

Without active fund managers, IPO bankers would have no investors to market to or figure out how to price an offering.

But you can imagine an IPO market that is dominated by IPO index funds.

The number of public companies has been falling, too.

Even companies in index funds may soon start to believe their stock prices no longer reflect their value despite good earnings or a new product.

Those companies might abandon the public market as well.

Perhaps indexing, and the growth of the private market, and private equity funds, and the still very liquid bond market, will morph the U.S. finance market into something that can support the world’s largest economy without a public stock market that is neither well used or loved.

Four cos line up Rs 2,500 crore IPOs in September

New Delhi, Aug 28 (PTI) Looking to tap into the upbeat investor sentiment, as many as four companies, including Bharat Road Network Ltd and and Matrimony.com, are expected to come out with their IPOs next month to raise over Rs 2,500 crore.

These four companies are expected to float their IPOs (initial public offers) in September to garner over Rs 2,500 crore, merchant banking sources said.

Amid persisting bullish market sentiments, despite intermittent volatility, around two dozen companies have filed preliminary papers for Initial Public Offers (IPOs) with the regulator Sebi so far this year.

So far this year, a total of 17 companies, including BSE, Avenue Supermarts, Housing and Urban Development Corporation (HUDCO), Eris Lifesciences and Cochin Shipyard, mopped-up more than Rs 12,000 crore through initial share-sale offers.

Going by current trends, the IPO segment is expected to see better performance in 2017 compared to last year when 26 companies collectively mopped up more than Rs 26,000 crore — making 2016 the best in six years.

The companys IPO consists of up to 29.30 lakh equity shares of face value of Rs 10 each.

According to sources, the firm is expected to raise an estimated Rs 1,200 crore through an IPO.

Dixon Technologies, plans to raise an estimated Rs 600 – 650 crore through its initial public offering, sources said.

The IPO, which comprises fresh issue of shares worth Rs 60 crore and an offer for sale of up to 3,753,739 equity scrips by the existing shareholders, will also be open on September 6 and close on September 8.

Capacite Infraprojects is expected to mop-up Rs 400 crore through its initial public offering.

Blue Apron and Snap’s ‘busted’ IPOs herald judgment day for unicorns

Blue Apron and Snap’s ‘busted’ IPOs herald judgment day for unicorns.

A year that began with high hopes for a tech IPO revival has crashed into a wall of reality following sputtering public offerings from Snap and Blue Apron.

The catastrophe that is Blue Apron was driven home in recent days thanks to multiple shareholder lawsuits claiming management misled investors.

Less than two months after its initial public offering, Blue Apron’s stock has been hovering at around half of its IPO price.

The stock has regained some lost ground in recent days, but it has remained under its IPO price since mid-July.

According to Renaissance Capital, there have been 16 tech IPOs so far this year.

Still, the disappointing Snap and Blue Apron IPOs are going to make life difficult for the herd of unicorns still waiting desperately to find an exit of some kind.

That shell company would then acquire unicorns facing valuation issues that can’t figure out a path to an IPO.

Smith said this points to a problem with unicorns rather then the IPO market itself.

So Smith expects to see a reckoning later this year, as valuations are forced down and startups are sold below their investment value — something that could ricochet back to slow overall venture capital investments.

Stretched thin: Venture capitalists serve on too many boards

Bill Gurley is one of the smartest venture capitalists in Silicon Valley, which is a big reason that the general partner of Benchmark Capital held a coveted seat on the board of directors at Uber until recently.

Venture capitalists might not have the time to help these companies properly develop into profitable businesses that will either be sold or go public.

Alfred Lin, a partner at Sequoia Capital, serves on six boards — including on Airbnb’s with Jordan.

“A venture capitalist’s job is not only to identify promising investments but to help the founders they’ve invested in build companies into thriving organizations,” the spokeswoman said in an email.

Perhaps directors don’t need to spend as much time on tiny startups as on publicly traded companies with billions of dollars of shareholder value at risk.

But there are only so many venture capitalists — and superstars— to go around.

Partners at venture capital firms, who lead the investments and thus get a board seat, are mostly white men.

One way to improve corporate governance by boards and boost diversity is for companies to add seats for independent directors — outside people who are not investors, said Sukhinder Singh Cassidy, founder and CEO of Joyus in San Francisco.

Normally, a company that gets a second round of funding from venture capitalists will provide a slot for an independent director, Singh said.

Until this year, Doerr served as lead independent director for Zynga.

After 87% Gain, Can This Tech IPO Process Another Breakout?

After 87% Gain, Can This Tech IPO Process Another Breakout?.

While Snap (SNAP) is hoping it can mimic Facebook (FB) and bounce back from a disappointing IPO, payment processor Square (SQ) has already made a nice run — and may be getting ready to take off again.

It remains to be seen if Snap can pull off that same feat.

Taking A Page From Amazon Based in San Francisco, Square provides point-of-sale payment processing solutions that help merchants of all sizes start, run and grow their businesses.

Founded in 2009, the company has expanded internationally, with offices in Canada, Japan, Australia, Ireland and the United Kingdom.

250% Earnings Growth Heading into its Q2 earnings report, Square had already posted four straight quarters of triple-digit EPS gains, but those were all based on comparisons to quarters with losses.

Visa sports a 64.2% profit margin and 21.9% ROE, while the numbers for PayPal are 20.5% and 12.8%, respectively.

Square has been consolidating since the end of July and may getting ready to take a swipe at another breakout.

Friday closes out the fifth week in a potential new base, with the stock finding support at its 10-week line in the bottom of the pattern.

Also note how that area of support is right around the buy point in its earlier flat base — a sign it may be forming steppingstones for a continued climb.

Spotify signs crucial Warner Music deal

Spotify has signed a new licensing deal with Warner Music Group, paving the way for the music streaming service to go public.

Warner was the last of the three big record labels to agree to renewed terms to make its catalogue available to Spotify’s 140 million users.

However, Spotify has been forced to agree to some limitations to get the labels to sign.

Artists and labels have in the past complained about minuscule revenue from steaming sites when compared to downloads or physical sales. “Our partnership with Warner Music Group will help grow the new music economy where millions of artists can instantly connect with fans, and millions of fans can instantly connect with artists,” Spotify’s chief content officer Stefan Blom told the BBC. ‘Inventive ways’ Posting on Instagram, Warner Music chief digital officer Ole Obermann said: “It’s taken us a while to get here, but it’s been worth it, as we’ve arrived at a balanced set of future-focused deal terms.

Even with the current pace of growth, there’s still so much potential for music subscription to reach new audiences and territories.” The “inventive ways” were not outlined, but if Warner Music’s deal is similar to those agreed with Sony Music and Universal, it is likely to include a clause allowing the labels to hold back certain songs from Spotify’s non-paying users for a limited period of time.

Speaking about the Universal deal agreed in April, Spotify founder and chief executive Daniel Ek explained that “artists can choose to release new albums on premium only for two weeks, offering subscribers an earlier chance to explore the complete creative work, while the singles are available across Spotify for all our listeners to enjoy”.

Almost all companies IPO when going public to raise money and offer shares to more investors, but Spotify is expected to simply list on the NYSE without a sale.

___________ You can reach Dave securely through encrypted messaging app Signal on: +1 (628) 400-7370

COLUMN: 3 reasons IPOs are almost always bad investments

Over my 11 years of experience in the stock markets, I have rarely come across any IPO that has been launched keeping in mind the interest of investors.

A majority of them have been launched in the form of ‘legalized looting’ by company promoters and their investment bankers.

This is the reason most companies come out with their IPOs during rising or bull markets when money is aplenty.

Here are 3 reasons I believe small investors must avoid IPOs and rather search for great businesses among those already listed – 1.

In reality, by the time you buy shares of a company in its IPO, other parties have almost always invested earlier at lower prices – often, much lower prices.

Don’t buy a stock only because it’s an IPO – do it because it’s a good investment.

Final Word Here are some thoughts on IPOs from a few of the investing legends… Warren Buffett wrote in his 1993 letter… [An] intelligent investor in common stocks will do better in the secondary market than he will do buying new issues…[IPO] market is ruled by controlling stockholders and corporations, who can usually select the timing of offerings or, if the market looks unfavourable, can avoid an offering altogether.

Four characteristics of the IPO market makes it a market where it is far more profitable to be a seller than to be a buyer.

First, in the IPO market, there are many buyers and only a handful of sellers.

Hype and excitement don’t necessarily equate to a good investment opportunity.