Why Companies Built to be Acquired Usually Aren’t

Author: Ben Simkin / Source: Entrepreneur It seems the latest hottest thing is having a company that's about to issue its IPO or one that's so wildly successful another firm acquired it. The idea of going public with a company apparently is so compelling...

5 clever ways to fund your startup

Author: Heather Redding / Source: Born2Invest The most common challenge that startups face is the lack of capital. In this article, We explore five clever ways through which you can raise funds for your startup. Having your own business is a great way to...

Verizon reportedly wins bidding war for Straight Path with $3.1 billion offer

Author: Catherine Shu / Source: TechCrunch Verizon appears to have won its bidding war with AT&T for Straight Path Communications after offering $3.1 billion. AT&T announced last month that it had agreed to buy Straight Path for $1.6 billion, but...

5 Essentials for Raising Your Growth Round of Financing

Source: Entrepreneur The following excerpt is from the staff of Entrepreneur Media’s book Finance Your Business. Buy it now from Amazon | Barnes & Noble | iTunes As the founder and CEO of the HR platform Namely, Matt Straz has experience raising a growth round of...

How to Stay Organized With Evernote

Author: Kate Volman / Source: Entrepreneur Everyone has their pet ways of staying organized. Some people like writing out to-do lists with pen and paper or creating Excel spreadsheets. In this video, Entrepreneur Network partner Kate Volman explains why she...

4 Ways Your Website Should Change Over the Next 5 Years

Author: Elena Titova / Source: Entrepreneur Updating your website involves more than just rearranging words and pictures on the homepage. Changing your website involves implementing new technology behind the scenes, eliminating dot-com domains and using...

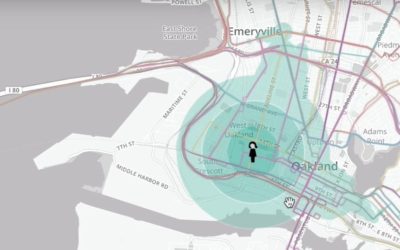

Remix Raises $10M, Sequoia Leads Series A Round

Author: Ben Miller / Source: Government Technology US A screenshot of Remix's transit planning platform. The drag-and-drop "Jane" tool shows how far a person could travel in a transit system in 30 minutes. Three years and 200 customers later, Remix is...

The Next Phase of the Maker Movement? Building Startups

Author: Jenny Abamu / Source: EdSurge Zainab Oni, speaking at the Mouse 20th-anniversary event “Everything that is old is new again!” Daniel Rabuzzi exclaims, his eyes light up with excitement that seems to match the glowing, handcrafted flower pinned on his...

Snap stock tanks after IPO expenses run up a $2.2 billion loss for the first quarter

Snap reported quarterly financial results for its first time as a public company on Wednesday, posting revenue that missed estimates and slower-than-expected user growth.

Shares plummeted more than 25 percent in after-hours trading.

CEO Evan Spiegel got a $750 million bonus for taking Snap public.

Despite the steep loss during the quarter, Snap is “still in investment mode,” the company’s chief financial officer, Drew Vollero, said on a conference call with analysts.

Revenue: $150 million reported vs. $158 million expected by a Thomson Reuters consensus estimate.

Daily active users rose 36 percent from the year-ago period, and average revenue per user grew 181 percent.

More than 3 billion Snaps were made daily in the first quarter, the company said, up from 2.5 billion in the third quarter of 2016. “We made good progress this quarter improving the performance and quality of our Snapchat application, especially on Android, which has helped result in increased net user adds and engagement,” Khan told CNBC.

As a whole, Facebook has 1.28 billion daily active users, nearly eight times as many as Snapchat.

Snap should have set its expectations lower, Art Hogan, chief market strategist at Wunderlich Securities, told CNBC’s “Closing Bell” on Wednesday.

Snap stock tanks after IPO expenses run up a $2.2 billion loss for the first quarter

Author: Anita Balakrishnan / Source: CNBC Snap reported quarterly financial results for its first time as a public company on Wednesday, posting revenue that missed estimates and slower-than-expected user growth. Shares plummeted more than 25 percent in...

TPG Pace Energy Holdings Corp. Completes $650 Million Initial Public Offering

TPG Pace Energy Holdings Corp. Completes $650 Million Initial Public Offering.

FORT WORTH, Texas–(BUSINESS WIRE)–TPG Pace Energy Holdings Corp. (the “Company” or “TPG Pace Energy”), an energy-focused special purpose acquisition entity, today announced the closing of its initial public offering of 65,000,000 units, which includes 5,000,000 units issued pursuant to the partial exercise by the underwriters of their over-allotment option.

Once the securities comprising the units begin separate trading, the Class A common stock and warrants are expected to be listed on the New York Stock Exchange under the symbols “TPGE” and “TPGE WS,” respectively.

Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC, Citigroup Global Markets Inc. and Credit Suisse Securities (USA) LLC served as joint book runners for the offering.

This press release contains statements that constitute “forward-looking statements,” including with respect to the anticipated use of the net proceeds.

Forward-looking statements are subject to numerous conditions, many of which are beyond the control of the Company, including those set forth in the Risk Factors section of the Company’s registration statement and preliminary prospectus for the Company’s offering filed with the Securities and Exchange Commission (“SEC”).

Copies are available on the SEC’s website, www.sec.gov.

About TPG Pace Energy TPG Pace Energy is a special purpose acquisition company formed by TPG Pace Group for the purpose of entering into a merger, stock purchase, or similar business combination with one or more businesses in energy or energy-related industries.

About TPG Pace Group TPG Pace Group is the firm’s dedicated permanent capital platform, created in 2015 with the objective of sponsoring special purpose acquisition companies and other permanent capital solutions for companies.

Since the start of 2014, the firm has launched several new products, including TPG Pace Group, TPG Real Estate Finance Trust, TSL Europe and Arrow Ridge Capital.

TPG Pace Energy Holdings Corp. Completes $650 Million Initial Public Offering

Source: Business Wire FORT WORTH, Texas--(BUSINESS WIRE)--TPG Pace Energy Holdings Corp. (the “Company” or “TPG Pace Energy”), an energy-focused special purpose acquisition entity, today announced the closing of its initial public offering of 65,000,000 units, which...

Creating Sales Presentations That Convince Prospects to Buy

Author: Jill Schiefelbein / Source: Entrepreneur The following excerpt is from Jill Schiefelbein’s book Dynamic Communication. Buy it now from Amazon | Barnes & Noble | iTunes If the goal of your presentation is persuasion, let me introduce you to my...

Beyond the Privacy Fine Print: Making Privacy More Transparent

Author: Dimitri Sirota / Source: Entrepreneur The past few weeks saw a series of news articles that focused consumer concern around personal data use (and misuse). Recently, it was revealed that email service Unroll.me anonymously used consumer email data to...

Innovation, Change and the Rest of Your Life

Author: Steve Blank / Source: The Huffington Post I gave the Alumni Day talk at U.C. Santa Cruz and had a few things to say about innovation. Even though I live just up the coast, I’ve never had the opportunity to start a talk by saying “Go Banana Slugs.”...

Cockroach Labs announces $27M Series B and enterprise tier for its reliable database

Author: John Mannes / Source: TechCrunch “A database that replicates itself and is meant to survive” — that was the connection that Cockroach Labs CEO Spencer Kimball made between the startup’s memorable name and its value proposition. Despite entering a...

How Very Successful People Think Differently

Author: Meiko Patton / Source: Entrepreneur Would you agree or disagree with each of the following statements? I wish I had fewer problems in life. I wish I didn’t have to struggle so much in life. I wish I had the opportunities that other people have. If...

Ceres Imaging raises $5 million to pinpoint crop stress for farmers

Author: Lora Kolodny / Source: TechCrunch Oakland, Calif.-based Ceres Imaging has raised $5 million in a Series A investment led by Romulus Capital. The startup uses cameras, sensors and software to pinpoint crop stress in the field for farmers, so that they...