Adtech company MediaMath secures $175M credit facility

Adtech company MediaMath secures $175M credit facility.

MediaMath, a company offering tools and data for automated ad-buying, announced today that it has secured a $175 million credit facility.

The deal was led by Goldman Sachs, with participation from Santander Bank.

The company says this financing will fund its continued growth and allow it to refinance existing debt.

(MediaMath’s 2014 funding round included $105 million in debt.)

In a note to MediaMath employees, CFO Stacey Bain said this doesn’t mean the company chose more debt “instead of” an equity funding round: “In fact, this line of credit allows us to be flexible in terms of how and when we decide to raise another round of equity, ensuring we get the best deal for MediaMath.” And while the IPO market seems to be improving for tech companies (including, perhaps, adtech), Bain also wrote that this isn’t setting MediaMath up for an IPO: “Right now, we like operating privately and we’ll explore an IPO when and if it makes sense for MediaMath.” The company says it now has nearly 700 employees and works with all of the major ad holding companies.

“We’re thrilled to work with Goldman Sachs and Santander, who are equally ambitious to support the growing scale of our business today, and motivated to support the needs of a reimagined and increasingly sophisticated supply chain in the future,” said CEO Joe Zawadzki in the funding release.

Featured Image: Smartline/Shutterstock

Cloud security broker Netskope raises $100m more led by Lightspeed and Accel

Cloud security broker Netskope raises $100m more led by Lightspeed and Accel.

As enterprises continue to move more of their computing to the cloud, and across an ever-expanding range of devices from computers to phones and tablets and more, hackers continue to find ways to break into those systems — resulting an unprecedented number of breaches globally.

Now, one of the more prominent security startups has raised a significant round of funding to help tackle this issue head-on.

The Series E was led by previous investors Lightspeed Venture Partners and Accel Partners, with Social Capital and Iconiq Capital also participating.

Netskope is not revealing its valuation in this round, but Sanjay Beri, its founder and CEO, said in an interview the other day that “it’s a significant upround” that the company will use to continue building out its team and customer base.

It brings the total raised to date by Netskope to $231.4 million.

“In other words, one quarter of files infected are exposed and shared.” “When you look at the cloud and the use of newer features like software as a service, platforms as a service, and the influx of apps based around the principles of social media, these have disrupted all the markets in the world, and that has disrupted the security market,” he continued.

“Security has become one of the top topics businesses have to think about when they consider mobile and cloud and remote working.

Security officers realise that they can’t use their old systems.

The old way doesn’t work for the cloud.” The old way includes incumbents like Symantec, which Beri considers a key competitor.

India Dealbook: GyanDhan, MaxMyWealth, BHIVE, Ftcash raise funding

India Dealbook: GyanDhan, MaxMyWealth, BHIVE, Ftcash raise funding.

Education loans marketplace GyanDhan has raised funding from Sundaram Finance, fintech firm MaxMyWealth has received funds from two UK-based firms.

Workspace solutions provider BHIVE Workspace has secured $1.2 million funding from Blume Ventures and payments startup Ftcash has secured funding from 500 Startups.

The startup was founded in May 2016 by IIT Kanpur alumnus Ankit Mehra and IIT Delhi graduate Jainesh Sinha.

Fintech firm MaxMyWealth raises funding MaxMyWealth has raised an undisclosed amount from UK-based Global Advisors (Jersey) Ltd and diversified investment company Horseferry, according to a statement.

Workspace solutions provider BHIVE receives $1.2m funding Workspace solutions provider BHIVE Workspace has raised $1.2 million in a funding round led by early-stage technology investor Blume Ventures, the company said in a statement on Wednesday.

Other investors like actor-director Ramesh Aravind, SKCL MD Meera Reddy and other high net-worth individuals also participated in the round.

Payments startup Ftcash raises funding from 500 Startups Mobile payments platform for micro merchants Ftcash has raised an undisclosed amount of funding as a part of its pre-Series A round from venture capital firm 500 Startups and existing investor IvyCap Ventures.

The fintech startup will utilise the capital in developing products in the payment and loan categories, scaling annual transactions to Rs 1,500 crore and disbursing loans to merchants upwards of Rs 150 crore, as per a statement.

Last year in March, the startup had raised 1 crore in pre-series A funding led by IvyCap Ventures.

Snap acquires Placed to prove geofilters drive store visits

Snap acquires Placed to prove geofilters drive store visits.

If Snapchat’s growth remains slow, it needs to maximize how much it can charge per ad by demonstrating they inspire purchases and physical store foot traffic.

So today, Snap confirmed to TechCrunch that it’s acquired location-based analytics and ad measurement startup Placed for an undisclosed sum.

Placed will help Snap scale its measurement systems like Snap To Store so advertisers can chart how online Snapchat ads translate into offline return on investment.

The six-year-old had raised at least $13.4 million, including a $10 million Series B led by Two Sigma Ventures in 2014.

It had measured over $500 million in ad spend for hundreds of partner platforms like PayPal and Pandora.

Boosting advertiser confidence in ROI could help Snap grow its revenue, which fell short of expectations in its first earnings call this month and sank its share price more than 20%.

Snap says Placed will continue to run independently at its Seattle headquarters plus its NYC and LA offices with its CEO David Shim reporting to Snap chief strategy officer Imran Khan.

Snap will also put in place strict privacy, data-sharing, and security rules to guarantee a physical and digital separation between Snapchat and Placed data.

When a users visits a business like McDonald’s and applies their Snapchat sponsored geofilter to a Story post or private message, Snap-To-Store measures whether any of their friends that viewed that geofiltered Snap subsequently visited any of that brand’s locations.

THE ROCKY ROAD FOR CYBERSECURITY STARTUPS

New technology and security companies seemingly pop up every other week.

Witness the WannaCry ransomware strike that hit over 300,000 computers in 150 countries, the Mirai botnet attack that denied surfers access to thousands of websites around the world, or massive data breaches such as the ones that compromised some 1.5 billion Yahoo!

Inc. user accounts.

During pitch meetings, where companies seek funding for their cybersecurity solutions from venture capitalists or investors, businesses need to stand out from the pack, Rich Baich, chief information security officer at Wells Fargo & Co., said at the recent Cyber Investing Summit at the New York Stock Exchange.

Using security buzzwords, such as artificial intelligence and end-to-end encryption, will only get a startup so far, because “there are three to four vendors” looking for investment “that said the same thing,” he said.

Not all startups will receive funding early on, but this doesn’t mean the company or services offered aren’t worth developing further.

On some occasions, investors will circle back and “gobble up” the startup “down the line,” Baich said.

Daniel R. Stoller is a Senior Legal Editor for Bloomberg BNA’s Privacy & Security Law Report, and a former Research Specialist for Bloomberg Law and Bloomberg Government.

Before joining Bloomberg BNA, he worked as a law clerk for the SEC.

Daniel received his J.D.

Apple HomePod Smart Speaker Arrives in December

Apple HomePod Smart Speaker Arrives in December.

While Apple exec Phil Schiller thumbed his nose at the Amazon Echo for its lack of a touch screen, the HomePod does not feature any sort of display.

From what Cupertino showed off at WWDC today, the HomePod looks like a small version of the trashcan-shaped Mac Pro, with little more than speaker grilles adorning its exterior.

Echo devices are intended as a way for owners to get information and tap into the Amazon store to purchase items, but Apple is positioning HomePod as, first and foremost, a music speaker.

The name, of course, is a reference to the iPod, which gave Apple its start in music.

As Schiller explains, “Apple reinvented portable music with iPod and now HomePod will reinvent how we enjoy music wirelessly throughout our homes.”

The 7-inch HomePod features an array of six microphones, which will listen for your command to Siri.

Apple also claims HomePod and Siri can handle more advanced queries, like “Hey Siri, who’s the drummer in this?”

Room-sensing tech will let HomePod learn where it’s placed in a room so it can deliver the best sound — there are seven beam-forming tweeters and automatic detection and balance of two speakers.

The HomePod is designed to work with an Apple Music subscription and iPhone 5s and above running iOS 11.

Announcing the London TechCrunch Meetup + Pitch-off!

Announcing the London TechCrunch Meetup + Pitch-off!.

We missed you — although, admittedly, I do live here — which is why we’re returning for a TechCrunch Meetup + Pitch-off on 19 July, in conjunction with the incredibly fun conference, Unbound.

If you’re looking to pitch your startup to the TechCrunch team (because, who isn’t?

Ten companies will be selected to participate in the pitch-off.

Each will have exactly 60 seconds to pitch their startup in front of a panel of expert judges, including TC editors and local venture capitalists.

Second place gets two tickets to the show, and the Audience Choice winner takes home one ticket to the conference.

Apply to pitch our editors and panel of judges here.

Plus, there will be beer (and, if I have my way, tea also).

Buy tickets for just £10 by following this link.

Laters!

Are You Missing Talent That’s Right Under Your Nose?

Consider this: A vegetarian hired one of her most talented employees after buying a t-shirt at a Spam festival.

This HR professional probably never imagined she’d meet a potential employee at a festival dedicated to Spam.

However, Lucas’s open mind helped her spot talent.

Looking at every reference as a possible candidate opens the doors for employers and organizations to find new, targeted talent.

But, how do employers start career conversations with references? “Doing this helps build your talent pool and open the door to start sharing information about your brand and potential opportunities.” “I explained my client’s company and mission and asked what they were missing in their current job,” McDonald said.

Recruit talent by finding out what’s missing from a person’s current job.

Now, she’s one of the company’s top employees.

Volunteer settings are great place for employers to meet potential candidates who hold similar interests.

Krypt.co scores a 1.2 M seed round to simplify developer encryption key security

Krypt.co scores a 1.2 M seed round to simplify developer encryption key security.

Krypt.co, a new security startup founded by two former MIT students and one of their professors, is launching today with a free product called Kryptonite, designed to help developers protect their private encryption keys, using an app on their smartphones.

That’s a solid roster of backers for their first swing at funding.

Kryptonite takes advantage of typical public/private key encryption using the Secure Socket Shell (SSH) protocol used by developers to log onto networks remotely.

As you try to log onto remote services like Github to commit your code, you’ll see a notification on your phone.

While they acknowledge that people could lose their phones, they say that you could cut off access to services using your private key, and render the key essentially useless to the person who found (or stole) your phone.

While the initial product is free, the company sees this offering as a way to build relationships in the developer community, and eventually add services on top of that free product they can charge for.

The founders are still working on the administrative architecture, but they are envisioning a team administrator, who will have access to a central dashboard to set device policies and view the public keys for all of the developers on the team.

Down the road, they could apply this technology to code signing to avoid fraudulent commits, or even possibly at some point, simplify the use of encrypted emails for all users, not just developers.

Featured Image: Getty Images

The Most Brilliant Business Ideas

The Most Brilliant Business Ideas.

Entrepreneurship is about ideas.

It is the foundation of everything — an insight into how to improve something, or what consumers want, or what they don’t even know they want.

Consider it: A business is an idea come to life; an entrepreneur is an ideas-driven person.

And if you want to truly learn from the smartest people around you, and calibrate to their way of thinking, you have to ask, What’s their core idea?

Below we have some of the most insightful ideas from Entrepreneur’s “Brilliant Ideas” series in the June issue of our magazine.

For Entrepreneurs, VC Capital Is Not Always the Best Option What Gary Vaynerchuk Learned by Experimenting on Himself Ellevest’s Investing Platform Knows How to Speak to Women The Website That Is Helping Companies Find Diverse Talent How the Rules of Tech Branding Helped Raden Create a Smart Suitcase 9 Science-Backed Insights on Finding Success in Your Business and Personal Life Businesses Disrupting Industries With Their Brilliant Ideas — And What You Can Learn From Them

Angel investment workshop scheduled for women, investors, to learn about financing startups

Angel investment workshop scheduled for women, investors, to learn about financing startups.

The primary goal of the workshop is to educate qualified investors on the ins and outs of investing in early-stage companies, while helping female entrepreneurs understand what lies ahead as they begin to raise venture capital funding.

“For innovation in our community to thrive, it is critical for women to be comfortable and competent interacting with and investing in emerging companies.” Nancy Aichholz, CEO of Aviatra Accelerators, an organization devoted to empowering women-owned businesses, expanded on this statement, agreed, pointing out that women start the majority of new businesses in the United States.

This was the impetus for the workshop.” Speakers in the line-up have extensive experience working with early-stage companies: · Gina Drosos serves as president and CEO of Assurex Health, a pharmacogenomics company that was recognized as one of America’s leading entrepreneurial ventures by USA Today, and one of INC. Magazine’s 50 fastest growing women-led businesses in America.

· Paige Connelly is an attorney at Thompson Hine in the corporate transactions and securities group.

· Daniela Yoder, Sr. Vice President at Valuation Research Corporation, specializes in helping companies value their business for transactions and other complex needs.

Ludlow will share valuable “lessons learned” from her time as a startup investor.

“We are also aiming to educate female entrepreneurs on what early stage investors are looking for to assist them in developing successful, high-growth companies.” “Introduction to Early Stage Investing” is for qualified investors, female entrepreneurs and women interested in learning more about start-up funding.

Areas of focus will be: · Learning terminology used by angel investors, venture capitalists and impact investors · Understanding the pros and cons of early stage investing · Examining the impact women investors can have on women entrepreneurs · Meeting women investors and entrepreneurs from the region · Exploring what is happening in the region’s vibrant start-up community Visit Eventbrite to register, or for more details about the workshop and pricing, click here .

This workshop is purely an educational session to discuss the process of investing in early stage companies.

404 Not Found: How Silicon Valley forgot Palestine

Such was the case when a student, by simply arriving late to an event, transformed how Google, and I, understand the politics of tech in Israel and Palestine.

Last week, as I found myself in Gaza participating in the AngelHack Global Hackathon Series hosted by Gaza Sky Geeks, I had cause to reflect on the progress we in the tech industry have made on this front and what work still remains to be done.

We did this by launching a Palestinian domain, ensuring “Palestine” was a location on product offerings, and investing in a Palestinian venture capital fund in the West Bank and a startup accelerator in Gaza.

I recently noticed “Palestine” was not in the list of countries for YouTube sign-ups.

Decisions made in tech often have political consequences, even if that decision is to stay above the fray.

We must take care not to do this, as it goes against what we stand for and, in Silicon Valley, what we stand for has scalable impact.

Therefore, in our business dealings, we must recognize all of Israel and Palestine as being territory controlled by one authority and ensure we are not directly or indirectly discriminating against anyone in that territory because of their ethnic or religious identity.

We must work to ensure those values are extended to our business dealings around the world, including in Israel and Palestine, where we can make a difference.

Tech has a remarkable ability to transcend borders, and several companies have already been engaging with the Palestinian tech sector.

Its aim is to assist both Palestinian entrepreneurs in connecting with Silicon Valley and tech companies here in learning how to navigate the region.

Three computer vision experts join TechCrunch’s Tel Aviv event

Three computer vision experts join TechCrunch’s Tel Aviv event.

It seems like Israeli entrepreneurs are one step ahead when it comes to developing computer vision technology.

First up, Inon Beracha has become a well-known name in Israel.

He is the former CEO of PrimeSense a computer vision startup that developed the core technology behind Microsoft’s Kinect.

He handles research and development for OrCam.

The company has been working on a hardware product that turns your glasses into your most powerful ally, especially if you have a disability or you have a hard time reading.

First Place: A table in Startup Alley at TechCrunch Disrupt San Francisco or Disrupt Berlin Second Place: Two tickets to attend TechCrunch Disrupt Berlin Third Place: One ticket to attend TechCrunch Disrupt Berlin Also, shout out to our sponsors Leumi Tech and Blonde 2.0.

Gadi Tirosh Gadi Tirosh is Managing Partner of Jerusalem Venture Partners (“JVP”) a global venture capital fund out of Jerusalem.

Inon Beracha Inon, formerly CEO of PrimeSense, the creator of the Kinect sensor for Xbox360, PrimeSense was acquired by Apple (APPL) in 2013.

He currently leads the R&D team at OrCam, a company that has developed a unique device for blind and visually impaired people.

India’s new startups find fewer venture capital backers

Since 2007, when venture capital as an asset class returned in earnest to the Indian market, venture capital firms have invested more than $10 billion in local start-ups, mostly in the technology and Internet sectors, according to data compiled by Chennai-based researcher Venture Intelligence.

Copycat investing The current crisis that the venture capital industry finds itself in today can, to a great extent, be attributed to investors backing too many so-called copycat businesses, especially in the consumer Internet sector.

I also don’t understand entrepreneurs getting rich without building great companies,” says Kanwal Rekhi, founder and managing director of Bengaluru-based venture capital firm Inventus Capital Partners.

Its valuation has crashed from a peak of $6.5 billion to about $1 billion in a matter of months.

“But it wasn’t as if these businesses weren’t appropriate for India.

Last year, Sequoia Capital India, the country’s largest venture capital firm by funds under management, made an unconventional bet.

In Bengaluru, Accel India, which also raised a large fund last year ($450 million), has put money to work across eight deals this year.

New generation of investors The sustainable ecosystem Reddy is talking about includes a vast population of angel investors, a growing number of local family offices and, most important, a new generation of smaller venture capital firms that have taken root in the midst of the downturn over the past 18-odd months.

For example, in Gurgaon, Pravega Ventures, a venture capital firm founded last year by former SAIF Partners fund managers Mukul Singhal and Rohit Jain, wants to do only seed stage technology deals and back businesses at the concept stage.

There’s certainly more than enough money still available to back the next generation of start-up businesses.

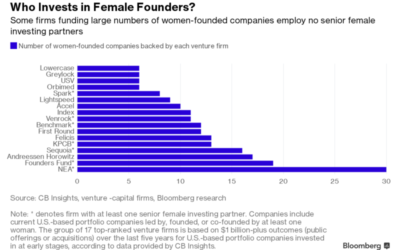

At Top VC Firms, More Women Partners Doesn’t Mean More Women Funded

At Top VC Firms, More Women Partners Doesn’t Mean More Women Funded.

Raising her first major funding round for her then three-year-old shipping and data company last year, Shippo Chief Executive Officer Laura Behrens Wu came to an uncomfortable realization: pitching any of Silicon Valley’s rare female venture capitalists gave her more anxiety than pitching men.

Those with senior women partners backed companies founded or co-founded by women at roughly the same rate as firms with no senior women partners.

And a Bloomberg analysis of the top 10 private companies founded or co-founded by women, ranked by Pitchbook by funds raised, showed that none had raised money from a female venture capitalist as a young company, defined as the venture stages known as Series A or B.

Her firm is one of the top seven with at least one senior woman investing partner based in the U.S. NEA has invested in the most female founded or co-founded U.S. startups, with 30.

Some of the most female-founder friendly firms have no senior female partners, or in some cases, no female partners at all.

In many cases, that is because the women partners are relatively new, hired in the last 18 months, as the case at Benchmark, Founders Fund and Sequoia Capital.

At the top firms, male partners hold the most board seats at companies with women founders.

And many newer firms led by accomplished women venture capitalists who back large numbers of women have sprung up in recent years, including Aspect Ventures and Cowboy Ventures.

Another study, the Diana Project from Babson College, examined the venture universe overall rather than just top firms, and showed evidence that women investors are more likely to back women founders.

Lorem raises $1.1M to connect small businesses and web developers for quick assistance

Lorem raises $1.1M to connect small businesses and web developers for quick assistance.

When small and medium businesses want to build a website, they can take advantage of easy-to-use web tools like Squarespace — but who do they turn to when they need more technical help?

New York City startup Lorem Technologies is trying to make this process easier.

After all, CEO Sam Wilcoxon (pictured above with his co-founder Charlie Fogarty) told me that not only do many business owners lack the technical knowledge to build, customize or fix their sites — they also don’t have the time or the know-how to find and manage freelancers to help.

With Lorem, on the other hand, they can just press an “instant help” button, and within a minute, the startup will match them with a freelance developer or designer who’s suited for the job.

The goal is to turn Lorem into the resource that businesses turn to whenever they need development or design help.

And the startup seems to have made a good start with its current customers — Wilcoxon said 42 percent of them come back with a second job.

And from the freelancer’s perspective, they can just go about their normal workday without having to chase down the work — they’ll get alerted by their browser when Lorem has a job for them.

Lorem recently graduated from the TechStars Boston accelerator.

Its seed funding was led by Flybridge, with participation from Founder Collective and angel investors including Constant Contact founder Randy Parker and Frederick Townes, creator of the W3 Total Cache plugin for WordPress.

You Can Boost Your Creativity by Imagining You’re Someone Else

You Can Boost Your Creativity by Imagining You’re Someone Else.

Do you feel like you are creatively blocked?

Well, we have a solution for you: psychological halloweenism.

No, you’re not going to wear orange and black, play the Monster Mash and try to figure out the Wolfman’s childhood trauma.

Well, you could, but you might get some weird looks.

Psychological halloweenism is a term that Harvard Medical School professor, author and NeuroBusiness Group CEO Srini Pillay came up with to describe the action of trying on a different identity or perspective to get you thinking in a more creative way.

In a recent piece in Harvard Business Review, Pillay cites a study with a group of college students from last winter conducted by researchers Denis Dumas and Kevin Dunbar.

The psychologists told one third of the participants to imagine they were eccentric poets and had another third pretend that they were rigid librarians.

They compared the results of these categories to a control group that just behaved as they normally would.

Dumas and Dunbar gave the students the names of 10 run-of-the-mill objects, things such as book, carrot, fork, pants and shovel.