Here’s what the top accelerators in North America are funding

Here’s what the top accelerators in North America are funding.

After all, who would have foreseen billion-dollar businesses based on renting your air mattress to strangers, or shopping for their groceries?

So when prestigious accelerators invest around common themes, it’s worth taking note of what’s resonating.

The data set looks for companies that raised first-time funding in the past six months from accelerators in North America with a standout record for backing startups that go on to secure much higher valuations.

AI bots for businesses are big The bots will help you.

It’s one of several personal finance apps accelerators are rolling out.

Real estate gets more temporary, efficient and on demand Sure, you can still show up in person and sign a long-term lease on a home, office or shop.

But a lot of startups are coming up with both simpler and more temporary ways to secure space.

A number of transport startups have launched with an analytics focus, such as Revmax, a vehicle routing tool, and Gridwise, which helps ride-hailing drivers maximize earnings.

For now, however, we can sit back and enjoy (or fear) the vision of a future chatting with humanoid bots en route to one’s temporary home or office using the most efficient route that technology can provide.

Postmates acqhires Secret CEO David Byttow’s startup Bold

The founder of one of Silicon Valley’s most famous flameouts, anonymous social app Secret, is the new product lead for Postmates’ app.

After Secret shut down and gave investors back their money, David Byttow went on to raise a $1 million seed round from Index to launch a blog publishing tool for enterprises called Bold.

Today Bold was acqhired by Postmates, Byttow confirmed to TechCrunch, with he and co-founder Ben South Lee (also formerly of Secret) joining the delivery startup.

“Postmates is gonna slay” Byttow DMed me, elaborating that “I think Postmates is in a very unique position to leapfrog itself and continue be the leader in the on-demand delivery space.

In Secret’s hyped-up heyday, it raised a $25 million Series B. Byttow notoriously took $3 million off the table during the round and convinced co-founder Chrys Bader-Wechsler to do the same.

Instead, less than a year later, Secret had imploded, raising questions about the practice of founders cashing out early.

Postmates is trusting Byttow and Lee at a critical time for the company.

Having raised a $160 million Series D last year, Postmates must prove it can build a sustainable business despite the on-demand delivery space’s tough unit economics.

Once upon a time, Byttow convinced 15 million to use a controversial app in another risky market.

Postmates will have to hope Byttow can similarly drive traction of its app while letting someone else handle the business.

Postmates acqhires Secret CEO David Byttow’s startup Bold

The founder of one of Silicon Valley’s most famous flameouts, anonymous social app Secret, is the new product lead for Postmates’ app.

After Secret shut down and gave investors back their money, David Byttow went on to raise a $1 million seed round from Index to launch a blog publishing tool for enterprises called Bold.

Today Bold was acqhired by Postmates, Byttow confirmed to TechCrunch, with he and co-founder Ben South Lee (also formerly of Secret) joining the delivery startup.

“Postmates is gonna slay” Byttow DMed me, elaborating that “I think Postmates is in a very unique position to leapfrog itself and continue be the leader in the on-demand delivery space.

In Secret’s hyped-up heyday, it raised a $25 million Series B. Byttow notoriously took $3 million off the table during the round and convinced co-founder Chrys Bader-Wechsler to do the same.

Instead, less than a year later, Secret had imploded, raising questions about the practice of founders cashing out early.

Postmates is trusting Byttow and Lee at a critical time for the company.

Having raised a $160 million Series D last year, Postmates must prove it can build a sustainable business despite the on-demand delivery space’s tough unit economics.

Once upon a time, Byttow convinced 15 million to use a controversial app in another risky market.

Postmates will have to hope Byttow can similarly drive traction of its app while letting someone else handle the business.

Your guide to accelerators focused on the FinTech space

Your guide to accelerators focused on the FinTech space.

For some companies, it may help to join an accelerator that only focuses on their specific area.

Investment amount: Techstars invests in each company and retains 6 percent equity as common stock, as it does with all of its programmes.

Historically, it has taken less than 10 percent for the $100,000 and the services it offers as an accelerator.

Investment amount: Wells Fargo may fund each startup with up to 4.9 percent of equity with a potential direct equity investment of up to $500,000 for selected companies.

Program benefits: A six month program that includes Access to Wells Fargo business and technology leaders who are looking to solve real problems and to explore relevant opportunities for their areas of focus.

Portfolio companies: Coalesce.Info, Algoriz, Koyfin, Stilt “Queen City Fintech provides fintech startups access to world class mentors, capital, and leading financial services organizations; all in the heart of global banking hub Charlotte, NC.”

Investment amount: Accepted companies receive an upfront capital infusion of at least $20,000 per company with the potential for follow on funding for the top performers in the program.

It takes a 6 percent equity stake in the companies in the program.

Program benefits: Queen City Fintech is a 12-week accelerator program designed to mature financial technology startups through intense mentorship from leading banking executives, business development professionals, and venture capitalists and attorneys, among others in Charlotte’s robust business community.

PQ Group Holdings Inc. Announces Filing of Registration Statement for Proposed Initial Public Offering

Announces Filing of Registration Statement for Proposed Initial Public Offering.

MALVERN, Pa.–(BUSINESS WIRE)–PQ Group Holdings Inc. (“PQ”) today announced that it has filed a registration statement on Form S-1 with the U.S. Securities and Exchange Commission relating to the proposed initial public offering of its common stock.

The number of shares to be offered and the price range for the proposed offering have not yet been determined.

PQ intends to apply to list its common stock on the New York Stock Exchange under the proposed symbol “PQG.” The offering will be made only by means of a prospectus.

When available, a copy of the preliminary prospectus may be obtained from the offices of Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180 Varick Street, 2nd Floor, New York, New York 10014.

A registration statement on Form S-1 relating to the proposed offering has been filed with the Securities and Exchange Commission but has not yet become effective.

The shares to be registered may not be sold nor may offers to buy be accepted prior to the time when the registration statement becomes effective.

About PQ Group Holdings, Inc. PQ Group Holdings, Inc. is an integrated, global provider of catalysts, specialty materials and chemicals, and services.

Our environmental catalysts and services business is a leading global innovator and producer of catalysts for the refinery, emissions control, and petrochemical industries and is also a leading provider of catalyst recycling services to the North American refining industry.

Our performance materials and chemicals business is a silicates and specialty materials producer with leading supply positions in North America, Europe, South America, and Asia serving diverse and growing end uses such as personal and industrial cleaning products, fuel efficient tires, surface coatings, and food and beverage products.

This NYC Startup Raised $11.4M to Bring Institutional Trading to Bitcoin

This NYC Startup Raised $11.4M to Bring Institutional Trading to Bitcoin.

One such company is LedgerX, the first regulated bitcoin exchange and clearing house that allows you to obtain and hedge bitcoin using exchange-traded and centrally-cleared options contracts.

Operated by some of the savviest minds in finance from Goldman Sachs, MIT and CFTC, LedgerX is bringing accessibility and infrastructure support to Bitcoin at an institutional level.

AlleyWatch spoke with CEO Paul Chou about the company and discussed their most recent round of funding.

Who were your investors and how much did you raise?

We intend to provide a regulated platform for trading Bitcoin and other the digital currencies.

Impossible to predict, but in the long term the price potential is extremely positive.

Discussing the potential of the company with future partners takes quite a bit of time.

What are the biggest challenges that you faced while raising capital?

Where do you see the company going now over the near term?

Colleges Funnel Millions Into On-Campus Startups

Turning them into viable businesses requires money, patience, and investor appetite.

And that is becoming a trend,” said Katie Rae, president, CEO, and managing partner of The Engine.

The fund has raised over $150 million from investors, including $25 million from MIT as a limited partner.

“This isn’t a typical venture capital fund.

Investing in Ecosystem Nearly 60 percent of The Engine fund will be invested in MIT community startups, with the rest in companies that arise from the labs of other universities in the area, like Harvard and Northeastern.

That’s what differentiates The Engine from other college venture funds, said Rae.

The program will provide provide access to lab space, equipment, counseling, and other resources at MIT.

The University of North Carolina–Chapel Hill, for example, established Carolina Research Venture Fund last year to invest up to $10 million in startups founded by UNC-Chapel Hill faculty and staff.

So far, the fund has invested in four startups, including G1 Therapeutics, a clinical-stage company that develops cancer therapies.

The startup recently went public, reaching a market valuation of $480 million.

Pandora raises $480M from SiriusXM, sells Ticketfly to Eventbrite for $200M

The investment will come in the form of newly-issued Series A convertible preferred Pandora stock.

$172.5M of the preferred stock was purchased upon execution of the deal, and the balance will be bought at a second closing.

Separately, EventBrite just announced they have entered into an agreement with Pandora to purchase Ticketfly for $200M.

However this integration was never as successful as Pandora hoped, which may be why they are offloading it at such a discount to the price they paid a few years ago.

This preferred stock will bear a 6% cumulative cash dividend for SiriusXM – which makes the deal particularly sweet.

The preferred stock can also be converted into common stock at a price of $10.50 per share, which is a 14.2 percent premium to Pandora’s average stock price over the past 20-days.

This As part of the deal SiriusXM will get three seats on Pandora’s (now nine-person) Board of Directors, with one of those acting as Chairman.

SiriusXM had been previously negotiating with Pandora to acquire the entire company, but those talks stalled to disagreements over price.

This investment should still give Pandora the strategic help that only a major radio player like SIriusXM can provide, while still giving SiriusXM a large enough financial stake to make it worth their while.

Today’s deal means that KKR will no longer be taking a stake in Pandora, and Pandora will subsequently pay KKR a $22.5M termination fee, which is common practice when a deal falls through at such a late stage.

India’s Supr Daily raises $1.5M to expand its milk and grocery delivery service

India’s Supr Daily raises $1.5M to expand its milk and grocery delivery service.

Milk deliveries may not sound like an industry in need of disruption, but that’s exactly what one startup in India is working to do.

Supr Daily — the company in question — graduated the Y Combinator accelerator program this year and now it has raised $1.5 million from a range of investors to expand its service.

The Supr Daily service is designed to bring formality and order to India’s chaotic system of morning milk deliveries, while it also combats quality issues around milk, as we wrote when we covered the company in February.

The milk can include additives like detergent, caustic soda, glucose, white paint and refined oil to mask coloration, according to Times Internet.

Company co-founder Puneet Kumar told TechCrunch that it is close to making its one millionth delivery.

Supr Daily started out with limited reach very deliberately to test the viability of its service, and now Kumar and fellow co-founder Shreyas Nagdawane are eying expansions.

Initially that will be to cover all of Mumbai, and then later into one of India’s other tier-one cities.

“We’re using [this new] capital to scale and build a city playbook to take this business to multiple cities in India,” Kumar said in an interview.

The investment comes from a range of backers including Soma Capital, Great Oaks Ventures and 122 West Ventures.

Softbank is buying robotics firms Boston Dynamics and Schaft from Alphabet

Softbank is buying robotics firms Boston Dynamics and Schaft from Alphabet.

In case you are wondering (we were), we have double checked and these are the only two of Alphabet’s robotics companies getting acquired by Softbank.

“Smart robotics are going to be a key driver of the next stage of the Information Revolution, and Marc and his team at Boston Dynamics are the clear technology leaders in advanced dynamic robots.

I am thrilled to welcome them to the SoftBank family and look forward to supporting them as they continue to advance the field of robotics and explore applications that can help make life easier, safer and more fulfilling.” While Softbank has been hard at work doubling down on big bets in areas that it believes will be at the center of the future of computing — other acquisitions have included its $24 billion acquisition of chip maker ARM Holdings — for Alphabet, this is part of the company’s bigger efforts to rationalise some of its many acquisitions and strategic bets over the years that have not panned out as great fits with the wider business.

It looks like the whole team is coming over with the deal.

“We at Boston Dynamics are excited to be part of SoftBank’s bold vision and its position creating the next technology revolution, and we share SoftBank’s belief that advances in technology should be for the benefit of humanity,” said Marc Raibert, CEO and founder of Boston Dynamics, in a statement.

“We look forward to working with SoftBank in our mission to push the boundaries of what advanced robots can do and to create useful applications in a smarter and more connected world.” When Alphabet (still called Google at the time) acquired Shaft and Boston Dynamics in 2013 (Shaft was purchased as one of a group of seven acquisitions), the company did not disclose the terms of the deals.

Schaft revealed its first big prototypes only about two years after the acquisition.

The company has been around since 2012, after being incubated in the JSK Robotics Laboratory at the University of Tokyo by co-founders Yuto Nakanishi, Junichi Urata, Narito Suzuki and Koichi Nishiwaki.

It remains a secretive company: an attempted visit to its website today was blocked.

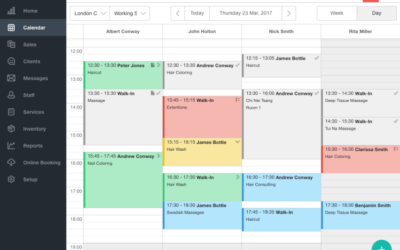

Shedul raises $6 million for hair salon booking

The startup is trying to change that, by offering scheduling software for the the salon and spa industry.

And it’s been catching on because it’s free.

Now they’re raising $6 million, led by Dubai’s Middle East Venture Partners (MEVP), with participation from BECO Capital and Lumia Capital.

They plan to use the funding to add more merchants to their platform and build out a two-sided marketplace.

They also will be introducing some paid offerings to complement their booking technology.

With offices in Dubai and Warsaw, Shedul has an international presence, with 40,000 merchants in more than 120 countries.

They say they’re bringing in $1.5 billion in annual GMV.

He says they spent just $5,000 on Google ads.

They aren’t just looking for salons still using pen and paper, they are also targeting customers of Mindbody, Booker and StyleSeat.

The “customer experience has been very bad” on Mindbody, Zeqiri claimed.

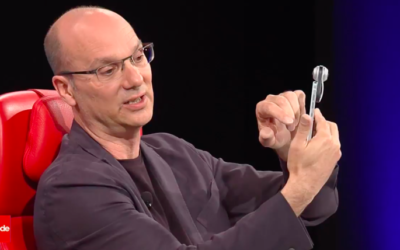

Andy Rubin’s Essential has reportedly raised $300 million

Andy Rubin’s Essential has reportedly raised $300 million.

Speculation has been circling the Android founder’s next move since he unceremoniously parted ways with Google.

Funding, it seems, hasn’t really been a problem, either.

That number comes from Equidate, a new firm that offers up valuations of private startups for investment firms.

It tells TechCrunch that its own numbers were sourced from public filings.

This marks the second major round of funding for Essential, following a $30 million raise last year, led by Redpoint Ventures and Playground Global, Rubin’s own investment firm, which also helped incubate the startup.

Rubin had earlier reached out to SoftBank group as a potential source of outside funding.

Its financing would have valued Essential at $1 billion, but the $100 million investment ultimately fell through, reportedly due in part to the Japanese firm’s investment with Apple.

Essential’s second product, a smart home hub, will also be a direct competitor to Apple’s newly announced HomePod speaker.

While it’s clear that investors ranging from firms like Tencent to manufacturers like Foxconn have faith in Essential’s future, the company’s got a tough road ahead of it as it attempts to win over public interest in a pair of highly competitive spaces.

Snap Is Year’s Most-Shorted Tech IPO Before Lockup Ends

Short interest in Snapchat parent rises to 28% of free float Facebook faced half as much shorting at same point after IPO Snap Inc. is the most-shorted tech initial public offering of the year, with a growing number of traders betting the stock will fall.

That’s helped drive short interest in Snap up to 28 percent of the free float, or shares available to be traded publicly, according to data from Markit Group Ltd.

The increase comes before the first lockup expiration on the shares — on July 30 — when certain stakeholders and executives will be free to unload their positions for the first time since the March 1 IPO.

An investor successfully shorts a stock by borrowing a number of shares from a broker, paying the broker a stock-loan fee and interest for the loan, and then selling the shares at the current share price.

DiClemente noted that there are more than $1 billion in Snap shares sold short, and with so few shares left to borrow, the cost to finance short positions has risen to 37 percent, compared with a 1 percent fee in May.

Though the shares were up about 11 percent since the IPO at Thursday’s close, the percentage of Snapchat sold short as of Wednesday was about double Facebook’s short interest at the same point — 68 completed trading days — after it debuted as a public company.

At the time, Facebook was facing serious doubts about its ability to make money from mobile advertising, causing the stock to lose half its value in the first six months of trading.

Twitter Inc., which went public in 2013, had short interest of 40 percent at the same number of days after its IPO, and its shares remain about 32 percent below their initial price.

The January 2018 $15 put options, with an exercise price 23 percent below Wednesday’s $19.56 close, had the highest open interest, which is the number of contracts outstanding, according to data compiled by Bloomberg.

For more on Snap, check out the Decrypted podcast: Traders also own more bearish put options than bullish call options, with put open interest being about 70 percent larger than the number of calls outstanding Wednesday, data compiled by Bloomberg show.

Spektral raises $2.8 million for development of AI-powered green screen technology

Spektral raises $2.8 million for development of AI-powered green screen technology.

The augmented reality acquisition space is hot — Facebook, Snap, Apple and others are throwing money at teams and technologies that promise to increase user engagement.

Spektral, unlike 99 percent of venture-backed startups doesn’t have a product or at least not in the traditional tech sense.

After first pursuing still frames under the name CloudCutout, the team is moving into real time video — combining machine learning with spectral graph theory to separate people and objects from their original backgrounds and overlay them in a new stream.

This is probably why Spektral is making the effort to show how its technology could be useful in other use cases, like production and advertising.

Adobe, the Beckman Institute for Advanced Science and Technology and the University of Illinois at Urbana-Champaign worked together to publish research on automating that process.

Hair strokes have long been a key criteria for judging cut outs.

But even with the latest deep learning models trained on over a million images, machines struggle.

In the future, this technology could pave the way for more complex video editing.

Lange was formerly the leader of machine learning efforts at Uber.

How Ethereum became the platform of choice for ICO’d digital assets

How Ethereum became the platform of choice for ICO’d digital assets.

The number of new digital assets is on the rise In roughly the past 12 months, the number of cryptocurrencies listed on CoinMarketCap.com, a main reference site for digital asset developers and speculators alike, has increased significantly.

As of the June 4 snapshot, there were 809 cryptocurrencies and other digital assets listed on the main CoinMarketCap page.

Scrypt, at the time, was still economical to hash on graphics cards, and as Litecoin and a few other Scrypt-based currencies began to appreciate in value, wholly separate cryptocurrencies were forked off of the original protocols to rise anew.

But another part comes from cryptocurrency entrepreneurs wising up to the fact that their little upstart protocols, in order to be valuable, needed to have an ecosystem built around them.

That, of course, takes time and money.

What explains the price increase?

Bitcoin is a relatively bare-bones blockchain system that requires layers of protocols to be built on top of it to make it a usable platform for utilities like smart contracts.

Ethereum’s flexible, extensible blockchain system makes it relatively easy for developers to build and launch their own DApps, DAOs and crypto-assets.

Although roughly a third of the assets listed were built on Ethereum, just over three-quarters of the market value of all of these assets is tied up in assets built on top of the Ethereum platform.

20-somethings managing millions: How venture capital is changing

20-somethings managing millions: How venture capital is changing.

But this baby-faced Stanford graduate is already managing $55 million of other people’s money.

Stahr and his partner, 24-year-old Phil Brady, launched GoAhead Ventures in their senior year at Stanford, and closed their first investment fund last fall.

In a trend that turns the established venture capital dynamic on its head, the investors backing the Bay Area’s early-stage tech startups increasingly are 20-somethings with little more than college credits, internships or a few years of work experience under their belts — a far cry from the seasoned tech veterans who traditionally have offered sage advice and guidance to the startups in their portfolios.

$25,000 — you can be an ‘angel.’” While the trend is largely anecdotal — and many 20-somethings still would rather follow in the footsteps of entrepreneurs like Mark Zuckerberg or Larry Page — the chance to cash in as an investor in the next Facebook or Google is increasingly alluring.

Young VCs say they can spot great investments because they’re more plugged into the hottest tech trends and university talent pools than their older counterparts.

But not everyone thinks fresh college graduates — who often are younger than the founders they invest in — can do the job.

Tech entrepreneur Kori Handy, who is 36, sees no value in accepting money from 20-something investors who haven’t launched companies of their own.

“It’s almost a slap in the face to people like me who actually run startups and build things,” he said.

That’s led to an explosion of new seed-stage funds, some of which close with just a few million dollars — making them attractive to young or first-time investors who don’t have the capital or connections to raise huge sums, Davidson said.

Uncertain future of state angel tax credit worries venture capitalists, entrepreneurs

Uncertain future of state angel tax credit worries venture capitalists, entrepreneurs.

A local venture capitalist said the credit was critical to attracting investments in startups, and a state official said the credit had pumped millions of dollars of out-of-state investments.

“It changes the economics of investing in a Kentucky small business,” McClelland said.

He said he understand when people ask why “rich dudes” get tax credits, but it comes down to economics: Without the credit, investors will take their money elsewhere, which hurts Kentucky entrepreneurs and communities because it reduces economic activity.

Sean O’Leary, a local entrepreneur and investor, said the credit had helped him get funds for a business — and also had prompted him to make investments.

The local chamber, Greater Louisville Inc., identified the lack of any changes to the program in the most recent legislative session as a “missed opportunity.” McClelland said he understands that lawmakers have to walk a fine line: They cannot keep the cap in place because it serves as a disincentive to investors and hampers startups — but they also cannot just eliminate the cap, because they risk depleting the $40 million total that has been made available for the credit and another economic development incentive.

Lawmakers could reduce the tax credit — to 30 percent, for example — which would make it last longer because it would take more investments to hit the $3 million cap, but McClelland said that if legislators reduce the cap too much, they would undermine the whole program and prompt investors to take their money elsewhere.

Those adjustments also could include reducing the tax credit percentage, he said.

If lawmakers want to keep the program, they’ll have to make changes soon.

Under current law, the program will run out of funds as soon as next year: Of the original $40 million the state has allotted for the credit and another program, only $6 million remain.

London-based Trint raises $3.1M for AI-driven transcription service

London-based Trint, a startup co-founded by Emmy-winning journalist Jeff Kofman, is tackling a paint-point I know all too well: the time it takes to transcribe an interview (or any audio) accurately.

Specifically, Trint integrates a web-based audio/video player and text editor, with the outputted automated transcription synced to the audio player’s playhead.

It’s a deceptively simple idea but one that makes a ton of difference when checking (and editing) a transcription for accuracy.

Of course, the outputted text means that otherwise hard to search content becomes searchable, taking Trint’s application way beyond journalism or academic interviews.

“There’s this concept of dark data.

It’s that simple.

Trint originally launched in September 2016 with funding from the Knight Enterprise Fund and the Google Digital News Initiative, as well as support from BBC Worldwide Labs and Cisco.

It claims to have close to 7,000 regular users in just nine months, which hasn’t gone unnoticed by investors.

The U.K. company has closed $3.1 million in “pre-Series A funding,” in a round led by Horizons Labs, the Hong Kong-based seed fund operated by the managers of Horizons Ventures.

Kofman says the new capital will be used to support the development of technology to transform Trint into an “end-to-end publishing platform”.