The 3 Holiday Gifts All Entrepreneurs Need

Zhongan Online Said to Scrap H.K. IPO, Consider China Listing

VCs Want to See Product-Market Fit: Here’s How to Prove It

VCs Want to See Product-Market Fit: Here’s How to Prove It.

Related: Elite Venture Capital Firm Andreessen Horowitz Looks for These 3 Things in Startups With lower funding, entrepreneurs who want a slice of the (shrunken pie) must prove to VCs that they’re worth the dough.

Product-market fit wins investments.

With a 60 percent gross margin, the company would likely sell for about four times the next year’s revenue.

But if the company’s gross margin is lower, then it might sell for only twice next year’s projected revenue.

Before investing, my company looks for a churn rate below 6 percent.

A churn value higher than that can indicate a product problem or a weak market.

A high lifetime value indicates a strong market that’s satisfied with your product.

Put your target user under the microscope.

Over the course of 90 days you might test different packages or pricing options to maximize conversion rates and gross margins while minimizing churn.

Jagged Peak Energy files for initial public offering

Jagged Peak Energy files for initial public offering.

Jagged Peak Energy Inc. said it plans to raise up to $100 million in an initial public offering, according to a filing with the Securities and Exchange Commission late Monday.

The oil and natural gas company reported revenue of $33.8 million and a loss of $7.5 million in 2015.

Citigroup, Credit Suisse, and J.P. Morgan are lsited as underwriters for the offering.

The company plans to list on the New York Stock Exchange under the ticker “JAG”.

SoFi pushes back IPO plans amid financial tech sector struggles

The San Francisco online lending company known as SoFi, which specializes in refinancing student loans, is pushing back plans for an initial public offering in order to focus on developing other business lines, said CEO Mike Cagney.

A decline in public market valuations of online lenders isn’t encouraging for a SoFi IPO, Cagney said in an interview.

Cagney said in May 2015 that the company would likely go public within the next 12 months.

That’s mostly because SoFi’s newer business lines are still evolving and the company plans to add more financial products, Cagney said.

As newer offerings like wealth management and life insurance are being developed, the startup sometimes has to make changes in certain months that may cause metrics to fluctuate quarter by quarter, according to Cagney.

Shares of small-business-lender On Deck Capital Inc. plummeted about 60 percent.

Last year, the company issued $5 billion in loans.

SoFi reached a valuation of about $4 billion last year when it raised $1 billion from a group of investors led by SoftBank Group Corp., a person familiar with the matter said in September.

The office said this month that it plans to start accepting applications from fintech companies for a special charter that would formally subject them to federal banking rules.

Being designated as a national bank could help fintech firms like SoFi accelerate their growth by giving confidence to potential customers and investors.

WildHorse Resource Development Corporation Announces Closing of Initial Public Offering

WildHorse Resource Development Corporation Announces Closing of Initial Public Offering.

The offering raised net proceeds to the Company of approximately $391.7 million, after deducting underwriting discounts and commissions and estimated offering expenses.

The Company intends to use the net proceeds from the offering, along with borrowings from the Company’s revolving credit facility, to (i) fund the remaining portion of the Burleson North acquisition purchase price for $344.8 million, (ii) repay in full and terminate the existing revolving credit facilities of its subsidiaries and (iii) repay in full all notes payable by one of its subsidiaries to its prior owners.

Copies of the written prospectus for the offering may be obtained from: Barclays BofA Merrill Lynch c/o Broadridge Financial Solutions Attn: Prospectus Department 1155 Long Island Avenue 200 North College Street, 3rd Floor Edgewood, NY 11717 Charlotte, NC 28255-0001 (888) 603-5847 dg.prospectus_requests@baml.com barclaysprospectus@broadridge.com BMO Capital Markets Corp. Citigroup Global Markets Inc. Attn: Equity Syndicate Department c/o Broadridge Financial Solutions 3 Times Square, 25th Floor 1155 Long Island Avenue New York, NY 10036 Edgewood, NY 11717 (800) 414-3627 (800) 831-9146 bmoprospectus@bmo.com Wells Fargo Securities Attention: Equity Syndicate Department 375 Park Avenue New York, NY, 10152 Email: cmclientsupport@wellsfargo.com Telephone: 1 (800) 326-5897 About WildHorse Resource Development WildHorse Resource Development Corporation is an independent oil and natural gas company focused on the acquisition, exploration, development and production of oil, natural gas and NGL properties primarily in the Eagle Ford Shale in East Texas and the Over-Pressured Cotton Valley in North Louisiana.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy these securities, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction Cautionary Statement Concerning Forward-Looking Statements This release includes “forward-looking statements” within the meaning of federal securities laws.

Such forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company’s control.

All statements, other than historical facts included in this release, are forward-looking statements.

Although the Company believes that the plans, intentions and expectations reflected in or suggested by the forward-looking statements are reasonable, there is no assurance that these plans, intentions or expectations will be achieved.

The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

The risk factors and other factors noted in the preliminary prospectus could cause the Company’s actual results to differ materially from those contained in any forward-looking statement.

Traveling With Your Pet This Holiday? Bone Voyage!

Dogs are all about smells.

This may mean that you, at the wheel, spend your time being both pet parent and taxi driver, dividing your focus between the road and your fur baby, which is an accident waiting to happen.

To prevent any faux-paws, here are a few ways to calm frightened pets on a road trip: Invest in an “away toy”– a great way to keep pets distracted for many miles to come Bring your dog’s bed with him, and let him lie on it, wherever he’ll be riding.

Smells like home .

Collapsible pet bowls are a great way to keep pups full and hydrated during stop and go’s.

If you plan on taking your pet on a long distance trip, a vet check-up is a must.

We may want to have our best friends with us while we travel, but be sure to plan ahead and ask yourself, “Will traveling cause more stress to my pet than traveling with him is worth?” 3.

Consider a Plan B!

Image credit: Figo Pet Insurasnce After all, health emergencies can happen to anyone at any time — including furry family members.

Plus, the Pet Cloud (see below) makes traveling a breeze.

Why Tim Ferriss Wants to Be the Dumbest Guy in the Room

Why Tim Ferriss Wants to Be the Dumbest Guy in the Room.

In a long-ranging discussion about his insightful new book, Tools of Titans, Tim Ferriss and Entrepreneur magazine’s editor in chief Jason Feifer went live on Facebook to discuss some of the most useful tips Ferris has learned from great innovators and leaders over the years.

Some topics they touched on include: The dangers of working in a bubble How to conquer fear How to test advice and figure out what’s good for you How to get your energy up during grueling workweeks What Ferriss eats to make sure he feels good and focused What Ferriss doesn’t track about himself, and the importance of not over-examining your life Watch out the full video above, and check out Ferriss’s Tools of Titans.

The Difference Between a Leader and a Boss

The Difference Between a Leader and a Boss.

Join us Dec 20. for our free webinar on attracting top talent, fueling productivity and building a brag-worthy culture.

Register Now » It’s easy to think bosses and leaders are the same.

In fact, they’re nearly opposites.

So what makes a leader different from a boss?

The answer is simple: Leaders lead, motivate and empower.

Bosses just try to get the job done.

While bosses are focused on themselves, leaders look for ways they can help and encourage those around them.

A leader understands that the people he or she works with are essential to an organization’s success, treating them as equals and providing them with helpful direction.

Bosses, on the other hand, give out orders and view employees as disposable inferiors.

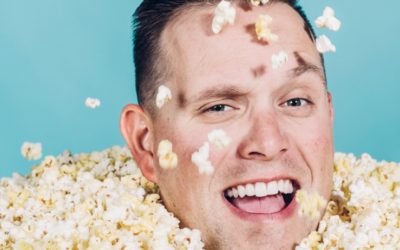

How an Obsessive Movie-Goer Reinvented the Theater’s Favorite Food

Bric simpson was a genuine movie buff: He hit the theater about five times a month.

In 2009, Simpson and his wife were shaking a popcorn bucket to distribute the butter when she said, “You know what we need?

But the process wasn’t easy.

Simpson had always loved the idea of running his own business.

Once he had a design and a patent pending, it was sales time.

Simpson also found early success at Bow Tie Cinemas, a chain with 50 locations, mostly on the East Coast.

The Kernel King solved all these problems — and, although Simpson won’t reveal his price, he says the lids are far cheaper than drink trays.

(To help sales along, Simpson also hired a production company to make a commercial for Kernel King lids; many theaters now play it for free before movies.)

Kernel King is now in 160 locations, and Simpson expects to be in more than 300 in the next year.

“We don’t want to stop until every single popcorn bucket has a Kernel King lid on it,” says Simpson.

Venture capitalists waking up to Nashville firms

GV, Google’s venture capital arm, Oak Investment Partners, Nasdaq, Goldman Sachs, Credit Suisse and BlueCross BlueShield Ventures are among the national or global companies and investment groups he rattles off that have poured millions into Nashville startups.

“We are having a great deal of success graduating companies to regional and national venture capital groups,” Chambless, director of Nashville Capital Network investment firm, said.

“It used to be regional, that’s where the story has changed in the last couple of years.” Nashville’s entrepreneurial community has gained significant support in recent years with the creation of the Nashville Entrepreneur Center, multiple new investment funds, the state’s $200 million TNInvestco initiative, Launch Tennessee’s programs and healthcare investment fund Jumpstart Foundry.

Aspire, which brings doctors and nurse practitioners to patients’ homes, had raised $2 million from Nashville investors before landing much larger rounds from BlueCross BlueShield and Oak, based in Connecticut and Palo Alto, California.

Brad Smith, CEO of Aspire Health, at his office on Friday, Dec. 9, 2016, in Nashville, Tenn. Smith landed $32 million in venture capital from GV, the investment arm of Google.

A GV partner has also spent a few days in Nashville to follow nurse practitioners and help improve their retention rates.

That the investment brings GV partners to Nashville is also notable.

That growth stage of capital needs more local support to help lure more national players to the area, Chambless said.

“Goldman Sachs isn’t going to come in and do the $1 to $2 million round,” Chambless said.

Seed stage funding has grown significantly in recent years, in part fueled by TNInvestco, which raised about $120 million to invest Tennessee-based companies.

NoBroker Raises Another Rs 50 Crores Via Series B Funding From South Korean Investor KTB

NoBroker Raises Another Rs 50 Crores Via Series B Funding From South Korean Investor KTB.

Online real estate platform and rental provider NoBroker has raised another $7 million, or Rs 50 crores through investments by KTB Network and existing investors- SAIF Partners, BEENEXT & Digital Garage.

KTB is the venture capital arm of the South Korean major KTB Network.

Early this year, KTB had expressed interest in investing in Indian growth stage start-ups and now it seems to have made good on that assurance.

This move is also a major boost to the ‘Make in India‘ campaign.

The Economic Times quoted Chun Soo Kim, team manager for investment screening at KTB saying,”India’s domestic market is large, it is growing and has a very young population.

Their Korean start-up experiences will help us further with innovative ideas so that we can continue to grow exponentially.

We are in an excellent position now in terms of customer growth and financials.

#MakeInIndia https://t.co/R87h2qmdkV — Make in India (@makeinindia) December 19, 2016 NoBroker is essentially a C2C platform, with customers seeking to rent properties directly and without any broker.

NoBroker has served 1.5 million customers till date, making it the world’s largest C2C real estate platform.

6 Skills You Can Learn Online for a Lucrative and Productive 2017

A focused and determined person can learn many skills online and use them to diversify his or her income.

There are countless websites readily available for you to acquire valuable skills and knowledge for free or with little fee for a productive 2017.

These skills are: 1.

Fashion designing.

The beauty of having this skill lies in the way customers flock around fashion designers within few hours of setting up an office.

5. Business research.

Many people want to venture into business while those who are already in business are seeking other businesses to invest in.

You can actually learn how to create and run a blog online.

You can create a blog for your web design and development business, statistical data analysis, fashion designing, makeup and business research businesses.

There is so much to be gained by acquiring one or more skills online.

5 Job Trends to Look Out for in 2017

5 Job Trends to Look Out for in 2017.

Join us Dec 20. for our free webinar on attracting top talent, fueling productivity and building a brag-worthy culture.

Data science will find its way into human resources.

Many companies have hired data scientists to better streamline the way they approach things such as marketing and logistics, but in the year ahead, Chamberlain expects that more HR departments will take that tack when they are dealing with employee engagement, from utilizing A/B testing to tracking their feelings.

While technology won’t make jobs disappear entirely, multiple industries including retail, finance, transportation and, of course, manufacturing will see automation augment existing roles.

To offset these changes, Chamberlain recommends professional development — on both a personal and a company level — focusing on building skills that will be complementary and separate from the machines that will become an integral part of the work.

Say farewell to ostentatious office perks.

In critiquing the startup world, there is often the concern that companies that provide cushy perks — ping pong tables and video games, catered lunches, on-site spa treatments — are more style than substance.

The idea of the “gig” economy will be reshaped.

However, the ethos of the gig economy, especially with regard to flexibility in making your own hours and working from anywhere, will become more prevalent in more established fields.

10 Rules for Leveraging Social Media to Grow Your Business

How This Mom Grew Multiple 6-Figure Businesses From Home

U.S. Startups Are Piling on Debt

His New York-based startup doubled annual revenue this year and is on track to break even in 2017.

Silicon Valley Bank’s loan volume to venture-backed startups surged 19 percent during the past year to $1.1 billion for the quarter ending Sept 30.

Wellington Financial made more than 10 new loans to venture-backed startups in 2016, double last year’s total.

Western Technology Investment CEO Maurice Werdegar called volume “robust” and described the lending environment as “hyper-competitive.” “Debt allows you to get around that.”

Silicon Valley Bank, the granddaddy of tech lending, says loan volume and value could have gone even higher.

They require timely payments from all their companies, with interest that’s designed to provide the lender with a more predictable and less risky source of revenue than venture investing.

He says he didn’t consider tapping VCs again because another round would have diluted his shares too much.

The offers had interest rates ranging from 9 percent to 15 percent over two to five years, and the terms protecting the lenders varied.

Driscoll passed on that, opting instead for cleaner terms for a $14.25 million loan in October at around a 14 percent rate from Wellington Financial and City National Bank.

Startup Parentune’s online community helpline tries to solve parents’ problems

Startup Parentune’s online community helpline tries to solve parents’ problems.

Venugopal Pottu (left) and Nitin Pandey, Co-founders, Parentune.

“More often than not, my discussions with parents would veer from academics to the bigger challenge they were facing: Raising their kids right—education was just one aspect,” says Pandey.

As a part of his business research, Pandey went about meeting parents at their homes, offices and stood outside schools—with a handycam and a tripod to record the conversations.

The research involved more than 2,000 parents across Delhi, Mumbai, Bengaluru, Pune, Chandigarh and Hyderabad.

In March 2012, he founded Parentune, an online community helpline to solve parents’ queries, address their concerns and offer personalised support based on their specific needs and challenges.

The members of the Parentune community can discuss among themselves issues related to parenting, write blogs, seek advice from an array of experts— paediatricians, psychologists, nutritionists, educationist, among others—and participate in online workshops.

Even as the startup aims to grow its community of registered parents and visitor count to five and 10 million respectively by end-2018, Pandey insists that all parents need to be verified before they join the platform.

In fact, initially, they had to let go of investors who found verification an impediment to the startup’s growth.

In order to expand its community, Parentune is looking to offer support in regional languages.