Callsign pulls in $35M Series A for its adaptive authentication platform

Callsign pulls in $35M Series A for its adaptive authentication platform.

Its approach essentially combines multi-factor authentication with fraud analytics powered by deep-learning technology to offer a authentication platform that can adapt to potentially suspicious signals to combat the threat of unauthorized logins.

It’s worth noting that Callsign does not replace any existing authenticator technologies — rather the aim is to enable businesses to more effectively deploy these technologies, based upon the intelligence it gathers and the policies it allows enterprises to flexibly set.

“The purpose of this data analysis (this is our unique AI) is to spot potentially suspicious usage and then adapt the authentication journey (security challenges),” Hayat tells TechCrunch via email.

As well as using AI to power authentication decisions, Hayat says Callsign’s platform supports manual adaption — which he says might be useful if, for example, a business realizes that a specific authenticator type has been hacked.

Another possible scenario he describes is a customer wanting to login to a banking or retail website to make a purchase.

“They have the correct password but the way they entered it was unrecognised (i.e. AI finds muscle memory mismatch), additionally the device the customer is coming from is unrecognised (i.e. AI profiles the device and finds the user has never been seen on this before) but the location does seem to be one that is recognised (i.e. AI profiles a number of metrics and decides that this is a known location) for this given customer.

“As a result, dependant upon the policies the business has set, the user may be prompted for an additional authenticator (e.g. face) or simply let through because location is recognised with correct password, meaning the user may be on a borrowed/new device.” Expansion plans and market positioning While financial services (banking and insurance) has been Callsign’s main first customer focus, Hayat says it’s now starting to broaden that base, with deployments beginning “across verticals — government, retail, healthcare, legal & accounting and telecoms”.

In addition all data is transformed on the device before being transported to the server for processing, this means raw information (timings, accelerometer, gyroscope, touch coordinates, geo-coordinates etc) are not stored on the server,” he says, adding: “You can think of this as all data going through a unique (one way transformation) on the device before the server processes and stores it.

If somebody manages to get access to databases in which user data is stored, firstly they would need to hack both Callsign and our business customers (as encryption keys are known and managed by the businesses themselves) and then they would need to somehow transform this to the actual data.” “All of this has had to go through approvals with tier 1 banking customers,” he adds.

Slack is raising a $250 million round at $5 billion valuation

Enterprise messaging service Slack is raising a $250 million round at a $5 billion valuation, TechCrunch has confirmed.

We’re hearing that SoftBank, Accel Partners and other existing investors participated.

Axios first had the names of the lead investors.

Recode originally reported on a $500 million round last month, but we’re hearing that was likely in reference to the same round and the amount just wound up being $250 million.

There have also been various reports about acquisition conversations, but at least one source with direct knowledge claims the parties never came close to finalizing a deal.

Yet investors certainly believe Slack has strong “exit” potential.

Over $500 million in equity funding has been disclosed so far, and the $5 billion valuation means that some investors believe it will be acquired or go public at a value significantly higher than that.

We use Slack at TechCrunch for much of our internal communication.

(And gifs!

Some people are really excited about the Giphy integration.)

Stitch Fix COO reportedly departs amid rumored IPO prep

Stitch Fix COO reportedly departs amid rumored IPO prep.

Because of the awkward timing though, just ahead of the subscription apparel retailer’s planned initial public offering, Recode’s Jason Del Rey speculates there may be more to the story, either disagreement among the company’s top management or an actual opportunity for Bornstein to serve as CEO somewhere.

A request for details or comment from Retail Dive wasn’t immediately returned.

Dive Insight: Earlier this year, privately-held Stitch Fix said it had $730 million in revenue in the 2016 fiscal year, marking its third consecutive year of profitability.

However, the online personal styling service last month tapped Paul Yee, who has extensive experience at major brands, as CFO, and speculation about an IPO intensified.

Stitch Fix has garnered backing from venture capital firms Baseline Ventures, Benchmark, Lightspeed Venture Partners and Western Technology to the tune of $46.75 million in three rounds, most recently $30 million in 2014.

Despite their popularity among consumers, it’s not clear how these players are doing financially, considering nearly all of them are privately-owned companies.

But Nordstrom’s Trunk Club, which began as a concierge service for men but now also styles women, perhaps gives a clue to the concept’s viability: While it gets high marks from users, Nordstrom wrote down $197 million of that business last year.

Three years ago, Nordstrom acquired the service, started by Bonobos co-founder Brian Spaly (who left late last year as CEO); it’s not yet profitable and the nearly $200 million non-cash goodwill impairment represents more than half of the $350 million Nordstrom paid to purchase it.

San Francisco-based Stitch Fix similarly has a $20 try-on fee that can be used toward a purchase and generally offers prices that are lower than Trunk Club thanks, in part, to a less costly styling approach based on inputs from a questionnaire rather than Trunk Club’s direct human interaction.

August Home raises another $25 million as it expands service partnerships for its smart locks

August Home raises another $25 million as it expands service partnerships for its smart locks.

The service has already made some headway in the rental market, counting Airbnb and vacation rental site HomeAway among its major partners.

The smart lock makes a lot of sense for those offerings, giving home owners and landlords the ability to generate temporary access codes remotely, for short stays.

The list of investors offers some insight into the kind of additional partnerships the company is focused on, moving forward.

Along with familiar investment groups like Bessemer Venture and Liberty Mutual are Comcast Ventures and Australian utility company, AGL.

August CEO Jason Johnson tells TechCrunch that Access is still a fairly small portion of the business, with most of the company’s sales still arriving through traditional retail channels.

That’s especially true when the company makes it a point to continually upgrade the product’s firmware in an attempt to improve the experience long after the device has been purchased.

Partnerships with utility and cable companies, on the other hand, offer an avenue into home that don’t aggressively seek out the latest and greatest tech products.

“We have a pretty aggressive product roadmap,” says Johnson.

“We’ll be introducing additional new products this year.

CPG investing platform CircleUp will now issue loans to help consumer brands grow

CPG investing platform CircleUp will now issue loans to help consumer brands grow.

It’s hard raising money as a consumer packaged goods (CPG) company, but one startup wants to make it easier.

CircleUp, which already helps consumer brands raise millions in equity financing, is now going to issue loans to help smaller CPG companies raise working capital and avoid cash crunches.

To launch the new lending product, CircleUp has partnered with Community Investment Management (CIM), an investment manager focused specifically on economic development and social impact that comes from backing small and medium-sized businesses.

To get the program off the ground, CIM is contributing a $20 million credit facility which CircleUp will use to fund the loans it issues.

“Most banks are uninterested… in lending to small businesses,” Haar said.

CircleUp wanted to do what few banks in the industry were willing to do, which is provide reasonable and responsible lending products to help small businesses grow.

Powerful Yogurt had previously raised $2 million in equity financing through CircleUp, but when it came time for Ramirez to invest more into his business, he didn’t want to dilute himself further.

By contrast, he said the process of borrowing money was easy and transparent.

With more than 17,000 companies having already applied to its investment platform and millions of data points to help evaluate them, the lending option is well on its way to providing a much lower-cost way of raising working capital for consumer brands.

The 2017 IPO Market Was Supposed To Be Huge — What Happened?

The weak performances of Snap (SNAP) and Blue Apron (APRN) in the stock market since the two came public in recent months is putting a damper on what was expected to be a strong year for initial public offerings.

Blue Apron, which started trading June 29, is down 25% from its IPO price of 10 and down 32% from its record high of 11. “The IPO returns and market condition are good, yet activity is fairly subdued,” said Smith.

Blue Apron cut its IPO price to 10, from previous plans to offer shares in the range of $15 to $17.

The operator of 50 yoga studios had intended to raise $75 million via an initial public offering, before pulling its IPO, citing “market conditions.” “The discounts have been painful for companies coming to market expecting to get a high market valuation,” said Smith.

IBD’S TAKE: The biggest stock market winners typically make their major price moves within a few months or years of their initial public offering.

Akcea came public on July 14 and currently trades near 13.75, up 72% from its IPO price.

That makes Akcea one of the top-performing IPO stocks this year.

Floor & Decor was recently featured in IBD’s New America section.

Tencent backs Indian education startup BYJU’s at a valuation of $800 million

Tencent backs Indian education startup BYJU’s at a valuation of $800 million.

Tencent, Asia’s highest-valued tech company, has continued to invest in India after it backed online education service BYJU’s.

The startup that includes the Chan Zuckerberg Initiative and Sequoia among its investors.

It said it has turned profitable in the last quarter with annual revenue more than doubling to reach $40 million for the 2016-2017 period.

The World Bank’s IFC fund added $15 million more in December.

The latter transaction is notable for a few reasons.

BYJU’s positioned the deal as a potential accelerator to enable expansion into new markets — a vision the firm is seemingly moving towards — because of TutorVista’s range of services, which include digital content and information for school, test preparation and offline coaching to students, and management of K-12 schools.

Pearson paid around $150 million over several investments to acquire TutorVista.

Its acquisition by BYJU’s was never disclosed, but Indian tech media outlet The Ken claims it paid just $3 million for the deal.

That would make it, potentially, a very good piece of business.

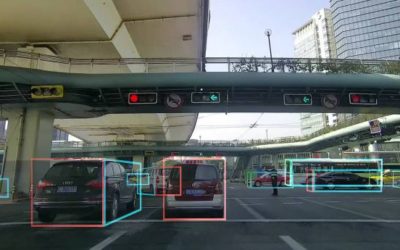

Momenta raises $46M Series B for its self-driving car software

Momenta raises $46M Series B for its self-driving car software.

Shunwei Capital, Sinovation Ventures, Unity Ventures and Daimler also participated in the round.

Quite a few U.S. startups are trying to create the software to power autonomous vehicles — Drive.ai and nuTonomy to name a few.

The startup counts three ex-Microsoft researchers on its team and three PhDs.

And outside of other obvious differentiators like investment size and location, the deal is notable because it features German automaker Daimler AG.

Just yesterday the company showed off cars that can automatically park themselves inside a parking structure.

And over the course of the year, Daimler has promised fully autonomous cars in just five years.

This isn’t the first investment made by Daimler into an autonomous vehicle startup.

We’ve put a note into the Momenta team to see if they are willing to share what their plans are for the pile of cash they just got their hands on.

We will update this post if and when we get more details.

SEC regulators are coming after ICOs

SEC regulators are coming after ICOs.

The SEC has concluded that the digital currencies will be regulated as securities, meaning unregistered offerings could be subject to criminal punishment.

The decision was announced on Tuesday.

To reach its findings, regulators evaluated an offering facilitated by “The DAO.” The report concluded, “that issuers of distributed ledger or blockchain technology-based securities must register offers and sales of such securities unless a valid exemption applies.” It warned that those “participating in unregistered offerings also may be liable for violations of the securities laws.” This is a blow to many startups that had been using ICOs as an alternative way to raise capital.

There have been a wave of these offerings in recent months, where people have been investing in business ideas via Bitcoin, Ethereum or other cryptocurrencies.

But like all startups, these investments bear risks.

And the opaque nature of the ICOs meant that there wasn’t oversight about what the businesses did with the proceeds.

Although many of the ICOs have been smaller unknown companies, the difficult fundraising environment has caused some venture-backed startups to raise coin offerings for enough capital to get them to the next step.

Messaging app Kik was a notable recent example.

Featured Image: Anthony Bradshaw/DigitalVision/Getty Images

Kala Pharmaceuticals Announces Close of Initial Public Offering and Exercise of Underwriters’ Option

Kala Pharmaceuticals Announces Close of Initial Public Offering and Exercise of Underwriters’ Option.

WALTHAM, Mass.–(BUSINESS WIRE)–Kala Pharmaceuticals, Inc. (NASDAQ:KALA), a biopharmaceutical company focused on the development and commercialization of two Phase 3 product candidates, KPI-121 1.0% for the treatment of inflammation and pain following ocular surgery and KPI-121 0.25% for the temporary relief of the signs and symptoms of dry eye disease using its proprietary mucus-penetrating particle (MPP) technology, today announced the closing of its initial public offering of 6,900,000 shares of common stock, including the underwriters’ exercise in full of their option to purchase an additional 900,000 shares, at the public offering price of $15.00 per share.

The exercise of the underwriters’ option brought the amount of gross proceeds raised in the offering to approximately $103.5 million, before underwriting discounts, commissions and estimated expenses of the offering.

J.P. Morgan, BofA Merrill Lynch and Wells Fargo Securities acted as joint bookrunners for the offering.

Wedbush PacGrow acted as a co-manager for the offering.

A registration statement relating to the shares of common stock being sold in this offering has been filed with the U.S. Securities and Exchange Commission and was declared effective on July 19, 2017.

Copies of the final prospectus may be obtained by contacting J.P. Morgan Securities LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, or by telephone at (866) 803-9204, BofA Merrill Lynch, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte, NC 28255-0001, Attention: Prospectus Department, or by email at dg.prospectus_requests@baml.com or Wells Fargo Securities, Attention: Equity Syndicate Department, 375 Park Avenue, New York, NY 10152, at (800) 326-5897 or email a request to cmclientsupport@wellsfargo.com.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of shares of Kala’s common stock in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of such jurisdiction.

About Kala Pharmaceuticals, Inc. Kala is a biopharmaceutical company focused on the development and commercialization of therapeutics using its proprietary MPP technology, with an initial focus on the treatment of eye diseases.

Kala has applied the MPP technology to create a corticosteroid designed for ocular applications, resulting in two product candidates in Phase 3 clinical development, KPI-121 1.0% for the treatment of inflammation and pain following ocular surgery and KPI-121 0.25% for the temporary relief of the signs and symptoms of dry eye disease.

7 Entrepreneurs on What It’s Like to Be a Startup in Denver

With a supportive ecosystem focused on work-life balance and promoting diversity, it’s no wonder the Mile-High City is thriving.

Mile-High Culture Yes, work-life balance is important to tech companies around the country.

And as we have scaled we have been active supporters and participants, and been able to help maintain and grow the startup infrastructure for so many other newer startups.” Thin Air Funding While the culture is focused on work-life balance and the community is undeniably supportive, it’s important to remember that Denver is not one of the major tech hubs.

This means that the funding situation is less than ideal, making for a competitive environment when it comes to locking down capital.

Compared to the West and East Coast, Colorado is not as big from funding amount standpoint.” Despite the hard to find funding, the supportive attitude makes getting your foot in the door a little easier than the smaller ecosystems.

“After an introduction, it’s on you to unearth any potential opportunities!

In general, Denver‘s culture works in favor of startup founders when it comes to making connections needed to start a business.” Denver Diversity A thriving ecosystem is about more than business capital and startup exits.

“Denver is doing a better job of being more inclusive of diverse entrepreneurs,” said Molly Berger, head of client engagement at P2Binvestor.

“We still have a long way to go but strides are being made by everyone from major tech companies, to support organizations and the city and state governments as well.” Read more about the Denver startup ecosystem on TechCo Conor is a writer, comedian and world-renowned sweetheart.

Conor is the Senior Writer at Tech.Co.

Node raises $10.8 million to find you better sales leads

Node raises $10.8 million to find you better sales leads.

The first step of any salesperson is to figure out who to pitch, but some of them are wasting time targeting the wrong prospective clients.

That’s the premise behind Node, a startup that says its platform uses artificial intelligence to find sales leads.

In “stealth mode” for the past 2.5 years, the company is now announcing a $10.8 million venture financing round led by Avalon Ventures, with participation from Mark Cuban, NEA and Canaan Partners.

Cuban told TechCrunch that he invested because “it is an incredible company that is changing the game for sales intelligence.” He says that with Node, “selling is no longer hunting and gathering.

They make it a knowledge approach.” Falon Fatemi, founder and CEO at San Francisco-based Node, says that her work experience at Google helped her understand how to build search algorithms that help businesses.

She says that Node’s platform is a “search engine without a search box.” It’s “people-based intelligence.” She summed up her business by saying that “the main problem that we’re solving is that we’re essentially facilitating the discovery of the right person at the right company at the right time and even suggesting the right message to reach out.” While Node is targeting salespeople right now, she hopes to eventually build platforms for other categories.

In the future Node will be “recommending the next hire, next job opportunity or even dating.” There have been a flurry of investments in sales startups, as investors believe there’s a large market opportunity in sales efficiency.

Salesforce Venture, Box Group and 500 Startups have been the most active in the category.

Node previously raised over $5 million in seed funding.

But did it work? Ad measurement companies are thriving

But did it work?

Ad measurement companies are thriving.

The rise of ad measurement companies is best exemplified in the $850 million that Oracle is reportedly paying to purchase Moat.

But the demand for ad measurement can also be seen in the fact that ad measurement startups are raising money at a time when venture capital funding in ad tech has dried up.

Alphonso, which verifies linear TV viewers on their mobile devices, raised about $6 million in June.

Although startup measurement firms can’t compete with industry stalwarts like Moat, DoubleVerify and Integral Ad Science on pure scale, they can find success in niches, like Alphonso does with measuring targeted TV ads.

A series of unfortunate events over the past year have also increased the demand for ad measurement.

Prime acquisition candidates include cloud companies that want to compete with Oracle on this front after its purchase of Moat, programmatic platforms that want to integrate measurement companies directly into their systems to entice buyer clients and traditional ad measurement companies like Nielsen that want to overhaul their digital products, he said.

The rising valuations of measurement companies produce regret among investors who missed out.

Auren Hoffman, founder of ad tech companies LiveRamp and SafeGraph, has invested in dozens of ad tech companies, but he hasn’t yet put money down on any measurement firms.

Looser standards will not fix initial public offering market

Yet the logic of loosening standards to increase the number of companies seeking to list is wrong.

Many sources of private money, from hedge funds and private equity firms to sovereign wealth funds, are eager for a cut of a hot sector.

Facebook raised $US2.2bn in private equity funding over seven years ahead of its IPO.

This means that, even as the number of IPOs has decreased, the average size of companies that go public has increased dramatically.

A winner-takes-all dynamic is created in which a small number of institutional investors get in early on hot new companies, and fewer such companies need to come to market.

In lieu of a debt jubilee or healthcare reform, pushing back against short-term market pressure is a good start.

That would probably require major tort reform.

One of the reasons boards spend so much time on such issues is the amount of corporate litigation in the US.

Community banks represent 13 per cent of banking industry assets but 43 per cent of all small business funding.

Financial Times

BAML, UBS launch petrol station initial public offering

BAML, UBS launch petrol station initial public offering.

Bank of America-Merrill Lynch and UBS are seeking buyers for an additional $38 million of shares in petrol station owner Convenience Retail REIT.

The brokers launched Convenience Retail REIT’s initial public offering bookbuild late on Tuesday morning, and were seeking bids from fund managers by 4pm on Tuesday.

Under the IPO, Convenience Retail REIT raised $95.2 million via the sale of 31.7 million new securities at $3 each.

However, there was an additional 12.7 million securities available at $3 a security up for grabs on Tuesday, representing stock from some of Convenience Retail REIT’s existing shareholders.

The offer was priced at a premium to net tangible asset backing, worth $2.73 a security, and implied a 6.75 per cent forecast distribution yield for the 2019 financial year.

Convenience Retail REIT is scheduled to begin trading with a $236.8 million market capitalisation on Wednesday.

The new listed property trust comes to market with 66 properties leased to petrol station operators Puma Energy Australia, Woolworths, 7-Eleven and Viva Energy Australia, which were independently valued at $308 million.

SIS India sets IPO band at Rs. 805-815

SIS India sets IPO band at Rs.

780 crore at the higher end of the price band.

New Delhi, Jul 24: Security and Intelligence Services (India) Ltd (SIS) has set the price band of Rs.

805-815 per share for its initial public offering (IPO) through which it aims to raise up to Rs.

780 crore, sources said.

The IPO comprises fresh issue of shares worth Rs.

362.25 crore and an offer for sale of up to 51,20,619 shares by the existing shareholders.

According to the sources, the company is estimated to raise around Rs.

780 crore at the higher end of the price band.

SBI Capital Markets, IDBI Capital Markets and Securities and Yes Securities (India) are merchant bankers to the issue.

This Ethereum and Cryptocurrency Backed Micro-loan and Micro-credit Company is Disrupting Banking

This Ethereum and Cryptocurrency Backed Micro-loan and Micro-credit Company is Disrupting Banking.

A new Ethereum based ICO company in the banking space, , is bringing banking services to over 2 billion people who do not have a bank account.

Everex gives those people access to a mobile based Everex wallet that essentially serves as a bank account with all of the related services but with no fees for exchanging money.

And it’s all backed by actual cryptocurrency.

In fact, on a recent trip to Australia it took me over 5 business days to just physically move money to myself while traveling.

From my own accounts.

The burden and hassle on top of the long wait was extremely annoying, just to access my own money.

Everex allows you to send it fee free as well as exchange currency anywhere in the world without the astronomical percentage based pricing structures.

Another pretty cool feature of Everex is cryptocurrency backed micro-loans and micro-credit.

These are all 100% backed by Ethereum and Ethereum based cryptocurrencies.

Federal Street Acquisition Corp. Completes $460,000,000 Initial Public Offering

Federal Street Acquisition Corp. Completes $460,000,000 Initial Public Offering.

Each unit consists of one share of the Company’s Class A common stock and one-half of one warrant.

Once the securities comprising the units begin separate trading, the Class A common stock and warrants are expected to be listed on the NASDAQ Capital Market under the ticker symbols “FSAC” and “FSACW,” respectively.

Citigroup Global Markets Inc. and BofA Merrill Lynch served as joint book-running managers of the offering.

The offering was made only by means of a prospectus, copies of which may be obtained from Citigroup Global Markets Inc., c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, Telephone: (800) 831-9146, Email: prospectus@citi.com or BofA Merrill Lynch Attention: Prospectus Department, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte NC 28255-0001, dg.prospectus_requests@baml.com.

A registration statement relating to the securities has been declared effective by the Securities and Exchange Commission (the “SEC”) on July 18, 2017.

This press release contains statements that constitute “forward-looking statements,” including with respect to the proposed initial public offering and the anticipated use of the net proceeds.

No assurance can be given that the offering discussed above will be completed on the terms described, or at all, or that the net proceeds of the offering will be used as indicated.

Copies are available on the SEC’s website, www.sec.gov.

Contacts Sard Verbinnen & Co. Matt Benson, Robin Weinberg or Devin Broda (212) 687-8080