How Uber Used a Simplified Business Model to Disrupt the Taxi Industry

How Uber Used a Simplified Business Model to Disrupt the Taxi Industry.

And while fares may be cheaper than in a normal taxi, depending on location, the big advantage of Uber is the proposition, not the price.

Simplifies the payment process.

Travis Kalanick stated in early 2015 that the traditional taxi market in San Francisco is about $140 million per year, while Uber’s gross revenues in that city are now approximately $500 million per year — a good three times larger than the traditional market.

Moreover, Uber’s revenues in San Francisco are tripling each year and should continue to grow for several years yet, which will easily make it 10 times larger than the whole of the old market.

There were fundamental characteristics of Uber’s service, and how it had to operate within its markets, with which the company’s leaders had to grapple.

In fact, it’s been copied hundreds of times in various countries around the world, in many cases with less than a million dollars of investment capital.

The second threat faced by Uber is that its rivals not only poach valuable customers but also degrade Uber’s service characteristics while improving their own by being the larger operator in certain cities.

Hence, the competitive footprint and success conditions for competitors started to become harder than merely achieving dominance in a particular city.

Lyft has accused Uber of poaching its drivers in order to disrupt its network growth; and both companies have accused the other of ordering and cancelling cars to interfere with service levels.

Stocks, bonds, and … desks?

« Previous Next » Bar Works spaces (credit: Bar Works) What do you do when you’re a co-working-bar-hybrid startup and you need to raise cash, but getting a bank loan is hard and getting venture funding even harder?

That thought, at least, is what New York-based Bar Works is doing, earning it The Real Deal’s prize for the most creative real estate funding model of 2016.

Bar Works leases (and sometimes buys) retail spaces and turns them into co-working spaces, with the added twist that each of its locations is also a bar (because having just one keg in your office is so 2015).

At its San Francisco location, according to a spokesperson the only property Bar Works owns, the lease has a 99-year term.

But securitizing co-working leases appears far more risky.

Jonathan Black, co-founder of Bar Works, declined to talk about the funding model and it wasn’t clear what collateral the company offers.

A Bar Works spokesperson told TRD that the company doesn’t own its spaces, with the exception of its San Francisco location, meaning there would be no real estate for the bond investor to foreclose on in the event of a default.

“If you are looking for a secure, proven and hands-free overseas property investment opportunity that offers unrivaled, double-digit income returns over the next decade, with guaranteed capital appreciation and an assured exit strategy this is the perfect property investment abroad for you,” it reads.

We have had clients invest who have received their promised returns every month without fail.” Bar Works declined to tell TRD how much money it has raised through the program.

On New World Property Investment’s website, five out of six Bar Works investment offerings are marked as “sold out.”

5 Reasons to Ask Sales Prospects More Questions

What do your sales prospects care about?

Ask more questions.

When you ask your prospects questions to discover their deepest frustrations, you’ll know exactly how to craft a solution they actually want to invest in.

You can’t find out what key challenges will motivate your prospects to buy from you unless you simply ask them.

Hone in on the obstacles and problems in each prospect’s world and look for ways you can present your product or service as a solution to those problems.

The only way to disqualify prospects is to ask the right questions, right away.

But, when you don’t disqualify, you only waste time and energy chasing down prospects you’ll never, ever close.

Value-based questions that tap into your prospect’s top challenges and goals allow a sales rep to discover if the prospect is a fit for your product in the first place.

In order to close any prospect, you have to make sure that there is a connection.

In the end, you’ll be able to close more profitable sales.

Why You Should Move Forward With the Next Opportunity

Why You Should Move Forward With the Next Opportunity.

Alex Brown, CEO of Chicago-based technology consultancy 10th Magnitude, has learned throughout his career and personal life that opportunities are fleeting.

If you’re worried about seizing it, consider the long view.

While it might disrupt your life today or this year, the future payoff could be huge.

Brown’s carpe diem mentality requires him to think positive, focus on the future and learn from — not dwell on — past mistakes.

Don’t try to predict everything, he says.

Click play to find out why Brown is convinced that no matter what you’re facing now as an entrepreneur, things will work themselves out.

Watch more videos from BizCast on its YouTube channel here.

Entrepreneur Network is a premium video network providing entertainment, education and inspiration from successful entrepreneurs and thought leaders.

We provide expertise and opportunities to accelerate brand growth and effectively monetize video and audio content distributed across all digital platforms for the business genre.

5 Essentials for Connecting With Your Ideal Target Market on Social Media

Proterra Nabs $140 Million as Electric Bus Maker Targets 2017 IPO

Proterra Nabs $140 Million as Electric Bus Maker Targets 2017 IPO.

A rendering of Proterra’s Catalyst E2 battery-powered bus.

Proterra Inc., a Silicon Valley maker of electric transit buses, said it raised $140 million as it accelerates manufacturing in the U.S. before a possible initial public offering this year.

The venture funding is the company’s fifth round, and Proterra Chief Executive Officer Ryan Popple said he expects it to be the last before taking the company public late this year or in 2018.

Proterra declined to name the lead investor in the latest financing round, saying it includes several new and existing backers, including Tao Capital Partners, Kleiner Perkins Caufield & Byers and General Motors Co.’s venture arm.

“The size of the round and the diversity of our investors reflects what we’re seeing around the world as institutions and businesses divest from fossil fuels,” Popple said.

That’s already true in places such as Proterra’s home state of California, where transportation accounts for more than a third of emissions.

It now has customers among transit agencies across the country.

The company said it sells each bus for $749,000.

Proterra makes its buses at a factory in Greenville, South Carolina, and plans to open a second plant near Los Angeles this year.

Richard Branson on How to Keep Track of Your New Year’s Resolutions

Richard Branson on How to Keep Track of Your New Year’s Resolutions.

2017 is underway, and you’ve likely got your New Year’s resolutions set and started.

But we all know it’s not selecting resolutions that’s the hard part — it’s about sticking to them for the next 362 days.

So, what’s the best way to keep your resolutions?

Write them down, says Virgin Group founder Richard Branson in a blog post.

In fact, writing things down — from ideas you hear to books you read to dreams you have — should be a new resolution for the year in and of itself.

Composing daily to-do lists and recording longterm goals and resolutions are great ways to manage your life — and helpful when taking on new resolutions, Branson explains.

“It’s how I make sense of the world, bring order to the ideas in my head and start turning them into action.” Start your year strong and maintain your goals.

Get out your notebook, smartphone or iPad and get started writing things down this year.

“If you don’t take notes, your ideas will get lost,” Branson warns.

6 Things to Consider Before Partnering Up

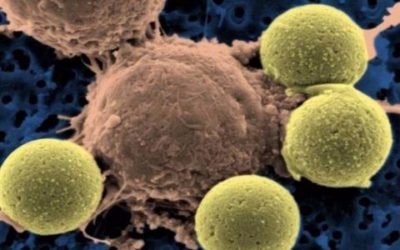

A startup trying to get the human body to fight cancer just filed for an IPO

Raising Pre-series A Funds is More Than Just Art Say These 4 New Winners on the Block

U.S. Customs System Outage Irks Travelers

5 New Year’s Resolutions for Busy Entrepreneurs in 2017

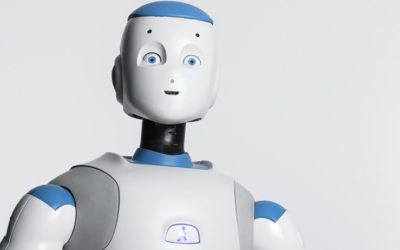

Robots Will Play a Bigger Role in the Coming Years, But Not as Big as You Think

What’s Behind the Rise in Deaf-Owned Businesses?

Make It Your New Year’s Resolution to Cold Email Your Idol

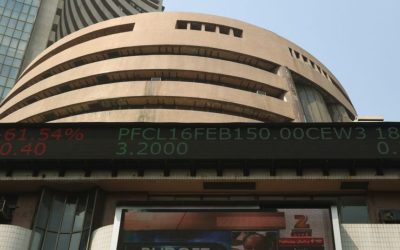

Sebi approves BSE’s initial public offering proposal

Plan to Get the Most Out of CES

China’s Sogou Targets IPO at $5 Billion Valuation to Chase Baidu

Sogou, whose name means “search dog,” plans to sell about 10 percent of its shares in an IPO that will probably be held this year, Chief Executive Officer Wang Xiaochuan said in an interview.

Wang plans to use part of the IPO proceeds to improve search results by backing companies developing artificial intelligence and machine-learning technologies.

“So over the next year or two, as more people feel more comfortable with Sogou they’ll realize it is able to replace Baidu.” Baidu accounted for 44.5 percent of mobile search queries in the third quarter, while Alibaba Group Holding Ltd.-backed Shenma had 20.8 percent and Sogou was third with 16.2 percent, according to research from iiMedia.

Wang said Sogou can match Baidu in mobile search within three years.

Marie Sun, an analyst at Morningstar Investment Service, said Wang’s emphasis on artificial intelligence was the correct strategy as search engines around the world adopt the technology to improve results.

“The problem is I don’t think they have that much data — Baidu has a lot more data,” said Sun.

“We’d float about 10 to 12 percent,” Wang said of the expected IPO. “After the listing I’d estimate we’d reach $4 to $5 billion.” Tencent didn’t respond to an e-mailed request for comment while calls to the mobile phones of its spokeswoman weren’t answered.

Sogou’s IPO plans come at a complicated time for search companies in China.

Sogou’s marketing spending in the December quarter probably reached 100 million yuan ($14 million), five times more than previous periods.