Cochin Shipyard IPO: Five Things To Know Before You Invest

Here are five things to know about this offer: 1) Through this IPO, Government of India is offloading 25 per cent stake (1.13 crore shares) in Cochin Shipyard.

Post this IPO, government’s shareholding in the company will come down to 75 per cent from 100 per cent now.

The company is also raising fresh capital worth R 979 crore, which it plans to use to set up a new dry dock (with R 443 crore investment) and an international ship repair facility (with R 230 crore investment) at Cochin Port Trust area.

2) Cochin Shipyard provides both shipbuilding services (74 per cent of its revenue) and ship repair services (26 per cent of its revenue) to defence and non-defence sector.

Ship repair business has two times margins than ship building and Cochin Shipyard is the market leader in the ship repair segment with 39 per cent market share.

3) Cochin Shipyard has an order book of R 3,078 crore, which is 1.5 times its FY2017 revenue.

Out of the total order book, 80 per cent is from defence sector and 20 per cent is from non-defence sector.

Angel Broking said, Cochin Shipyard’s “healthy” order book provides revenue visibility in the near term.

4) Cochin Shipyard reported a net profit of R 312 crore on revenues of R 2,059 crore in FY17.

Its revenue and net profit has grown at a CAGR of 11 per cent and 19 per cent over FY2007-FY2017.

IPO mart abuzz: Watch out for 6 upcoming issues

IPO mart abuzz: Watch out for 6 upcoming issues.

UTI Asset Management IPO details: The company is planning to launch its IPO by March 2018 and is likely to submit their Draft Red Herring Prospectus (DRHP) in the next three months.

UTI MF will be the first domestic MF company to come up with an IPO.

About the company: SBI, PNB, LIC each hold 18.3 per cent stakes in UTI MF and in this IPO, SBI, PNB and Bank of Baroda are likely to opt for a full exit.

The insurance regulator has approved SBI Life’s IPO application, seeking to raise Rs 7,000 crore, the largest share sale by a life insurer in India.

About the company: The company’s embedded value stands at around Rs 15,200 crore, up 17 per cent from Rs 12,999 at the end of March 2016.

Reliance Nippon Life Asset Management IPO details: The company on June 8, 2017 announced that it has received approval of the board of directors for an initial public offering of AMC in FY18.

As on March 31, 2017, Reliance Nippon Life Asset Management managed assets of Rs 3.58,059 crore of which MF AUM stood at Rs 2,10,891 crore.

Lenskart IPO details: The online eyewear firm is planning to come up with its IPO in the next 3 years.

It has raised around Rs 700 crore from various sources with TPG Global being one of the lead investors.

Stitch Fix quietly files for an IPO

Stitch Fix quietly files for an IPO.

Dive Brief: Stitch Fix has filed for an initial public offering under a special “IPO on-ramp” provision under the 2012 Jumpstart Our Business Startups Act (also known as the JOBS Act), TechCrunch reports.

A request to Stitch Fix from Retail Dive for more details or comment was not immediately returned.

The apparel subscription company tapped Paul Yee, who has extensive experience at major brands, as CFO just last month.

Earlier this year, the privately-held startup said it had $730 million in revenue in the 2016 fiscal year, marking its third consecutive year of profitability.

Subscription services are proving to have enduring popularity among consumers, but the long-term financial viability of the model remains largely unproven.

Nordstrom’s Trunk Club for example, began as a concierge service for men and now also styles women.

But while it gets high marks from users, Nordstrom wrote down $197 million of that business last year.

Still, Trunk Club is not yet profitable and the nearly $200 million non-cash goodwill impairment represents more than half of the $350 million Nordstrom paid to purchase it.

To stem those losses, Nordstrom last year instituted a $25 at-home try-on fee (which can be credited to a purchase) and shortened the return window.

Pennsylvania lags behind nation in small business start-ups, report says

In compiling its report, WalletHub analysts — which included business professors at Georgetown University and Case Western University — compared each state with 20 key indicators of startup success that included average growth of a small business, labor costs, office-space affordability as well as cost of living.

Analysts then placed and ranked the information in three categories: business environment, access to resources and business costs.

Pennsylvania was ranked below Connecticut at 44th and above Hawaii at 46th.

“In this same study, North Dakota is rated as number one, due to their energy boom, but already that boom is declining.

WalletHub’s finding runs contrary to a recent report from the Small Business Development Center, a partnership of the Small Business Administration, the state Department of Community and Economic Development and 18 Pennsylvania colleges and universities.

In its survey, WalletHub said Pennsylvania was 32nd in the average growth in the number of small businesses; 33rd in office-space affordability, 30th in labor costs, 33rd in average length of work week, 34th in cost of living, 38th in industry variety, and 24th in percentage of population aged 25 and older with an undergraduate degree, or higher.

West Virginia was ranked third in the lowest labor costs.

West Virginia was fourth in the highest availability of human capital.

West Virginia was 50th in the lowest average growth of small business and was fifth in most-accessible funding.

“It’s not all gloom and doom for starting a business in Pennsylvania or Fayette County,” said Bob Shark, executive director of the Fay-Penn Economic Development Council.

On the Road With ‘Shark Tank’ 2017: Meet the CEO of The Startup Admin

I began to create working procedures for every task that needed to be done.

I did this for a few startups then one day Jeff Bonforte, who was the CEO at Xobni, said to me “if you could teach others how to run startups the way you do, it would be a goldmine.” This is when the light bulb went off and I started to work on my own startup, The Startup Admin!

Higgins: The Startup Admin is the right solution for entrepreneurs because there is a race against time to get your product or service to market.

We are always hiring and training new admins to meet the demand on new business formation.

How does The Startup Admin work?

Once the clients selects an admin to work with, they are connected to start working together.

One of the requirements of our admin is for them to create “Working Procedures” for the company they are supporting.

Higgins: The opportunity to appear on Shark Tank Season 9 would bring national exposure to our services and the need for every startup to work with an experienced admin to catapult their business forward.

What’s next for your business?

From my personal experience as an admin I have created multiple business ventures that support the success of entrepreneurs.

Not so Secret: Travel site Secret Escapes eyeing up initial public offering in London from 2020 onwards

Not so Secret: Travel site Secret Escapes eyeing up initial public offering in London from 2020 onwards.

Secret Escapes, the flash deals travel firm, is considering launching an initial public offering (IPO) in London, chief executive Alex Saint has told City A.M. “At some point in the next three to four years I think we will very seriously consider it,” Saint said.

“It’s not on the short-term radar, but it’s very much part of my thinking.” Saint, who also co-founded the luxury travel deal site in 2011, added that despite Brexit uncertainty, the group would likely favour London.

“I have to say all the advice that we’ve had has been [to list] either in London or New York and I think because we are heavily Europe-centric right now and because we are headquartered in London it still makes a huge amount of sense for us to think about IPO in the UK.”

Saint added: I think given where we are at least two, maybe three, years away from really seriously getting into that discussion I think we’ll see how things develop but right now if you were to ask me I would say that London would be the favourite.

Secret Escapes served 1.6m customers in 2016 and more than half a million in the UK.

Read more: Secret Escapes gets $60m funding from Google The group turned over £175m in 2015 and after its most recent expansion last year now operates in 21 territories worldwide.

Read the full interview with chief executive Alex Saint here.

Redfin IPO to revolutionize real estate? Not so fast, say brokers

Redfin IPO to revolutionize real estate?

Some experts are saying the site has no chance of overturning the well-established real estate market, while others say the IPO could be a game changer.

They could be that go-to place to get that service,” said Jeremy Ross.

Ross says after seven years of thinking about renovations, the ease of the real estate app helped sell him.

“This time we’re using exclusively Redfin.

Redfin declined to comment, citing the SEC quiet period in the days before and after initial public offerings.

“I don’t think it’s a game changer at all,” Queen Anne Real Estate managing broker Sam Konswa said.

He says housing prices are generally influenced by employment opportunities and the economy, and it is difficult to tell if technology or tech companies are influencing home prices directly.

“We sold it for $130,000 more and in just 11 days.

So maybe they pay me $20,000 more in commission, but they get $130,000.” Konswa says Amazon’s rumored entry into real estate could be a true game changer.

The future of Snap is a ‘religious’ bet on Evan Spiegel for insiders looking to sell shares

The future of Snap is a ‘religious’ bet on Evan Spiegel for insiders looking to sell shares.

Around the time of Snap’s initial public offering in early March, employees got a rare chance to ask the CEO, Evan Spiegel, anything on their minds.

Unlike the “town hall” meetings at Google, Facebook, and other tech companies, the Q&A at Snap was a written affair.

Other answers of Spiegel’s explained how employees should not think about the competition and should instead focus on delivering the best products and on innovating.

Snap has already changed in many ways in its short life as a publicly traded company: Q&As with Spiegel are more frequent, new products are tested in ever smaller and more secretive circles, early executives have been quietly replaced, and headcount has grown.

But one thing that hasn’t changed is that Snap remains an Evan Spiegel project.

The company held multiple seminars for employees in the run-up to its IPO, covering the basics of what it means to be a public stockholder, like not revealing insider information or shorting stocks, according to people familiar with the matter.

“No one knows what’s inside his head,” said one former employee of Spiegel, noting that his opaqueness extends to senior management.

These written Q&As are the only time that most employees from across the company have the chance to ask the CEO direct questions.

While Snap is constantly compared to Facebook by outside investors and the press, Spiegel has told employees that he admires Amazon and the early product focus of Apple under Steve Jobs.

Dear Floyd Mayweather, you’re why the SEC exists

While perusing Facebook, I chanced across your post drumming up interest in the upcoming Stox initial coin offering (ICO).

ICOs, like any other securities offering, come with risks.

The financial diligence on a traditional IPO takes months and involves hundreds of legal and financial experts.

Even still, things go wrong all the time.

The SEC recognizes that buying stock in private tech companies is more risky than buying stock in blue-chip companies.

The SEC exists to protect small investors, like your fans.

It’d be fairly sleazy if they did, but either way, you have a responsibility to be forthcoming about what you stand to gain and what your passionate followers stand to lose.

If you’ve seen The Wolf of Wall Street, you’re probably familiar with the practice of selling penny stocks by heaving misleading information at potential investors that lack a strong background in finance.

This is predatory behavior.

Indeed, 452,715 of your fans liked your Instagram post and another 73,000 fans liked your Facebook post.

Redfin goes public, stock explodes in early trading

Redfin goes public, stock explodes in early trading.

Online real estate brokerage Redfin became the latest real estate company to go public, when the company’s shares began trading on the Nasdaq on Friday morning.

Interestingly, the company priced its initial public offering at $15 per share, which is actually beyond the range the company set in its prospectus.

Last month, Redfin laid out its IPO plans in a S-1 form filed with the Securities and Exchange Commissions.

In early trading, Redfin’s stock (trading under the symbol “RDFN”) shot up past $20 per share, an increase of more than 35% above its initial trading price.

Redfin started as an online real estate brokerage, but the company has been expanding into other areas of the home buying process recently.

“We believe our industry-leading algorithms for calculating what a home is worth will limit the risk that the price we pay a Redfin Now customer for her home is below the price we charge a new buyer for that home,” Redfin said in its prospectus.

Redfin Now is currently only offered to a limited number of customers in two non-disclosed markets, but the company said that depending on the program’s early results, it could be expanded beyond that.

The company celebrated its introduction to the Nasdaq by ringing the opening bell on Friday, and based on the company’s posts on Twitter and some pictures shared by Nasdaq, the results of the company’s IPO have Redfin executives rather excited.

#nasdaqlisted pic.twitter.com/BkiD1XQi6d — Nasdaq (@Nasdaq) July 28, 2017 1st trade $RDFN.

Redfin prices IPO at $15 per share, higher than expected, in advance of Wall Street debut

UPDATE: Redfin debuted on the Nasdaq stock exchange Friday morning, and it’s stock opened well above the $15 initial pricing.

“We have done it our way, with real estate agents and software engineers working together as partners, where we are one Redfin.” Original story below Redfin priced its initial public offering at $15 per share on Thursday night, above the anticipated range, signaling strong interest in the tech-powered real estate brokerage in advance of its likely Wall Street trading debut on Friday.

The Seattle company is raising $138 million on its quest to transform how people buy and sell homes across the U.S.

Redfin initially planned to sell shares in the $12 to $14 range.

Under the direction of CEO Glenn Kelman, a veteran of Plumtree Software, Redfin has morphed into a large real estate brokerage, with technology as one of its key underpinnings.

Transform how people buy and sell homes in the U.S. in an industry that Kelman declared on 60 Minutes 10 years ago is the “most screwed up industry in America.” Last year, Redfin brokers and affiliated real estate agents helped people in the U.S. buy and sell more than 75,000 homes, representing $35.3 million of Redfin’s $41.6 million in revenue.

It reported a loss of $28.1 million on revenue of $59.9 million for the first three months of 2017, according to the SEC filing.

Here’s a breakdown of the company’s top shareholders: Redfin becomes one of the few tech-oriented companies to complete an IPO this year.

Redfin spent a whopping $34.5 million on technology last year, one third of its overall operating expenses.

What the market perceives Redfin to be will ultimately play a big role in its success as a public company, according to Robert Hahn, a management consultant at 7DS Associates who writes regularly about real estate and technology.

Stitch Fix has confidentially filed for an IPO

Stitch Fix has confidentially filed for an IPO.

Stitch Fix has filed confidentially for an initial public offering, setting itself up for another big test for the IPO market in the near future, sources tell TechCrunch.

Startups are allowed to file confidentially for IPOs under the JOBS act signed in 2012, allowing them to test the waters prior to formally releasing their company’s inner workings.

Stitch Fix will also mark one of the big tests for modern e-commerce startups and their viability as public companies.

Some subscription businesses, like we saw with Blue Apron, have struggled with customer retention.

Part fashion startup, part tech startup, Stitch Fix has morphed into a massive e-commerce startup and is a big success story for Lake in the midst of a lot of competition.

The last round Stitch Fix raised was in June 2014, with a post-valuation of $309.31 million, according to data from PitchBook.

Blue Apron, too, has seen a sharp decline following — no surprise — Amazon’s looming entry into meal kit delivery.

It’s not clear if investors will see whether Stitch Fix faces the same dilemma as Blue Apron with the threat of Amazon.

Stitch Fix’s next steps will be to publicly release the information, and 15 days later begin the “road show,” where it will pitch the company to bankers ahead of its public debut.

Real Estate Brokerage Redfin Finds A Home On The Public Market In $138 Million Offering

Real Estate Brokerage Redfin Finds A Home On The Public Market In $138 Million Offering.

Real estate brokerage Redfin is putting down roots on the public market, raising $138.5 million in an initial public offering Friday.

The IPO is a crucial test not only for the 11 year old company, but for the broader market of tech-enabled startups that many hope will shake up the sometimes stodgy real estate industry.

Redfin shares opened for trading Friday at $19.56, which was 30% higher than the offering price.

The surge gives the brokerage an initial market cap of around $1.38 billion.

Redfin claims tools like mobile-based listing notifications, on-demand home tours and intelligent pricing make its agents three-times more productive than the competition and save customers an average of $3,500 in closing costs.

Documents filed with the Securities and Exchange Commission show that in 2016 Redfin lost $22.5 million on revenue of $267.2 million.

In 2016 the company earned $213 million on $5.81 billion in revenue.

Most notable is New York-based Compass, which has raised $198 million and was last valued at $1 billion.

Prior to going the IPO route Redfin had raised $167 million privately.

100Most applying for initial public offering

100Most applying for initial public offering.

Satirical weekly magazine 100Most has applied for an initial public offering on the Hong Kong Stock Exchange.

Its publisher Most Kwai Chung Limited, which also owns various book titles including Blackpaper Magazine and is the operator of an online multimedia channel “TVMost” that produces sarcastic videos, submitted a draft document to the Hong Kong Stock Exchange on Wednesday (26 July).

The 63-people company revealed it earned a revenue of HK$95 million for the year ended March 31, 2017, in which 51.8% of the revenue was driven by its digital media services.

This marked a 74% year-on-year increase.

According to the document, the company has also earned a net profit of HK$36 million in the 2016-17 financial year.

Founded by media producers Lam Yat-hei, Au Bu and Chan Keung in March 2013, 100Most and TVMost aims to create derivative work that is meant to be funny and reflective of the general mood of youngsters.

In 2016, one of its advertising production, 明 NESCAFÉ 極品白咖啡【情深咖啡未曾飲】, which features legendary singer Leon Lai selling Nescafé instant coffee with a redo of his classic song and fun jokes, tops the chart of 2016 Q2 YouTube Ads Leaderboard.

Dropbox is reportedly inching closer to a potential IPO

Dropbox is reportedly inching closer to a potential IPO.

The company is expected to hire Goldman Sachs as the lead advisor of the IPO process, according to the report.

The company hit a $10 billion valuation riding a wave of euphoria around consumer startups earlier in the decade, but has since been frustrated by larger companies offering free file storage and sharing.

It’s started emphasizing its technology — specifically in terms of speed and simplicity — when observers have tried to draw comparisons between the company and other enterprise file-sharing services.

Box is the most natural comparable on the market, which could potentially cause problems for Dropbox’s valuation as it seeks to go public.

A representative from Dropbox declined to comment.

To be sure, the company has been on a streak of touting its business successes.

Earlier this year it said it hit a $1 billion revenue run rate on the strength of its growing business services.

To do that, Dropbox has been aggressively building its portfolio of business products and services.

As usual, this seems part of the process of testing the waters — and Dropbox may inevitably end up pulling out of the process or going in a different direction.

It looks like Amazon would be losing a lot of money if not for AWS

It looks like Amazon would be losing a lot of money if not for AWS.

Amazon reported its second-quarter earnings today, and it was a bit of a whiff — and a bummer for Jeff Bezos, who is now no longer the solar system’s richest human and has been relegated to the unfortunate position of second-richest human.

But Amazon’s cloud server farms, AWS, once again appear to be propping up Amazon’s profitability.

The company’s huge bet on building up the basis of modern cloud computing could, in a way, be held partially responsible for Amazon’s long streak of profitability for the past many quarters.

Here’s a quick breakdown of that: Amazon has turned AWS into a business that’s on track to generate well over $10 billion in revenue annually.

AWS revenue was up 42 percent in the second quarter compared to 2016.

That growth is slowing a bit, as AWS revenue was up 58 percent between 2015 an 2016.

Perhaps most importantly, Amazon signaled that it might return to losing money in the next quarter.

Amazon has long been known to burn cash in the quest to continue to grow into one of the largest companies in the world, and Wall Street has generally been quite patient with that strategy.

It looks like that huge bet on building a bunch of buildings with servers inside is paying off as Amazon continues to look into other lines of revenue.

Dropbox is reportedly inching closer to a potential IPO

Dropbox is reportedly inching closer to a potential IPO.

The company is expected to hire Goldman Sachs as the lead advisor of the IPO process, according to the report.

The company hit a $10 billion valuation riding a wave of euphoria around consumer startups earlier in the decade, but has since been frustrated by larger companies offering free file storage and sharing.

It’s started emphasizing its technology — specifically in terms of speed and simplicity — when observers have tried to draw comparisons between the company and other enterprise file-sharing services.

Box is the most natural comparable on the market, which could potentially cause problems for Dropbox’s valuation as it seeks to go public.

A representative from Dropbox declined to comment.

To be sure, the company has been on a streak of touting its business successes.

Earlier this year it said it hit a $1 billion revenue run rate on the strength of its growing business services.

To do that, Dropbox has been aggressively building its portfolio of business products and services.

As usual, this seems part of the process of testing the waters — and Dropbox may inevitably end up pulling out of the process or going in a different direction.

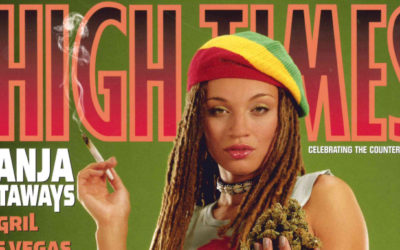

High Times weed magazine goes public but ditches IPO

High Times weed magazine goes public but ditches IPO.

How about HighPO?

The 43-year-old marijuana media brand High Times has found a shortcut to going public: It sold itself to an already public shell company, of which High Times share holders then got an 83 percent stake.

After private equity firm Oreva Capital bought a controlling stake in the publisher last month, they went and sold High Times to an already public special-purpose acquisition company, Origo.

High Times shareholders will have an 83 percent stake, whereas the Origo SPAC will own 17 percent.

It seems there are high hopes for High Times to become a massive media empire as marijuana becomes legal in more states.

High Times’ business includes its long-running print magazine, a popular online destination for cannabis news and its weed-growing competition event series, the Cannabis Cup.

That could earn it fat referral fees or ad sales from dispensaries seeking new stoners.

There are already serious competitors in the dispensary directory business, like WeedMaps and Leafly.

After the transaction closes, likely in October, High Times will be a publicly traded company on the Nasdaq.