NBA Star Mike Conley on Humility, Discipline and Getting Back Up

NBA Star Mike Conley on Humility, Discipline and Getting Back Up.

If you grew up or have lived in the U.S., you know what a big deal basketball is.

To make it into the NBA is extremely challenging.

To win games consistently is even harder because the season is so long and the risk of injury is high.

But Mike Conley Jr. has done all of this while being a husband, father, family man and overall great guy.

That was just one reason I was excited to have him on The School of Greatness.

Mike grew up seeing what a champion looks like (his dad was an Olympic gold medalist), but he has learned on his own how to craft a personal formula for success.

In our conversation we talked about the simple but effective ways he preps for games, recovers from losses and keeps focused on what is most important to him.

I’m proud to bring you this Episode 430 with NBA star Mike Conley.

More from Lewis Howes

5 Things to Know If You’re Starting a Business Under 30

5 Things to Know If You’re Starting a Business Under 30.

So, you’ve decided to start a business, even though you’re young and don’t have much experience.

There are a ton of advantages to starting a business in your 20s and 30s, including higher long-term potential gains and (generally) a higher level of energy and enthusiasm.

You can also offer investors hard evidence, social proof or a demonstration of your talent to compensate for your lack of experience.

As long as you realize what your weaknesses are and find a way to make up for them, the “experience” factor shouldn’t be a problem.

In investing, in business and life in general, youth favors risk-taking.

If you make a catastrophic error, such as a bad investment, you’ll have more time to make up for that mistake over the course of your life.

So, take advantage by taking more risks while you’re young.

You know the statistic about how most businesses fail, but when you’re young, it’s hard to wrap your mind around that reality.

There’s no “perfect” time to start a business, of course, but knowing the advantages and disadvantages of your specific timing is necessary if you want the greatest chance of success.

Gerard Adams on Success, Inspiration and Leadership

Whether you’re an aspiring entrepreneur or the founder of a multi-million dollar company, we all have something to teach each other.

In his video series Leaders Create Leaders, Entrepreneur Network partner Gerard Adams seeks to inspire others by meeting with a number of entrepreneurs and hearing their stories.

In his first semester of college, Adams decided that the partying and the general education courses weren’t for him — he needed to go off an do what he was set out to do now.

Dropping out of college, Adams became an entrepreneur and co-founded Elite Daily.

Serial entrepreneur, milennial branding expert, motivational speaker and investor — Adams has paved his way to success.

By age 24, his business was making $10 million a year.

If you believe in yourself and put in the work, you can do whatever you want, Adams says.

See more episodes of Leaders Create Leaders Season 1 and 2 Gerard Adam’s YouTube channel.

We provide expertise and opportunities to accelerate brand growth and effectively monetize video and audio content distributed across all digital platforms for the business genre.

Click here to become a part of this growing video network.

How Augmented Reality Will Shape the Future of Ecommerce

What’s more, devices that utilize virtual reality — and its cousin, augmented reality — have evolved from the dreams of tech enthusiasts to something your uncle can purchase from his local brick-and-mortar retailer.

Consumer demand, high-quality devices and market conditions have all aligned to make VR and AR the next major advancements in the tech world.

Ecommerce companies should be taking feverish notes: A recent demonstration of AR technology by Florida-based startup Magic Leap showed one way retailers might integrate AR technology into an e-commerce environment: The demonstration showed how a user could superimpose virtual models of lamps and other room décor atop a real-world dresser, with the digital objects shown to scale, to help the user determine how those items might look within the space.

The biggest hurdle customers so often face is determining whether a certain product is right for them.

AR offers shoppers the confidence that may motivate purchasing decisions.

That will allow customers to view the in-depth information available online — including reviews, related products and price — while simultaneously looking at the actual physical product via a smartphone.

Here are some of those considerations: Offer a useful experience.

Virtual shopping offers the same novelty, without any of the costs associated with shipping products to clients.

Allow users to customize.

And AR has the potential to do just that, but only if retailers work to bring the technology into the real world.

SEO Growth Hacking Techniques to Scale Your Business

Today it’s evolved and has become a necessity for every online business.

But there are a few who understand that like other professions, SEO is highly technical and must be implemented with care.

This keyword is exactly what your users are typing in google to find you.

Your effort should be towards enhancing your content with the right keyword and appearing on the first page when users search for specific keywords.

Before creating content, you have to find just the right keyword around which you will build your content.

The secret relies on other factors like content marketing, content promotion strategies and other growth hacking secrets.

One of the best ways to publish and promote great content and increase your conversion rate is to have a blog.

Once you set up your blog and craft your content, you must focus on building links.

In other words, you have to create visual content — either in a form of videos or articles — which will then be shared by other bloggers on their own websites.

Regardless of the products or services that you are offering, link building is a strategy that will improve your website ranking.

Can Equity Crowdfunding Be Fixed?

Can Equity Crowdfunding Be Fixed?.

With the adoption last year of the Regulation Crowdfunding (Reg CF) exemptions by the Securities and Exchange Commissionprivate companies can now raise capital from all 230 million American adults.

Let’s understand why equity crowdfunding doesn’t work.

Financial review requirement by third party CPA Reg CF requires that businesses raising more than $500K have GAAP Standard financials prepared and ready to share.

Form C Reg CF requires businesses to file a Form C with the SEC before they can solicit investors.

$1 million funding limit Reg CF caps a business at raising $1 million in a 12-month period.

12(g) rule This rule stipulates that if a business uses Reg CF to successfully raise capital and crosses $25 million in assets, they’ll be required to begin reporting as a public entity.

How would the Fix Crowdfunding Act (FCA) improve Regulation Crowdfunding?

What still needs to happen to make equity crowdfunding work?

This would make a big impact on the number of companies willing to use Reg CF, as many need to raise more than $1 million.

How Social Media Usage Could Affect Your Startup Funding Opportunities

How Social Media Usage Could Affect Your Startup Funding Opportunities.

While many startups usually receive poor attention from investors for reasons such as having a “me-too” product in an already oversaturated market or a founder delivering a poor pitch, many have not actually considered other outside-the-box factors that could affect their chances of getting funded.

Social media can play a role in helping founders secure funding for their startups.

This culture is seen in some startup founders, as well.

Investors, however, see things differently.

They often look out for reasons not to invest in a startup, and this means they see things differently than you do.

If investors love your company culture, then your customers could, too.

1 priority, then your social media content should reflect this.

Apart from being able to use social media to attract customers, VCs want to see how well you value your existing customers through your social media content.

Investors, and your customers, would infer your startup culture from statements your share on social media.

BSE sets its initial public offering at Rs 805-806 band

Indian stock exchange BSE’s initial public offering (IPO) of shares next week may raise as much as Rs 1,243 crore ($182 million) for its investors, based on the indicative price range for the sale announced on Monday.

Investors, led by Singapore Exchange, Atticus Mauritius and billionaire George Soros’ Quantum, will be selling up to 15.4 million shares in Asia’s oldest stock exchange in a price range Rs 805-806 a share, according to a public announcement.

BSE’s offering will be the first in Indian markets in 2017, after companies raised about $4 billion in 2016 from initial share sales making it the best year in six.

Indian investment banks Edelweiss and Axis Capital along with Jefferies and Nomura are the global coordinators for the BSE offering.

Motilal Oswal, SBI Capital Markets, SMC Capitals and Spark Capital are the other bookrunners.

Shares of BSE will list on rival National Stock Exchange (NSE) as domestic rules don’t allow self-listing.

Shares, however, could be available for trading on its own platform, under the permitted-to-trade category.

Shares of BSE are expected to list on February 3.

NSE, the country’s largest stock exchange, too, is expected to list soon.

Both NSE and CDSL are currently awaiting Sebi’s nod for their IPOs.

4 Reasons You Need Developers With Cybersecurity Skills in All Tech Teams

4 Reasons You Need Developers With Cybersecurity Skills in All Tech Teams.

According to a recent study, the global demand for cybersecurity professionals will create more than one million unfilled cybersecurity positions by 2019, with one of the most desired skills being secure software development.

No wonder, that entrepreneurs and companies are having increasingly hard time finding the security talent they need to build reliable services and keep the data of their users safe.

One way to bridge the skills gap and create more secure products is to train and hire more engineers specialized in cybersecurity.

New apps generate more data and more risks.

If companies creating these services lack security talent and a strategy for secure development, there’s a high risk that all of that information could be exposed to cyber security threats.

Companies need to develop software with security in mind from day one in order to build secure systems and minimize vulnerabilities.

Making sure your level of security is top-notch might increase development time for a feature that is not really visible for end-users and in some cases it might affect the performance of your software as well.

To find the right balance of security and usability or performance, they need to have practical knowledge of cryptography.

Also, integrating tools require regular maintenance and updates: not only do you have to find the right components, but you also have to make sure they work together properly.

Yahoo CEO Marissa Mayer’s next job should be a tech investor — her track record proves it

Yahoo CEO Marissa Mayer’s next job should be a tech investor — her track record proves it.

Or take an executive role at a big tech company.

And she will step down from the board of the remaining, un-acquired parts of Yahoo — mostly the company’s Asian investments — after the proposed deal closes.

According to Pitchbook data, Mayer has been a prolific investor since 2009, making over 20 early bets on startups that became big hits, like Square, Brit Media, and GetAround, as well as Snapchat’s 2014 round that propelled the app maker’s valuation to a whopping $10 billion.

(Snapchat wasn’t Mayer’s personal investment — it was made through Yahoo when she was CEO.)

Prolific investor Mayer’s first personal investment was in Square’s 2009 Series A round, which valued the company at $45 million.

According to Pitchbook, some of her other personal investments include: Minted: Invested in Series B round valuing it at $47 million; now worth $422 million.

uBeam: Invested in Series A round valuing it at $57 million; now looking to raise at a $500 million valuation, Pitchbook says — although it has recently been involved in a big controversy.

Snapchat Mayer’s best investment might not be any of her personal investments.

Instead, the lone VC funding she made for Yahoo in Snapchat’s parent company, Snap, might turn out to be the biggest hit.

Saudi Airline Flynas to Seek IPO Regulatory Approval by Mid-2017

Saudi Airline Flynas to Seek IPO Regulatory Approval by Mid-2017.

Saudi budget airline Flynas plans to seek regulatory approval this year for an initial public offering that would make it the first carrier to be listed on the country’s stock exchange, part of a broader effort to diversity the economy in the face of weak oil prices.

The closely held carrier, which announced an deal for 80 Airbus Group SE planes on Monday, is working with Banque Saudi Fransi and expects to apply for clearance from Saudi Arabia’s Capital Market Authority by mid-2017, Chief Executive Officer Paul Byrne said in a phone interview.

“We’ve been profitable for the past couple of years, so it’s something we need to think about,” Byrne said.

“The percentage to be floated is up to the shareholders to decide.” The Riyadh-based carrier, which began flying as Nas Air in 2007, is partly owned by Kingdom Holding Co., the investment vehicle of Saudi billionaire Prince Alwaleed Bin Talal.

The state budget deficit is expected to reach 17.8 percent of gross domestic product this year.

The deal also includes purchase options for another 40 A320neos.

The carrier expects to receive bids from United Technologies Corp.’s Pratt & Whitney division and General Electric Co. to supply the new planes’ engines, Bandar Al Muhanna, chief executive of Flynas parent company Nas Holding, said in an interview in Riyadh.

Flynas is facing increasing competition in its home market after Saudi Gulf Air and Nesma airline were granted domestic operating licenses last year.

Rivals abroad include Sharjah-based Air Arabia and FlyDubai.

Johns Hopkins is helping these 6 student-run startups get off the ground

Want to expedite and simplify access of funds to entrepreneurs: Nirmala Sitharaman

Rs 10,000 cr Startup India fund: Who actually benefitted from this ambitious scheme?

It has been a year since the Rs 10,000 crore Start Up India fund was announced with much fanfare to promote entrepreneurship.

On account of the limited visibility of the programme, no one is in the know of what the program achieved.

When it was announced, the government said that the fund is “expected to generate employment for 18 lakh persons on full deployment… A corpus of Rs 10,000 crore could potentially be the nucleus for catalysing Rs 60,000 crore of equity investment and twice as much debt investment.” However, it did not mention how the funds were to be disbursed.

A year down the line there is an advertisement in newspapers today quoting a flurry of numbers: That it has recognised over 500 startups, 118 incubators, 257 tinkering labs were sanctioned under the Atal Innovation Mission, over 170 startups were mentored for incubation and funding support.

“A year later, no one knows which agency/body is disbursing the funds, so one does not know how the programme can be termed a success,” he said.

The government should instead create an environment that creates opportunity for generation of funds and not go about disbursing money to foster entrepreneurship, said Harish HV, Partner, Grant Thornton India LLP, adding that there is a tax break given to VCs and HNIs who invest in the startups if they were to invest money in the government’s startup fund.

With digitisation the new name of the game, Mariwala feels that in the future fintech startups may be the beneficiaries of this fund.

The government can do more for investors to help the situation, says Professor Siddharth S Singh, Associate Professor of Marketing at the Indian School of Business.

He feels that the government can make it easier to invest in and exit from startups, along with lower tax burden. “The government should reduce the tax burden of entities involved in supporting and managing a startup.

BSE fixes IPO price band at Rs 805-806, to raise Rs 1,243 cr

BSE fixes IPO price band at Rs 805-806, to raise Rs 1,243 cr.

NEW DELHI: Leading bourse BSE has fixed the price band at Rs 805-806 per share for its upcoming initial public offering (IPO), through which it aims to raise up to Rs 1,243 crore.

The IPO opens on January 23 and closes on January 25, which will be the first by a domestic stock exchange.

During the initial share sale- this year’s first as well- shareholders will sell 15.43 million shares estimated to be around Rs 1,243.44 crore at the higher end of the price band.

The company said bids for the issue can be made for a minimum of 18 shares and in multiples of 18 thereafter.

Among the existing shareholders are Bajaj Holdings Investment, Caldwell India Holdings, Acacia Banyan Partners, Singapore Exchange, Mauritius-based arm of American investor George Soros’ Quantum Fund and foreign fund Atticus.

However, a host of foreign investors and domestic financial institutions have acquired shares over the years and the IPO will provide some of them an exit window to monetise their assets.

BSE shares will be listed on NSE as Sebi rules do not allow self-listing for an exchange.

Meanwhile, rival NSE had filed draft papers with Sebi last month for an estimated Rs 10,000 crore IPO.

Stay updated on the go with Times of India News App.

BRIEF-Uranium Resources announces pricing of $9.7 mln public offering

BRIEF-Uranium Resources announces pricing of $9.7 mln public offering.

Jan 16 Uranium Resources Inc : * Uranium Resources announces pricing of $9.7 million public * Priced a registered public offering of an aggregate of 4.8 million shares of common stock at a price to public of $2.01 per share Source text for Eikon: Further company coverage:

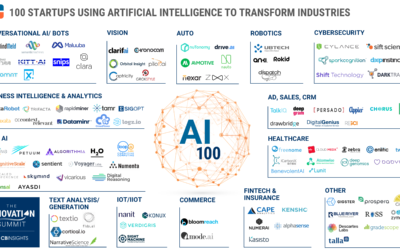

The 5 Biggest Artificial Intelligence Startups

The 5 Biggest Artificial Intelligence Startups.

What CB Insights does is provide a huge database of private company information that is collected using artificial intelligence.

They then sell this data to 100s of firms that need accurate data.

We call a startup with a $1 billion valuation a unicorn.

We talked about iCarbonX before when they were featured in our article on “The Top-5 Artificial Intelligence Companies in Healthcare“.

Zoox Founded in 2014, Silicon Valley startup Zoox has taken in $290 million as they operate in stealth mode to develop their autonomous taxi that can drive both forwards and backwards.

We speculated why in an article we wrote about “What a Driverless Taxi Company Will Look Like“.

There is this big electronics expo called CES which just concluded, and in that conference they unveiled a few new robots including a humanoid robot powered by Alexa called Lynx and a service robot called Cruzr.

Benevolent.ai Founded in 2013, British startup BenevolentAI has taken in $100 million in funding to work on bringing drugs to market faster using artificial intelligence.

So there you have the 5 biggest artificial intelligence startups by valuation as of mid-January 2017.

Technology fails to save Ringling Bros. circus

Technology fails to save Ringling Bros. circus.

After 146 years, the Greatest Show on Earth is closing.

Public tastes changed, and the group had damaging battles with animal rights groups over its treatment of elephants (retired earlier) and big cats, such as lions and tigers.

The circus was a staple of entertainment in the U.S., and the traveling circus became a part of the American landscape.

But the latest version that debuted in the San Francisco area in the summer was hardly recognizable.

Image Credit: Ringling Bros.

The Feld family bought the Ringling circus in 1967.

But now the drop was even steeper, said Juliette Feld.

To try to recover, the circus tried a high-tech show with a space-age theme and Cirque-style performers.

The Felds say the remaining animals will go to suitable homes.