7 Rules for Turning Business Conflicts into Win Win

In fact, most business conflict is constructive and should be embraced in steering through the maze of innovation and change that is part of every successful business.

Most often, conflicts present us with opportunities to solve problems and bring about necessary changes, to learn more about ourselves and the business, and to innovate – to go beyond what we already know and do.

Avoid the ones that are irrelevant to your startup, but don’t hesitate to engage in the others.

Therefore, you should always approach conflicts with others as mutually shared problems to be solved together.

Try to keep the problem separate from the person when in conflict (do not make them the problem).

When conflicts become personal, the rules change, the stakes get higher, emotions spike, and the conflict can quickly become unmanageable.

Meet face-to-face and listen carefully.

Accurate information is critical, and careful listening communicates respect.

This alone will move the conflict in a more friendly and constructive direction.

The most successful entrepreneurs are creative and skillful in handling conflicts, and actively seek constructive conflict with key stakeholders.

Tableau acquires ClearGraph, a startup that lets you analyze your data using natural language

Business intelligence and analytics firm Tableau today announced that it has acquired ClearGraph, a service that lets you query and visualize large amounts of business date through natural language queries (think “this week’s transactions over $500”).

Tableau expects to integrate this technology with its own products as it looks to make it easier for its users to use similar queries to visualize their data.

Tableau acquires ClearGraph, a startup that lets you analyze your data using natural language Typically, you’d have to know SQL or a similar database query language to pull information out of most enterprise databases.

Given that Microsoft’s Power BI and other competitors already offer this capability, it’s no surprise that Tableau is also looking into this (though Tableau argues that — unlike the likes of Microsoft — it can be a neutral party given that it has no investment in any particular cloud or on-premise technology outside of its own).

To build this, though, Tableau would have had to put a lot of infrastructure in place and ClearGraph had already done all of this work.

ClearGraph was founded in 2014 (and it was previously called Argo and Arktos) and the company says that it currently has “dozens” of customers, including a number of large enterprises.

While the company doesn’t disclose who its customers are (which is not unusual in the enterprise space), Ajenstat tells me that they include financial institutions, retailers and major internet companies.

Ajenstat also believes that this new technology will help his company to reach a wider range of users.

“Even though Tableau is top in its class for ease of use, it’s about expanding the number of users who can analyze data in the enterprise,” he told me.

The company declined to disclose the purchase price, but ClearGraph has raised a total of $1.53 million from Accel Partners before the acquisition.

Health startup Buoy raises $6.7 million to invest in recruitment and research

Health startup Buoy raises $6.7 million to invest in recruitment and research.

Buoy, a startup using an intelligent algorithm backed my medical data to guess what ails you, has raised $6.7 million in Series A funding from F-Prime Capital Partners, FundRx and various angel investors to help scale operations.

The startup debuted in March of this year to take on WebMD and other online symptom checkers with an algorithm it believes can more accurately diagnose patients.

Founder and Harvard-trained MD Andrew Le told TechCrunch at the time he had implemented “a battery of tests” and conducted “a series of studies” to ensure Buoy’s accuracy.

His plan at the time was to onboard both consumers and hospital organizations to swiftly process patients before they see the doctor.

Buoy claims it has experienced rapid growth since then and that over quarter of a million people have used the app.

Buoy will use this round of financing to invest in maintaining that growth in a few key areas, including the recruitment of additional clinical researchers, engineers, and marketers and build integrations with hospitals and providers.

FundRx will also supply the startup with physicians for a new medical board.

“The team at Buoy has taken an innovative approach to solving the problem of health symptom search,” said Carl Byers, Executive Partner at F-Prime.

“By engaging patients intelligently at the moment they experience symptoms, Buoy can deliver triage at scale in a way that can be adopted seamlessly within the healthcare system as a new digital front door to the care journey.”

Where Have All of the Initial Public Offerings Gone?

Where Have All of the Initial Public Offerings Gone?.

On June 29, the Securities and Exchange Commission (SEC) announced that it is permitting all companies to file the paperwork for an initial public offering (an IPO) without immediately disclosing the IPO to the public.

Further, companies will be permitted to immediately withdraw an IPO filing.

Previously, this “nonpublic review process,” known as the “stealth IPO rules,” was only available to emerging growth companies.

As of July 10, when the so-called “stealth IPO rules” went into effect, all companies, including those that would not be classified as emerging growth companies, have been able to take advantage of a confidential IPO process.

To continue reading, become a free ALM digital reader.

She can be reached at jaffarik@ballardspahr.com or 215-864-8475.

Kimberly W. Klayman is an associate at the firm.

She counsels publicly traded and privately held companies on mergers and acquisitions, securities offerings, regulatory compliance, corporate governance, corporate formation, contract review, and other business and financing matters.

She can be reached at klaymank@ballardspahr.com or 215-864-8792.

Three startup myths busted

Google pledges $3m over 3 years to 60 African Start-ups

Google pledges $3m over 3 years to 60 African Start-ups.

When it comes to the aforementioned support for African start-ups, through the Launchpad Accelerator programme Google plans to provide training and access.

Google may be interested in part owning some companies but that is not a prerequisite for getting the funding.

The initial focus will be on Nigeria, South Africa and Kenya.

Nigeria is the most populous country in Africa and along with South Africa and Egypt they are the only 3 countries in Africa with over $200bn economies.

More countries in Africa will be added to the list of eligible countries in Africa and the hope is that Zimbabwe will be added sooner rather than later.

You will only be eligible if you already have a product.

A lot of factors will obviously come into play, the product being offered being the best example, but with creativity and willpower it is not hard to imagine a company soaring.

After the 3 years even more start-ups from even more African countries will be eligible to join the programme.

If you have an operational company with a product already you would do well to follow developments in this programme so that you plan accordingly to raise the chance you become successful in obtaining the funding and mentorship.

Chicken Soup appeals to fans for stock offering

Chicken Soup appeals to fans for stock offering.

Using a Regulation A+ initial public offering, Chicken Soup for the Soul is marketing 900,000 shares of Class A common stock in the entertainment portion of the company to many of the same people who grew up reading its books.

Using a method that Chicken Soup chief executive Bill Rouhana terms as “Chicken Soupy,” the relatively new sort of stock offering his company chose allows for fans to buy stock alongside traditional Wall Street investors, he said.

“We try to act like our brand would imply,” Rouhana told Hearst Connecticut Media in an interview.

“Usually in traditional public offerings, individual investors don’t get a fair share of the offer — institutions get most.

That was meant to make it more Chicken Soupy.

Chicken Soup for the Soul will retain majority ownership of 70 percent over its Chicken Soup for the Soul Entertainment division.

Under the 2015 Jumpstart Our Business Startups Act, this IPO alternative was passed by the Securities and Exchange Commission “to facilitate smaller companies’ access to capital,” according to an SEC statement published at the time.

Chicken Soup has been marketing the stock offering to its millions of fans for several months.

The company set up an online registration process for individual investors to sign up to buy stock, but “processing it all has become a challenge,” Rouhana said last week.

Why Your 20s Is the Perfect Time to Start a Business

Why Your 20s Is the Perfect Time to Start a Business.

He wasn’t an entrepreneur, but he played tight end for the Oakland Raiders and was the most successful person I knew.

I told him I figured that I’d know within a year or two at most, and that I’d just go back to school if it happened.

Build your business credit.

When I started my company, I was a ghost to the credit bureaus.

Thanks to some well-meant but faulty advice, I’d never used a credit card in my life.

This made it impossible for lenders to assess me for risk, which in turn made it impossible to get financing.

Start building your business credit immediately.

It would be tragic if you gave up a mere six months into the game because of unrealistic expectations.

Seize the day.

Lambda School aims to cash in by upskilling untapped talent

This experience gave them the idea to restructure tuition fees for remote learning — starting with a computer science program but with the ambition of expanding out to teach “anything and everything” in future.

“Because we are investing in people instead of having them pay up front we can go a lot deeper and have a much longer program [than a bootcamp] and that is going to show when our students go get jobs.

“So the people that we see that we’re like ‘alright that person, they’ve never really gone to college, they probably didn’t do too well in school but they’re a hard worker and they seem really sharp’ — those people are consistently out-performing everybody else.

And we’re basically investing in those people.” How exactly are they making student selections?

So we’re finding people who are really, really sharp.” “We’re shipping people computers because they can’t afford a $200 computer, let alone a college education,” he adds.

Especially if that doesn’t work out, you’re paying that off the rest of your life — that’s a risk that most people can’t afford to take.

On the funding front, Allred says the longer term plan is to raise its own fund to sustain the marketplace they’re aiming to build.

“Eventually we’ll be raising an investment fund specifically for investing in our students the same way any other investment fund would exist to — for example — to fund student loans.

So we’ll be raising some equity, a fund to be clear, but that’s still a long way away.” “A lot of what we’re interested in long term is figuring out how we can get outside money to funnel into these underrepresented groups that don’t have any other options,” he adds.

“We can show that we can take somebody from making $20k per year to making $80k per year, so that’s a valuable model not only to the students, but also to society and to all sorts of other things.

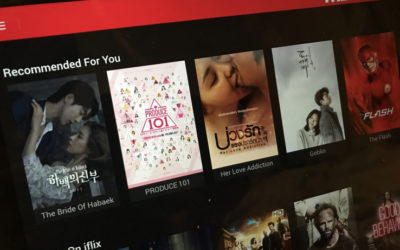

Iflix raises $133M for its Netflix-style service for emerging markets

Iflix raises $133M for its Netflix-style service for emerging markets.

Iflix, an Asia-based startup providing Netflix-like streaming services in emerging markets, has landed $133 million in fresh funding to accelerate its business.

The group was joined by another new backer EDBI — the corporate investment arm of the Singapore Economic Development Board — alongside undisclosed clients of Singapore-based DBS bank.

Today its streaming service is priced around $3 per month and available in 19 countries thanks to expansions into the Middle East and Africa.

It started out with a $30 million pre-launch round in 2015, before adding $45 million from Sky last year and completing a $90 million raise in March of this year.

“If Netflix is the iPhone of content streaming, our aspiration is to be the Android,” Britt added.

“We’ve realized the key for us is local content, not the Western content studios — the majority of our top 10 content is regional or local,” he told TechCrunch.

“Western content sets the bar for binge-watching, but in terms of reaching the mass market, what’s having a bigger impact is taking content from local cinemas or distributors.” That’s where this new funding is likely to be put to work, growing that local collection with a focus on exclusives and first-runs.

Britt said that Iflix may also look to enter new regions, too, with Latin America on the list of potential entries thanks to its similarities with regions where Iflix already plays.

“The opportunity is very real in emerging markets globally,” he added.

Honeydue is a money management app for couples

Honeydue is a money management app for couples.

Honeydue is a mobile app that aims to reduce money-related arguments between couples by offering tools to share information on respective account balances and spending.

The app also lets couples stay on top of money matters in other ways, such as being able to comment on individual transactions and manage bill reminders together — so they can, in the words of co-founder Eugene Park, “be on the same page” about money.

“18 per cent of couples that we surveyed are using spreadsheets.

“So you can choose which accounts you want to share, you can choose whether you just want to share the balance only.

The app is currently US-only.

“So we did a survey of 600 couples and 75% reported that they co-manage some to all of their finances together so that is generally our target market: People that are committed to sharing financial responsibility as well as financial literacy with each other.” Users are typically using the app to connect and share their bank account balances — which is what the team considers “our core use-case and our core pitch/value proposition” — although, interestingly, couples still choose not to share information on a portion of their accounts.

“What’s interesting is that approximately 60 per cent of accounts are shared at some level but 40 per cent are not,” notes Park.

Bill splitting (or “sharing” in the app’s language) is also supported, although Park says this turned out to be less popular than the founders thought it would be, with only around 5 per cent os users making use of it.

“Like other personal finance tools we go through one of three major financial data providers.

Chinese Movie Portal Douban Mulls Overseas IPO (Report)

Chinese Movie Portal Douban Mulls Overseas IPO (Report).

Courtesy of Douban Douban, essential reading for any serious movie fan in China, is considering an initial public offering of its shares.

The company is looking to list on an overseas stock market, according to business news site Caixin.

The company, which claims some 300 million monthly active users, is a portal and social media platform with thematic sections stretching from poetry to portraits.

Its movie, books and music operations are its best known, with its film database likely the most comprehensive in Chinese.

The company was started in 2005 and earns the bulk of its revenues from advertising.

Latterly it has launched ticketing services and music streaming services.

Quoting from an internal memo, Caixin reports Douban CEO Yang Bo as saying that the company will pare back unprofitable activities before the possible flotation.

It also suggests that a listing outside China could be intended to bypass Chinese stock markets’ requirement that companies listing be profitable.

The company last raised fresh capital six years ago, with a $50 million funding round led by Trustbridge Partners.

Real estate tech firm Redfin has successful IPO under shadow of potential patent suit

Real estate tech firm Redfin has successful IPO under shadow of potential patent suit.

In late July, Seattle, WA-based real estate tech firm Redfin (NASDAQ:RDFN) went public after an initial public offering that exceeded expectations, reaching $15 per share and a total valuation of $138.5 million.

The company offers a tech platform for real estate transactions available through its website and mobile app and relies on salaried employees instead of commission-based real estate agents.

Mr. Eraker released all claims against Redfin in connection with his departure.

We will defend ourselves vigorously if Mr. Eraker sues us.

However, litigation is uncertain and expensive, and any judgment or settlement could harm our business.” Eraker is listed as an inventor on multiple patents assigned to Redfin, which cover Internet-based real estate technologies.

U.S. Patent No.

The ‘317 patent lists Eraker as an inventor and is assigned to Redfin.

9105061, titled Online Marketplace for Real Estate Transactions, claims a method performed by a computer system communicating with at least one client computer which helps to facilitate online collaboration for real estate transactions.

Issued in August 2015, it also lists Eraker as an inventor and is assigned to Redfin.

Towergate owner to consider IPO when new group is a ‘monster’

Towergate owner to consider IPO when new group is a ‘monster’.

The boss of a UK insurance giant created by the merger of Towergate and four others has said the group will discuss the possibility of an initial public offering when it is a “monster” next year.

Now the UK’s largest independent broking and underwriting firm, the chief executive of the enlarged company – called The Ardonagh Group – is not ruling out a potential sale or listing of the business. “Decisions will be based on being in control of our own destiny in 10 years,” said chief executive David Ross, who previously ran rescued insurer Towergate. “We could IPO, could stay with private equity, could go to a trade buyer.

The five-way merger follows a tough period for Towergate, the largest of the businesses, which was taken over by creditors in early 2015 and faced legal action from Mr Ross’s former employer Gallagher. “It’s the realisation of a dream [the creation of Ardonagh] and the best thing is that nobody even saw it coming,” Mr Ross added, noting that the merger happened a year earlier than planned. “Now the shackles are off.”

The new group claims to insure more UK white van drivers than anyone else as well as one in three of the country’s GP surgeries, a quarter of the country’s narrow boats, 320,000 properties and 50,000 caravans.

Since the merger the company has won an £85m account in US-based insurer Bass Underwriters, which specialises in insuring coastal properties in Florida against wind and hurricane risk.

Did Snapchat Turn Down A $30 Billion Offer From Google?

Did Snapchat Turn Down A $30 Billion Offer From Google?.

Did Snapchat turn down a $30 billion offer from Google?

While neither company will publicly confirm whether the offer was discussed, this rumor has been circulating in the tech world and, according to Business Insider, has resurfaced in the last several days.

Advertisement Since neither Google nor Snapchat has confirmed that this offer was on the table even in an informal capacity, it is unknown how serious the talks were about a potential buyout.

The timeline of the rumored offer is said to be just before Snapchat completed a large round of private fundraising in May 2016.

At the time, the company was valued at $20 billion.

One quiet contributor to this round of fundraising was CapitalG, the growth equity fund managed by Google’s parent company, Alphabet.

It isn’t the first time that the photo and video sharing app has been courted for a buyout.

In an interview with Forbes, CEO Evan Spiegel explained why.

Snapchat is now 6-years-old, and their stocks are trading well below the $24 billion valuation they had at the initial public offering in spring.

Blue Apron Shares Tank On Reports Of Job Reductions

Blue Apron Shares Tank On Reports Of Job Reductions.

The meal-kit delivery system is eliminating 1,270 jobs from a Jersey City, N.J., facility it is closing in October, according to a public notice this week required of employers by federal law when they are planning large scale layoffs.

The fast-growing company 1,051 employees only two and a half years ago.)

But it is consolidating its New Jersey operations at a new 495,000-square-foot fulfillment center in Linden, some 15 miles away from Jersey City and Blue Apron says it has given all that staff the option of going to work at that facility.

A spokeswoman said some 800 of the affected employees have opted to make the move to Linden, while the rest have yet to tell Blue Apron their decision.

Still, the news rattled investors, coming just days after Blue Apron announced the exit of operations chief and co-founder Matt Wadiak as part of a post IPO-shakeup.

That’s a far cry weeks from the $10 level of Blue Apron’s IPO only five weeks ago, already a let down from very high expectations: the IPO was one of most anticipated 2017, and at one point the company was expected to hit a $3 billion market capitalization upon going public.

At $5.87, its market cap is $1.12 billion.

By the end of March, Blue Apron had delivered 159 million meals across the U.S., representing about 25 million paid orders.

Blue Apron—which ships meals that cost $9.99 per person for a two-person household—had 1.04 million customers as of the end of the March quarter, Concerns about what Amazon.com’s (amzn, +0.07%)pending $13.7 billion deal to buy grocer Whole Foods Market (wfm, -0.07%) could do to the meal-kit industry have dragged down Blue Apron shares.

Longtime enterprise exec Quentin Clark joins Dropbox as SVP of Engineering, Product and Design

Longtime enterprise exec Quentin Clark joins Dropbox as SVP of Engineering, Product and Design.

Dropbox has historically been known as a consumer-driven file storage company but has tried to use that as a wedge into larger corporations as it looks to build out its business.

“The leadership team was really interested in my ability to lead and manage teams that are scaling, and how to lead across engineering, product and design as a whole,” Clark said.

The other major topic of discussion was our shared view of where we could take the company.” Hires like this are part of the staffing-up process as it starts to position itself as a viable company on the public markets.

In July, Bloomberg reported that the company was working with Goldman Sachs to prepare documents, another small step toward its final debut as a public company.

With constant comparisons to Box and threats from all sides for its business, it’s had to figure out a way to find both a literal and perceptual position of strength as it seeks to eventually hit that milestone.

His hire comes recently after CTO Aditya Agarwal said he would be leaving the company.

But these kinds of moves are pretty common as a company matures over time and looks to bring on experienced leadership in order to position the company with positive momentum going forward.

The company has said it’s hit 500 million users, hit a $1 billion run rate and has continued to aggressively pursue business customers.

Clark starts at Dropbox at the beginning of September, where he asked us to check back in a couple of months as to what his specific goals will be.

SoFi to finally file for IPO?

Social Finance, better known as SoFi, first teased it would file for an initial public offering nearly three years ago.

But, according to an article in The Wall Street Journal by Peter Rudegeair, this never came into fruition after the online peer-to-peer lender raised $1 billion from Japanese technology giant SoftBank Group and other investors.

And then earlier this year, SoFi locked in $500 million investment led by Silver Lake, “the global leader in technology investing.” The investment brought SoFi’s total equity funding to $1.9 billion.

The article referenced a letter to investors reviewed by The Wall Street Journal.

From the article: In discussing SoFi’s search for a new finance chief to succeed Nino Fanlo, who left at the end of May, Mr. Cagney wrote that he and his colleagues “believe we can find a world-class candidate who can guide the company to an IPO in the not-so-distant future.” He added: “But I’m still not saying when.” If SoFi did file for an IPO, it would mark the second major IPO for a housing-related company after a dry spell the last few years.

There’s been a shortage of companies choosing to go public over the last few years due to adverse market conditions.

According to an article in Reuters by Lisa Lambert, “Last year IPOs in the United States fell by more than a third from 2015, and many of those 102 share offerings ended up trading below their debut price.” Online real estate brokerage Redfin helped break this dry spell in July, when it filed for an IPO at the beginning of July and began officially trading at the end of the month.

However, while SoFi and Redfin are both housing-related companies, they do not do the same thing.

Redfin priced its initial public offering at $15 per share.

In early trading, Redfin’s stock (trading under the symbol “RDFN”) shot up past $20 per share, an increase of more than 35% above its initial trading price.