Enterprise Tech Gets A New $40M Fund

Enterprise Tech Gets A New $40M Fund.

Fika Ventures, a seed investor in startups, has secured $40 million for its first fund.

According to a report, Fika is aiming to invest in enterprise companies that are in the seed stage.

While Los Angeles’ tech scene, where Fika is based, is focused on eCommerce, digital media and ad tech, enterprise tech is just starting to flourish in the area.

While L.A. churns out a lot of engineering graduates, many stayed away from startups until the big tech IPOs started happening.

“Now, the tech sections of job fairs are oversubscribed,” TX Zhou, general partner and cofounder of Karlin Ventures, said.

“It used to be that data was only in the hands of the C-suite, but now, it’s available to everyone in the organization, from the sales force to the people handling customer success.” The other general partners of the fund include Eva Ho, who previously cofounded Susa Ventures.

Its limited partners include Cross Creek Advisors and Knollwood Investment Advisory, as well as 15 founders Ho and Zhou backed in prior funds.

Some of the L.A. enterprise startups that are making a name for themselves include Comparably, a business software startup; DataScience, a data science company; and Renew.com, a benefits platform for senior citizens.

With the awakening of funding opportunities in 2017, Nigerian startups have little excuse to fail

With the awakening of funding opportunities in 2017, Nigerian startups have little excuse to fail.

If you’re an entrepreneur in Nigeria, chances are you’ve been heavily involved in several conversations that have something to do with getting funds to scale your business operation.

The struggle to expand one’s fund raising options is so real that failure could lead towards the exit path.

Thus far into the new year, the sheer number of firms calling on startups to apply for funds have been overwhelming.

The height of it is seeing calls for application from neighbouring countries; like in the case of Outlierz, a seed investment firm based in Morocco, that is offering African startups up to $200,000 in investment.

Just recently, the Lagos state government announced its pledge pump ₦900 million into 700 Lagos-based SMEs, each of them getting as much as ₦5 million to scale their business.

But my guess is few, and it all comes down to misappropriation of priorities by the fund seekers.

Although there might be many underlying issues and bottlenecks to accessing these funds as the case may have been (and as with many other applications for funds), it doesn’t remove the fact that the least effort required was for startups to apply.

Granted, the current economic situation of Nigeria can present a hard time for investment in startups, but things wouldn’t seem as bad as they look if most entrepreneurs weren’t quick to find loopholes in every opportunity that presents itself, and instead take advantage of it.

Unless, as supposed giants of Africa, we want to be found playing catch up.

Here’s How UBS Wealth Sees the Aramco IPO Changing Middle East Markets

The share sale will turn unprecedented attention on the Saudi market, says Zurich-based Bolliger, who helps oversee the investment strategy for $2.1 trillion in assets.

Below is a Q&A with Bolliger about the implications of Aramco’s share sale, which is estimated to raise as much as $100 billion, assuming 5 percent of the company is offered to investors.

Q: Will the IPO change your view of Saudi Arabia?

Its partial privatization will likely draw much attention to Saudi Arabia.

The IPO would increase the depth of the domestic market.

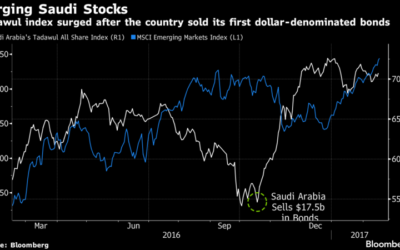

We also expect Saudi companies to start issuing Eurobonds after the $17.5 billion debut bond issued by the kingdom last year.

We see Aramco as a company with large business potential focusing on its long-term vision of becoming the world’s leading energy and chemical enterprise.

The stock could be bought either in Saudi Arabia or in a foreign market.

Transparency is set to gradually improve, markets will gradually open up, better scrutiny should improve governance standards and long-term financial sustainability of Saudi companies.

Other privatizations will follow, likely offering more opportunities for investors.

Snap Said to Set IPO Valuation at as Much as $22.2 Billion

Canada Goose Files for IPO in New York and Toronto

Canada Goose Files for IPO in New York and Toronto.

Canada Goose Holdings Inc. will be selling more than just $900 parkas in New York and Toronto this year.

The retailer, known for its trademark coats with coyote-lined hoods, filed for an initial public offering Wednesday, with plans for a dual listing in the two cities.

The Toronto-based company, which filed with a $100 million placeholder amount used to calculate fees, will seek to raise as much as $300 million in the sale, people familiar with the matter have said, for a company valuation of about $2 billion.

For the fiscal year ended March 31, 2016, revenue was $290.8 million.

In recent years it has shifted its focus to luxury consumers, targeting shoppers who drive Land Rovers rather than dogsleds.

Risks to the business include the expense of expanding into new markets and competition.

In 2013, when Bain acquired a majority stake in Canada Goose, the company was valued at about $250 million, people familiar with the matter have said.

Terms weren’t disclosed at the time.

Canadian Imperial Bank of Commerce, Credit Suisse Group AG, Goldman Sachs Group Inc. and RBC Capital Markets will be leading Canada Goose’s share sale, the filing shows.

IT’S OFFICIAL: Canada Goose files for an IPO

IT’S OFFICIAL: Canada Goose files for an IPO.

The company will list on the New York Stock Exchange and the Toronto Stock Exchange under the ticker “GOOS.”

It filed for a $100 million IPO, but that number is a placeholder and likely to change.

Canada Goose said it had revenue of $290.8 million and net income of $26.5 million.

The company indicated it is seeking to expand globally. “We have rapidly grown our online sales to $33.0 million in fiscal 2016, which represented 11.4% of our consolidated revenue,” it said in a statement.

It also indicated that it wants to expand beyond its popular jacket products. “Our strategy is to selectively respond to customer demand for functional products in adjacent categories,” the company said. “Consumer surveys conducted on our behalf indicate that our customers are looking for additional Canada Goose products, particularly in key categories such as knitwear, fleece, footwear, travel gear and bedding.”

The Canadian bank CIBC Capital Markets scored the lead advisory role, with Credit Suisse, Goldman Sachs, and RBC Capital Markets also on the deal.

How to Make a Crowdfunding Video People Actually Watch

How to Make a Crowdfunding Video People Actually Watch.

The power of video content According to Kickstarter, 33 percent of campaigns are successfully funded without videos.

Campaigns that include explainer videos generate 114 percent more funding than campaigns without videos.

Videos are effective because they use sight and sound to deliver content in a way that emotionally connects with the viewer in a short amount of time.

But not just any video will do.

When it comes to a crowdfunding video, its content must compel viewers to respond to your desired call-to-action: investing.

The answers to these questions determine your brand and how you plan to position it in the market.

Your branding and positioning strategy will give viewers an idea of your direction.

Related: A Successful Crowdfunding Campaign Needs a Video.

At the core of every marketing campaign is content.

Amazon Considers Parachutes for Drone Delivered Packages

Amazon Considers Parachutes for Drone Delivered Packages.

But if we assume laws will change and Amazon drones are going to fill the skies, the next problem to solve is the best way to leave a package at its destination.

But this method carries a lot of risk.

A pet or human could be injured by the drone, the drone could topple over and become stuck or it could be stolen.

CNN discovered a new patent granted to Amazon, entitled “Maneuvering a package following in-flight release from an unmanned aerial vehicle (UAV),” which describes methods to “forcefully propel a package” from a drone in order to alter its descent trajectory.

In other words, the ability to drop a package and make sure it lands in the right place.

Three methods of controlled descent are discussed: a parachute, landing flaps and compressed air canisters.

The drone would monitor the descent, sensors would be included with the package, and together they can determine if an adjustment is needed.

If so, a flap can be deployed, the canister could fire a blast or two of air, or one or more parachutes could be released.

Even though this drop method would allow the drone to keep flying, they all sound like very complicated and expensive ways to get a package to drop in the right place.

BlackBerry’s Smartphone Market Share Has Reached 0 Percent

BlackBerry’s Smartphone Market Share Has Reached 0 Percent.

It’s official — BlackBerry has finally been pushed out of the iPhone and Android-infused smartphone market.

Marking the end of an era, the Canadian mobile company’s share of the smartphone market has officially reached 0.0 percent, Business Insider reports.

In the fourth quarter of 2016, BlackBerry held a sliver of market share — approximately 0.0482 percent — and sold only 207,900 devices running on BlackBerry’s operating system, according to Gartner research.

Smartphone manufacturers worldwide sold 431 million units that quarter, with 352.7 million of those running on Android operating systems and 77 million on Apple iOS.

In the third quarter last year, BlackBerry’s OS had 0.1 percent market share.

Many BlackBerry devices now run on Android, though those also make up a small proportion of the overall smartphone market.

Throughout 2016, BlackBerry didn’t release any new phones that run on its mobile operating system, BB10. “BB10 has a strong following around the world in enterprise and government, as well as consumers in particular markets,” Alex Thurber, BlackBerry’s senior vice president for global device sales, told The Financial Post.

In September 2016, BlackBerry announced it would stop making its own phones and rely on third-party partners for any BlackBerry-branded devices.

How to Bleed Your Friends Dry for Your Business — and Still Remain Friends

In a perfect world, small business owners would stick to borrowing professional money and avoid going into debt with family and friends to fund an unproven venture.

While it’s true that entrepreneurs have more financing options than ever before, startups often discover that traditional bank loans are out of reach, while online lending can be prohibitively expensive.

If you’ve tried all your other options, family and friends might be the only place to turn.

More small businesses fail than succeed.

Only borrow from those who can afford it.

Never borrow money from someone who can’t afford to lend it.

Treat an investment from a loved one the same way you’d treat an investment from a traditional lender.

Consider a loan versus an investment.

Your family and friends may be excited by the idea of buying into your company, but you should give careful thought to taking their money as a loan instead.

My dad’s investment in my sign business helped me dramatically grow my business at a crucial time.

How Businesses Need to Change Their Leadership Style in a Tumultuous World

A Bank of England study suggests up to 80,000 million US jobs will be displaced, and automation will threaten 77 percent of jobs in China and 69 percent of jobs in India according to a World Bank report.

Related: Freelancers Make Up 34 Percent of the U.S.

It seems the millennial generation are also particular about their working environment.

Moreover, millennials embrace the concept of informal management styles, flexible working and continuous learning.

Resistance to a globalized world order seems to be an ideological factor.

Organizational leaders are going to have to be more adaptive and decisive in their decision-making.

At the same time, organizational leaders need to be consistent and clear-headed.

Here are three vertical learning approaches to help develop responsive leadership: 1.

Learning to learn Rather than imposing skills and competencies that reinforce predetermined notions of what makes an effective organizational leader, it is better to teach the leader how to learn to be adaptive and responsive.

We need to break the horizontal glass that contains and defines our leaders and develop them more vertically to be the adaptive and responsive organizational leaders that the World Economic Forum covets.

5 Reasons Why Your Startup Should Take Money From Celebrities

In recent years, there has been an increase in celebrity investing of tech startups.

Although official statistics are hard to come by, as a group, these investors are putting in tens of millions of dollars to work each year.

From Hollywood stars to professional athletes, market participants have included Ashton Kutscher, Leonardo DiCaprio, Lebron James and Shaquille O’Neill.

A question I often hear from entrepreneurs is whether taking in such money really provides any additional value?

Many celebrity investors, and their business managers, have access to television networks, advertisers, agencies and other business organizations that they regularly interact with.

Traffic explosion Many celebrities invest in consumer products or tech because this is what they’re familiar with the most, and it’s an area where they can have real impact.

If your company sells a product to consumers, a celebrity can help drive bursts of traffic to your web and mobile sites.

Entrepreneurs should understand that the organic reach that this can provide is not a substitute for a sustainable and effective marketing strategy.

Employee morale It may be a bit more subtle, but an investment by an individual or firm that is widely recognized can also boost employee morale.

So, if you are in the hunt for capital, and spark interest from a celebrity investor, once the flattery wears off, keep in mind the different ways their involvement can help your business hit a new chord.

Entrepreneurship Is All About the Fight

Entrepreneurship Is All About the Fight.

In this on-going series, we are sharing advice, tips and insights from real entrepreneurs who are out there doing battle day in and day out.

Competing every day.

Some of the new brands are recycling the same themes but deliver a product that is uninspiring.

Designs were boring, ads were boring and there’s been little innovation, especially on the design side.

It’s about interpreting limited and sometimes skewed data points.

We’ve overcome these early-stage challenges by understanding our customers through direct interaction — my partners and I answer customer calls/emails, we respond directly on social media and we’re constantly testing things beyond simple a/b test — like running contests on social media to get instant feedback from our followers.

What trait do you depend on most when making decisions and why is that useful for you?

I love data because it’s hard to cheat the old adage “numbers never lie”.

If everything is too hard – product development, systems, customers, capital, etc.

Add These 20 Fast-Growing Skills to Your Freelancing Repertoire

Add These 20 Fast-Growing Skills to Your Freelancing Repertoire.

Today, more than 35 percent of the U.S. workforce are freelancers — and this proportion is growing every year.

This means competition is fiercer than ever.

From data science to engineering to IT and development, 65 percent of the skills on the list are tech skills, while marketing skills account for 30 percent.

Between 2015 and 2016, demand for each of the skills on the list grew by at least 100 percent.

The top 10 saw 200 percent year-over-year growth.

Here are the top five fastest-growing skills: Natural language processing — a field of computer science that studies human-computer interaction Swift — a programming language for macOS, iOS, watchOS and tvOS Tableau — business intelligence and analytics software Amazon Marketplace Web Services — a web service that supports and helps individuals and companies sell through Amazon.com Stripe — online payment technology Between the third and fourth quarters of 2016, data science was the fastest-growing category.

With the rise of AI, and as products such as Amazon Echo and Google Home pick up in popularity, it’s no wonder natural language processing is the most coveted skill.

The programming language behind these devices is Swift, which takes second place on the list of top skills.

If you’re a freelancer, check out Upwork’s infographic below to find out which skills you should start learning today.

The People You Hire Make or Break Your Business, Says the Founder of Postmates

9 simple ways to raise capital for your ecommerce startup

It is easier than ever, or so it seems, to open a new business, especially an ecommerce or tech business.

But getting money to fund your startup, especially with so many new businesses competing for the same pool of seed money, can be tough.

Following are nine of the best, according to entrepreneurs and investors.

“My top tip for raising money is: use your own money first,” says Brandon Ackroyd, director, TigerMobiles, who has invested in a number of companies as an angel investor.

So it’s important to start saving early.

“The best way for a new tech company to raise funds for their startup is crowdfunding,” says Tamar Huggins, a serial entrepreneur.

If you currently have a job, and have a good relationship with the company and/or senior management, “approach your current boss for an in-kind contribution to your new business venture in exchange for equity or future re-payment,” suggests Roy Tal, cofounder, Homenova.

“Your current employer is already paying for the above.

“Most people assume they’re going to get angel or venture capital investment when starting an Internet-based business,” says David Nilssen, cofounder & CEO, Guidant Financial.

Ask friends and family (for a loan or investment).

How do you raise funding if your tech startup is not based in London?

How do you raise funding if your tech startup is not based in London?.

Last year, more was invested in UK tech and fintech outside of London than anywhere else in Europe.

And thousands of tech firms are finding competitive funding and startup costs outside the UK capital.

But how much is being invested elsewhere?

He enthuses: “The wealth of UK tech talent, generous incentives and tax breaks by the UK government, plus generous funding schemes from many UK cities have contributed to tech hubs emerging in Cambridge, Oxford, Scotland, Birmingham, Leeds, Glasgow, Cardiff and elsewhere.” This, he believes, has contributed to making the UK an attractive proposition for tech and fintech startups and investors alike, with many delivering huge growth of M&A activity in the UK’s tech sector over the past few years.

As someone who’s secured significant funding in Scotland, what advice would I give to tech startups looking to secure crucial investment outside of the M25?

And what are the benefits of being located in other regions or along with London?” It’s not just what you know, it’s where you go… With the costs of setting up in London quite steep for many young companies, other cities are not only considerably competitive, but offer attractive financial incentives as well.

For us, Glasgow was ideal both for the programmes offered by Scottish Enterprise and the Scottish Investment Bank and the local talent.

Plus, Scotland is a market in itself.” What do investors look for?

Roger sums up: “Finally, if you think you have a really good idea, but can’t get people to invest, then it’s probably time to refine the idea – even the most successful businesses have to refine their business models.

How Women Entrepreneurs Can Use Execution for Startup Success

How Women Entrepreneurs Can Use Execution for Startup Success.

In that regard, I’ve found that, as a female entrepreneur, I have a particular skill that has helped me overcome gender bias and act on these opportunities: execution.

Throughout 15 years as a female founder, investor in more than 60 startups and CEO, I’ve learned that execution is the one skill every entrepreneur has to master to be successful.

Visualization is one powerful tool that works here.

The National Association of Insurance and Financial Advisors has noted that 82 percent of small business owners who use visual goal-setting tools from the outset of their businesses achieve more than half of those initial goals.

Notebook company Moleskine, whose products are used for bullet journals, is bringing in profits double what the company saw just five years ago.

Sara Blakely, founder of Spanx, faced rejection after rejection when she started her company, but after two years of talking to department store customers, saw her business take off.

The late motivational speaker Jim Rohn said: “You are the average of the five people you spend the most time with.” So, invest in people and relationships that offer motivation, inspiration, productive challenge and support.

In fact, the Carnegie Institute of Technology found that 85 percent of the success of an average person who’s “made it” in terms of monetary success is owing to his or her people skills.

Being a woman shouldn’t determine whether a startup succeeds or fails: Use these skills to set goals, overcome stereotypes and succeed.