Raise the Bar – The Importance of Market Segmentation, Seven Virtues of Sales, and more

Raise the Bar – The Importance of Market Segmentation, Seven Virtues of Sales, and more.

The Benefits of Building a Repeatable Sales Process The best free-thrower in the world isn’t Shaq.

It isn’t Steph Curry.

It isn’t even Steve Nash.

It’s Ted St. Martin, the Guinness World Record for the most consecutive successful free throws in a row: 5,221.

His secret?

The advantages of developing this directed, systematic series of actions are twofold: consistency and efficiency.

Here’s why a sales process is important.

Here’s more info on its focus and why we started it.

Also published on Medium.

6 Tangible Steps to Launch an MVP Product

As a serial entrepreneur myself, I have more than 10 years’ experience under my belt; and I’ve developed a framework to test all of those crazy MVP (minimum viable product) ideas out there.

Many founders resist launching until a product is “perfect,” but I’ve got news for you — it will never be perfect, and holding out for that status could cost your product going forward.

Create a fake brand.

Zappos started out as Shoesite.com.

If or when your MVP clicks, you’ll build the true move-forward brand out of this process.

If you’re starting an ecommerce company, set up a Shopify store.

If you’re a service business, get a branded website through SquareSpace.

When you start driving traffic to the site to test interest, it helps to have some social media presence since it increases social proof and reduces risk among potential customers.

People don’t buy products they can’t see or services they don’t know about, so you’ll have to get creative because you most likely don’t have a product yet.

Before you launch the ads, decide how you will measure success or failure of your MVP in a quantitative way.

A Product-led Approach to Sales

More importantly, you’ve built your company around the idea that you are different.

But what should sales look like in a product-led company?

But the who, when, and how have to adapt to support a product-led business.

It’s more than LTV and CAC – it’s important to understand how you stack up against your competition, relative deal size, speed of adoption and the value you deliver to the end user.

A free product (should you choose to employ this PLG pricing technique) is offered to show value and build credibility as part of the sales process, but every lead is not created equal; neither is every customer.

Align your resources to supporting these engaged users and moving them further through your funnel.

There are three places to focus the time of your ‘sales’ team: Support: Provide an exceptional customer experience from the first time they touch your product.

Show value to your end user and make your product core to their everyday activities.

By focusing on the end user experience and encouraging them to invite their coworkers in, you extend the network effect and build a base of users that can grow to department and / or company-wide adoption Get your compensation plan right.

At some point, you may start to move up market.

Mattermark Daily – Thursday, February 23rd, 2017

Mattermark Daily – Thursday, February 23rd, 2017.

A Product-led Approach to Sales When approached in the right way, layering in a human sales effort into your product-led business can accelerate growth while maintaining envy-worthy unit economics.

But what should sales look like in a product-led company?

The fundamentals of sales remain the same – it’s all about engaging the right people, at the right time, with relevant information.

Here’s the who, when, and how of adapting to support a product-led business.

From the Investors Angela Tran Kingyens of Version One Ventures expands on the dynamics of each social platform type: messaging, private networks, public networks, enterprise networks, and communities in “Understanding Social Platforms” (83 slides) Stan Reiss of Matrix Partners weighs in on the worrying state of the IPO market and how entrepreneurs need to stop following trends and start taking risk again in “Time to Stop Acting like Lemmings” Toni Schneider of True Ventures notes how some marketplaces are the digital equivalent of using the town center to open a farmers market instead of a box store in “Why I Think “Marketplaces” Are Not Just Software, but a Human Opportunity” Isaac Madan of Venrock and Shaurya Saluja of LEO Express outline helpful recruiting metrics to better understand and optimize the hiring process in “Effective Recruiting Metrics for Fast-Growing Startups” Mark MacLeod of SurePath Capital Partners looks at fundraising and exit activity of SaaS companies based in North America that serve the SMB market in “The State of SMB SaaS Report” From the Operators Caitlin Kalinowski of Oculus / Facebook spells out what the just-right scenario looks like and lists the potholes to look out for before you hit the ‘ship’ button in “Six Steps to Superior Product Prototyping: Lessons from an Apple and Oculus Engineer” Jose Ancer, a startup lawyer, opines on why the future of professional services belongs to people who embrace technology and let it do what it does best in “Luddites v. Tech Utopians: 409A and Legal” Josh Pigford of Baremetrics thinks calling the tough days for what they are is much more therapeutic and healthy than brushing them under the rug and faking it until you do or don’t make it in “Confronting Imposter Syndrome as a Startup Founder” Josh Scott of Craftsy dissects why you should not wait to build your team with the right people in “Building Your Team: Focus on People, Not Jobs” Also published on Medium.

4 Keys to a Successful TEDx Talk

6 Things Angel Investors Look at Before Funding a Startup

6 Things Angel Investors Look at Before Funding a Startup.

It is not enough to have just an idea or a product that you want to sell.

A good team is the foundation of a potentially successful start-up and must include people who are not only good at ideation, but also know how to execute their ideas in a manner that fits the market requirements.

It is rare for start-ups to have the perfect product that fits the market right away, and they will most likely need to pivot depending on what customers need, the competition in the market, and the transformation within the industry.

• Product The product or concept is another important factor considered by investors when looking to fund a start-up.

Angels are knowledgeable in the start-up domain, so it’s very important for entrepreneurs to show them how and why their business is different and better than their competitors.

Start-ups should also possess the ability to convert their pilot users into potentially paying customers.

• Converting users to customers A pilot phase helps in testing the viability of a new product with a certain focus group, and has an added benefit of raising awareness about the product and getting conversations started through word-of-mouth referrals.

This requires creating a positive user experience that translates into the adoption of the product by the end-consumer.

Entrepreneurs must also look to create products that drive engagement, compelling users to tell others about their experience.

Two Tampa tech startups get $1.5 million from angel investors

Two Tampa technology startups will receive $1.5 million from angel investors in deals that the nonprofit startup incubator Tampa Bay WaVe helped shepherd by seeking capital from sources without a deep history in tech funding, the group said on Thursday.

Harness, a company founded by Miraj Patel and Andrew Scarborough, will receive $1.2 million from Santosh Govindaraju, CEO of Convergent Capital Partners, a real estate private equity firm in Tampa with $250 million in assets.

But Govindaraju said this is a personal investment unconnected to his company.

Harness has developed an app allowing users to “round-up” credit or debit card purchases with the change automatically donated back to their favorite charity.

Another Tampa company, Phonism, founded by CEO Steve Lazaridis, is getting $350,000 from an investment group formed by Tampa attorney Rich McIntyre.

Phonism is a cloud company that has developed tools allowing voice over Internet-Protocol phone service providers to reduce support costs.

Linda Olson, president and co-founder of Tampa Bay WaVe, said the group has worked to overcome the challenge of finding funding for tech startups in a Tampa Bay business environment without rich venture capital sources. “I intended to invest in tech startups in the late ’90s, but I didn’t find the market fit me because it was too speculative at the time,” he said. “Now, it’s a different world.” “They can grow rapidly with relative ease,” Govindaraju said of Harness.

China Rapid Finance Said to Target U.S. IPO as Soon as 2017

China Rapid Finance Said to Target U.S. IPO as Soon as 2017.

The company, which raised $20 million at a pre-money valuation of $1 billion in November, could hold the IPO as soon as this year, the people said, asking not to be identified because the information is private.

The money will be used to fund expansion in China, one of the people said.

Founded by Zane Wang in 2001, China Rapid Finance competes with Lufax, formally known as Shanghai Lujiazui International Financial Asset Exchange Co., a company that’s also marching toward a a potential IPO.

China Rapid Finance serviced 1 million borrowers and handled 8.8 million loans as of the end of October, it said in an e-mailed statement in November.

The company’s November raising included an investment from China United SME Guarantee Corp. China’s peer-to-peer lending industry brokered 982 billion yuan of loans in 2015, almost quadruple the amount in 2014 and an approximately 10-fold increase from 2013, according to consultancy Yingcan.

The proliferation of online lenders has however attracted scrutiny from regulators concerned about defaults and possible fraud.

In 2015, the country’s biggest Ponzi scheme was exposed after Internet lender Ezubo allegedly defrauded more than 900,000 people out of the equivalent of $7.6 billion.

The government has since imposed limits on lending by peer-to-peer platforms to individuals and companies in an effort to curb risks.

(An earlier version of this story corrected the year China Rapid Finance was founded.)

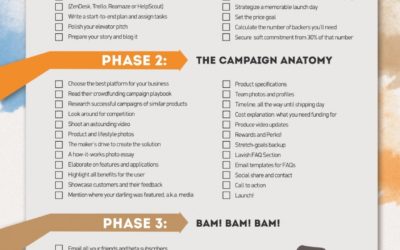

How to create a successful crowdfunding campaign

Snap IPO: The Next Facebook or Another Twitter?

Snap IPO: The Next Facebook or Another Twitter?.

As Snap Inc. approaches its initial public offering, one question on investors’ minds is whether the parent of the Snapchat social app will be the next Facebook (symbol FB) or the next Twitter (TWTR).

Shares of the two established social media companies have taken divergent paths since being offered to the public.

It’s competing head-to-head with Facebook, the 800-pound gorilla of social media that has 1.23 billion daily active users.

While Snapchat’s daily active users are increasing, the growth rate slowed in the second half of 2016 after Instagram debuted its own Stories feature.

Snap has already raised $2.7 billion from private investors, according to Goodwater’s analysis of the company and its upcoming IPO, but it’s down to $987 million in cash.

Snap spends heavily on cloud-based services to serve up the 2.5 billion snaps created daily on Snapchat.

Twitter shares soared 73% on their first day of trading and stayed well above their offering price for the next two years.

Shares fell in the aftermath and didn’t close above their offering price for more than a year.

There is tremendous hype, it’s going head-to-head with Facebook, and it has to corral fickle young users.

What Nobody Tells You About Taking VC Money

VCs, through their work, are connected to similar entrepreneurs in the space.

The hard truth about venture capital To be sure, there are good reasons to take venture capital.

Shows like Shark Tank make entrepreneurs think VC money works miracles for businesses, when in fact, less than 1 percent of companies are built that way.

If any of these three situations apply to your company, you should probably skip VC funding as well: 1.

Venture capital isn’t free money.

On one hand, taking VC money can create financial wiggle room for cash-starved startups.

Many companies — particularly service-sector companies or brick and mortar businesses in rural or suburban markets — are best served by steady, linear growth.

We’re not taking over large markets, we pay people well and our growth rate is safe and profitable.

Yes, our company isn’t growing like a VC-backed venture.

And we’ve done it without VC funding.

The Secret to Organic Networking

And they grow in relation to the value shared.

When you dig deep and come up with a thousand bars, however, you’ll have people come out of the woodwork to share your value and to make it grow.

Though we don’t have hoards of gold to start our networks, we all have something even more valuable: information that makes life better for others.

My organic networking breakthrough I started my writing career because I wanted to help people avoid the heartbreak I had experienced.

Then I started getting connections.

Gerald had gotten enough value from my relationship articles on a site called MindBodyGreen that he wanted to talk to me in person.

The more value we share, the more that connection will grow.

Instead, focus your energy on refining your craft, or your service, or your goods.

Work so hard at solving that problem that you become an expert.

I studied writing and personal development until I had what I needed to make money and live on my own.

The One Reason Why Your Business Idea Will Never Be Ready

The One Reason Why Your Business Idea Will Never Be Ready.

In this video, Entrepreneur Network partner Bryan Elliott meets with bestselling author Seth Godin to discuss the importance of understanding your customers and realizing when it’s time to test a business idea. “You will never be ready,” Godin says.

When Gutenberg launched the printing press .

94 percent of the people in Europe were illiterate.

It was a dumb time to launch the car.

Those are the symptoms of fear, and you’ll never get over that fear.”

Watch the full interview with Godin on YouTube.

See more episodes on Behind the Brand’s YouTube channel.

Click here to become a part of this growing video network.

Two Women Launch School to Teach People How to Be Adults

Two Women Launch School to Teach People How to Be Adults.

The idea of becoming an adult can be daunting, but maybe all you need is some outside help.

A new school in Maine called the Adulting School says it will teach students the essential skills it takes to be a successful grownup.

It’s not what you think though — students won’t find themselves in a home-ec class.

It’s quite the opposite: many events are hosted in bars and restaurants across the U.S. Related: The Game of Real Life: Tips for Being a Responsible Adult (Infographic) Launched by Rachel Weinstein, a psychotherapist, and Katie Brunelle, a wellness coach, the school organizes social media groups and local events to teach people everything from financial planning to meditation to yes — folding laundry.

The majority of attendees are women and millennials.

The school “is a great way to learn, have a good time with friends, meet some new people and drink good beer and eat yummy local food,” reads the school’s website.

Realizing how much young adults struggled with things from choosing a career to paying bills, the idea initially sparked from Weinstein’s work as a psychotherapist. “You know, when you see 10 people feeling like they’re the only one, and they’re all struggling with the same thing, you think, let’s get these people together so they can learn this stuff and not feel so isolated and ashamed,” Weinstein told NPR.

Who knew hanging out at a bar and learning to be an adult could go hand in hand?

What to Get Right When Raising Money: 5 Insights for Startups From a Former VC

What to Get Right When Raising Money: 5 Insights for Startups From a Former VC.

Here, I share a few insights from this that have helped me excel as a startup founder.

When a VC asks how long the money will last, the answer is generally 18 months.

A year can work, but it raises the same issue as six months of funding: You’ll need to start fundraising again fairly soon.

Instead of pitching your dream VC firm first, pitch your second or third favorite first.

Then, work your network to get an introduction.

Find someone who your target VC has funded recently, or an entrepreneur who has built a successful company.

Ask them what it’s like to be funded by that firm before asking for a connection.

Here’s what to include: “This is what my company does.”

Related: Partnering with the Ultra Successful Comes Down to What’s In It for Them 5.

Initialized Capital leads $4M round for Privacy Labs startup that helps users ‘take control of their data’

Initialized Capital leads $4M round for Privacy Labs startup that helps users ‘take control of their data’.

The new Bellevue, Wash.-based company is called Privacy Labs.

As a result, consumers have unknowingly traded the privacy and security of their data for access to these free services.

There are also some other clues that point to what Privacy Labs is building.

The company created an open source project this past June called Project Oasis, which allows users to “reclaim their email from centralized services like Gmail and store their data on hardware they own.” From the Project Oasis GitHub page: Oasis automates the setup of a Raspberry Pi email server meant to run from inside your home.

As engineers, designers, and product makers, we have a duty to create secure, private, and easy to use ways for people to communicate, store all their information, and own it completely.

It’s the best way to ensure that you maintain control of your personal data.

We are focused on delivering a secure, simple and easy to use product that is accessible to everyone.” Sreenivas and Sigurdson previously co-founded Mobilisafe, a Seattle mobile device security startup that raised investment from Madrona Venture Group, Trilogy Equity Partners, and T-Mobile’s venture arm before it was acquired by Boston-based Rapid7 in 2012.

Sreenivas, a Stanford grad, also spent more than three years as a software engineer at Lockheed Martin.

As a result of the new funding, Initialized Capital Managing Partner Garry Tan is joining the board.

5 Most Interesting Things We Learned From Tesla’s Recent Earnings Report

5 Most Interesting Things We Learned From Tesla’s Recent Earnings Report.

Musk anticipates that 47,000 to 50,000 Model S and Model X vehicles combined will be delivered to customers combined during the first half of the year.

“We are on track to generate $500M in cash (including growth of non-recourse project financing) by 2019,” he wrote.

Here are other interesting things we learned from the earnings results: Related: If You Crash Your Tesla to Save a Life, Elon Musk Might Foot the Bill 1.

Leadership change The company announced that Tesla CFO Jason Wheeler will be leaving the company in April and will be replaced by his predecessor, Deepak Ahuja, who took on the job in 2008 and left in 2015.

Wheeler said of his departure in a statement from the company: “After spending the last 15 years helping to make information accessible to everyone and to advance sustainable energy, I’m looking forward to continuing to champion these causes and others from a public policy perspective.” 2.

Inclusive packages On an earnings phone call, Jeff Evanson, the company’s VP of investor relations, said that Tesla has begun offering customers in Asia the option of buying a vehicle with the price of maintenance and insurance included, with plans to provide that choice in other markets.

DIY repairs In his letter to shareholders, Musk wrote that the company had plans to grow its service that lets drivers make repairs at their workplace or home as “80 percent of our repairs are so minor that they can be done remotely.” 4.

More Gigafactories The company will also be working towards building three more battery factories.

One stat he reported was that the injury rate in Tesla’s factories was less than half of the car industry average.

From Bootstrapped Startup to More than $1 Million in Annual Revenue

VC capital is still a difficult proposition for most Indian start-ups.

We have more than $58 billion of VC funding available to a population of 318.9 million people.

A grassroots network of talented people.

In the early years, Aggarwal’s team primarily traded their talent and time for equity in Designhill.

Designhill’s entire platform brings graphic designers together with companies that need their services.

There are many platforms or companies that claim to provide quality freelance graphic design.

The client and the designers competing for the cash prize communicate on the platform.

Designers from around the world gain the opportunity to showcase their work to real clients in more lucrative markets.

For Aggarwal, crowdsourcing talent allowed him to solve an economic challenge and improve opportunities for struggling designers around the globe.

From zero to $1 million in 14 months I first learned about Designhill from a magazine article.