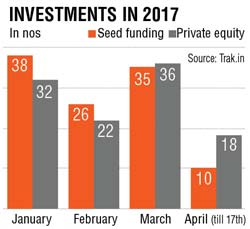

Seed funding and late-stage deals are neck and neck this year so far

Since 2017, there are as many private equity deals in the start-up space, as much as seed funding deals, according to data by trak.in. (See box). While the line between late-stage funding by venture capitals (VCs) and early private equity (PE) investments is blurred, the size of investments have steadily increased. This is an indication that start-ups with clearer revenue streams with better administration capabilities are being funded.

PE investments tend to back less-riskier companies. “I agree that the funding environment for start-up has matured but it is not completely there yet. There are founders with domain expertise who are doing a fairly mature job but there are as many young entrepreneurs who have nothing to lose, and running up losses,” says Ajeet Khurana, angel investor and start-up mentor who was the former CEO of IIT Bombay’s start-up incubator.

Funds flush in

According to Khurana, inferior quality start-ups with less or no vision are being funded, due to large volumes of funds available for investment. Globally, limited partners (LP) interest in the Indian start-up market is at an all-time high. Indian start-ups are exhibiting a growth of 40% annually, attracting global investors who are looking at control-based funding or buyouts along with funding acquisitions by Indian start-ups.

In 2016, start-up funding saw a slight dip from the record-breaking funding the year before, the activity is expected to…