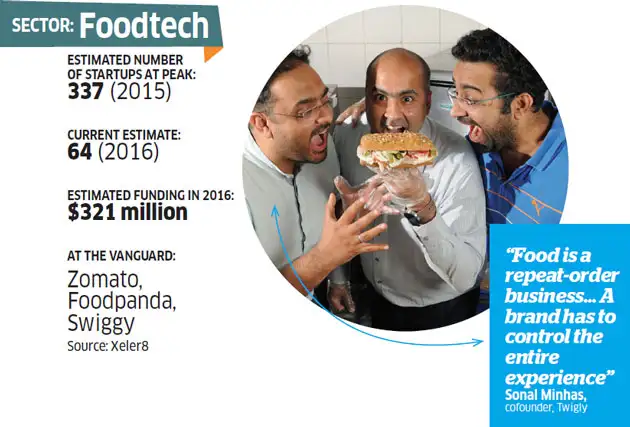

If the two poster boys of foodtech, Zomato and Foodpanda, continue to bleed heavily, as they did in 2016, it portends warning bells for others.

While online restaurant aggregator and food delivery platform Zomato reportedly posted a loss of Rs 492 crore in 2015-16 from Rs 136 crore a year ago, Foodpanda India’s loss ballooned four-fold to Rs 142.6 crore.

Elsewhere, a bunch of highly funded startups that had begun well faltered. For instance, TinyOwl, a Mumbai-based food delivery startup, which was founded in August 2014, reportedly raised $27.67 million from four investors, including Matrix Partners and Sequoia Capital, but shut down operations in May 2016. Eventually, it was acquired by hyperlocal delivery startup Roadrunnr.

Dazo, another startup that curated and delivered meals, shut down in October. Backed by Google India chief Rajan Anandan, TaxiForSure cofounder Aprameya Radhakrishna and former FreeCharge chief executive Alok Goel, Dazo failed to live up to expectations.

Zupermeal, a home delivery food venture backed by celebrity chef Sanjeev Kapoor, shut down in May, just eight months after raising seed funds. The list of startups that bit the dust in 2016 is long: ITiffin, EazyMeals, Zeppery, BiteClub….

Venture capitalists are not surprised that the foodtech is littered with corpses. Reason: There was little tech in foodtech startups, and most of them were merely restaurant cataloguing and delivery services.

For the most part, the rise and fall of these business models can be attributed to the hype cycle entrepreneurs and investors fell prey to, says Shubhankar Bhattacharya, venture partner at early-stage investing fund Kae Capital. Several businesses that were funded were too similar, competing for the same customers, and lacked a killer differentiation.

“Now, at least, it doesn’t seem like the Indian restaurant delivery market has the size and depth to support more than one or two large players,” adds Bhattacharya.

Not So Savoury

What added to the woe of delivery startups were the wafer-thin margins (2-10 per cent) they operate on. “Low-margin businesses generally require lots of external capital,” says Sid Talwar, cofounder of Lightbox Ventures. These companies either need to consistently raise money or shut shop. “We have seen both cases in 2016,” says Talwar, adding that while some of the delivery businesses have faltered, the overriding…