Shira Ovide is a Bloomberg Gadfly columnist covering technology. She previously was a reporter for the Wall Street Journal.

Perhaps even more than in the typical debate over tech company IPOs, opinions are split on whether Snapchat’s shares are worth buying in its initial public offering and whether it will prove a fit and lasting public company. The answer to the first question will come on Wednesday, when Snapchat is expected to close its first stock sale to the public.

If parent company Snap Inc. does start life as a public company on the right foot, it will mean investors have chosen to focus on Snapchat’s sunny qualities: its short but impressive history of generating advertising revenue and the affection younger people have for its consistently creative app.

If investors turn up their noses, it’s a sign they are fixated instead on some of Snapchat’s red flags, among them its relatively small and slow-growing audience and cash burn likely to persist for several years.

Here is a bullish and bearish case for Snapchat’s IPO in a dueling set of charts:

The Money Machine: Snapchat’s best pitch to IPO investors is how quickly the company has been able to generate advertising revenue from a standing start two years ago and narrow the gap with digital advertising powers such as Twitter Inc. and Facebook Inc.

The average revenue Snapchat generates from each daily user more than tripled in the fourth quarter of 2016 from the year-earlier period. If Snapchat can grow to Facebook’s average revenue per user, Susquehanna Financial Group estimates that would translate into an additional $5.5 billion in annual sales, even if Snapchat’s audience size stays the same.

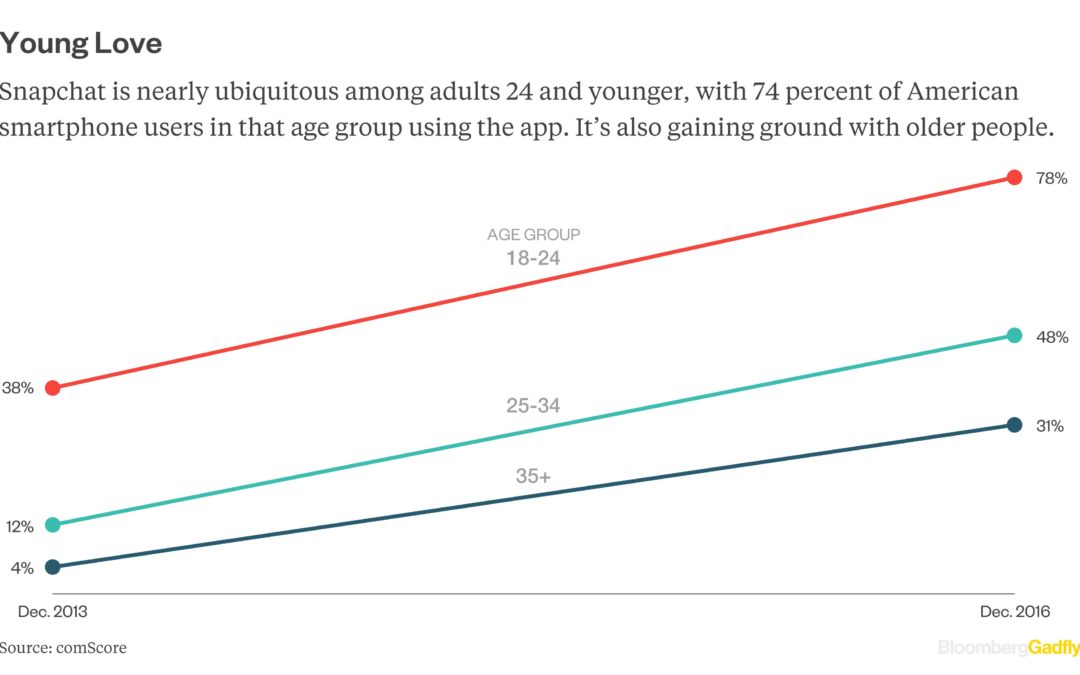

The Kids Are All Right: Snapchat has won over young people, which are highly valued because they are tough to reach with traditional marketing messages on TV or in newspapers. More than three-quarters of Americans 18 to 24 who have smartphones use Snapchat at least once month, according to comScore.

And Snapchat in its IPO document said that on average its users younger than 25 spent more than 30 minutes on Snapchat each day in the fourth…