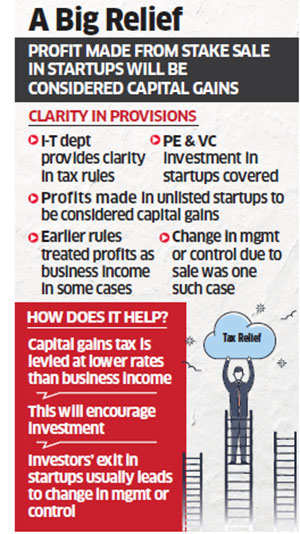

NEW DELHI: Private equity (PE) and venture capital (VC) funds investing in startups have got a tax relief. Income from transfer of unlisted shares by them would now be treated as capital gains and not as business income even if there is transfer of control or a management change.

A number of funds had received show cause notices from income-tax authorities on this issue, prompting a spate of representations from them as well as startups to the Central Board of Direct Taxes (CBDT). The relief is available to Sebi-registered Alternate Investment Fund (AIF), both category I and II.

The board has now sent out a letter to the field saying this change in control or management should not be applied in case of such investments as AIFs typically invest in unlisted shares of ventures, many of which are startups, making some form of ‘control and management of underlying business’ necessary. This issue had its origin in the long-standing debate on treatment of transfer of shares as business income or capital gains.

The CBDT had in February 2016 through a clarification settled…