Winter is a venture capital investor at Sapphire Ventures. Before joining Sapphire in 2014, he worked at Hall Capital Partners. Prior to Hall, Winter founded Mead and Mead, an international food distribution and logistics business. He also worked for several early-stage technology companies in the San Francisco Bay Area. Winter holds an MSc from the Saïd Business School at the University of Oxford and a BA from Harvard University.

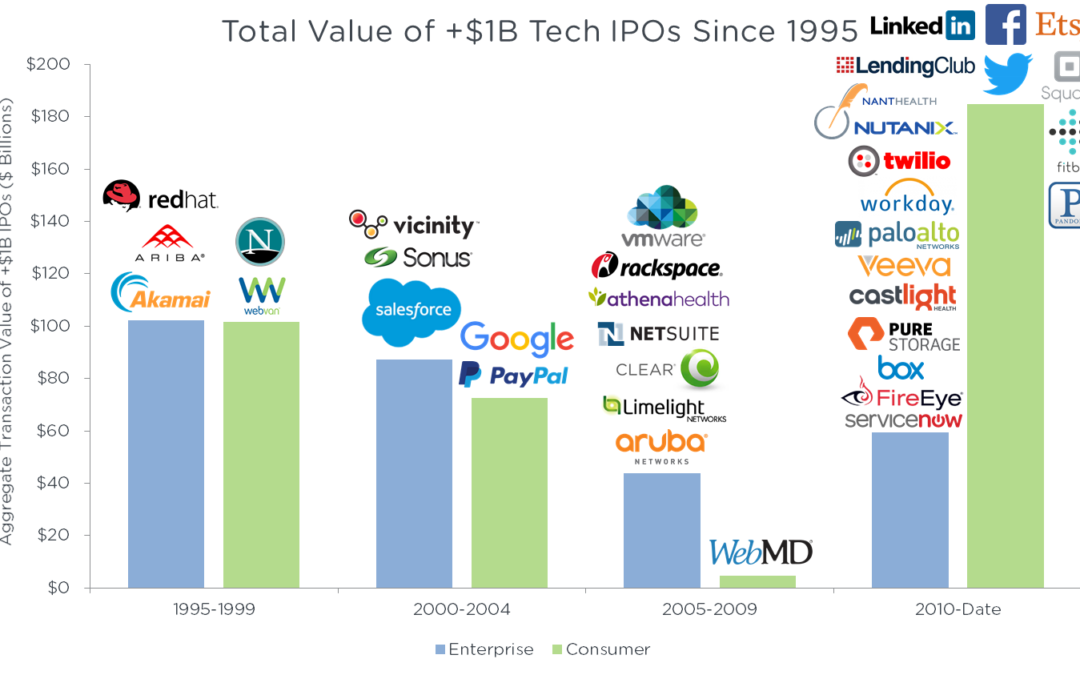

Value creation in enterprise tech is often driven by a cohort of exits, while value creation in consumer tech is generally driven by large, individual exits — a phenomenon I recently dug into. What the data revealed is that, in recent years, there is a trend of larger consumer exits, such as Facebook, Twitter and WhatsApp. And if this trend continues, that’s very good news for consumer-oriented funds.

But the data further begs a deeper dive on VC-backed exit dynamics; in particular, what are typical VC-backed exit sizes?, including a look at the frequency of exits greater than $1 billion across enterprise and consumer.

For companies with IPO exits of $1 billion or more in valuation, venture-backed enterprise exits outpaced consumer exits until recently. There were 144 IPO exits with greater than $1 billion in value, of which 97 are enterprise companies and 47 are consumer companies.

On the M&A front, there were 96 exits of $1 billion or more in value, of which 65 are enterprise companies and 31 are consumer companies. Similar to the chart above, acquisition value of enterprise companies outpaced that of consumer companies until recently, when the venture capital ecosystem became more accommodating of large M&A transactions, potentially driven by the run up in market capitalization of some of the earlier, successful IPOs…