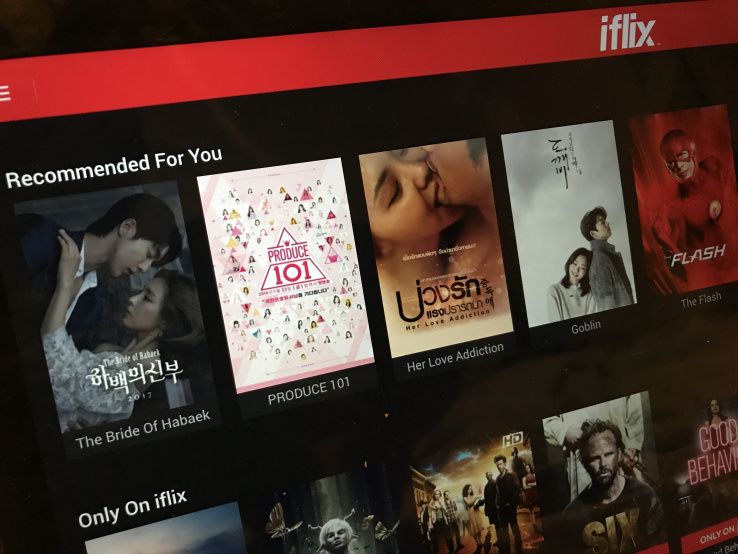

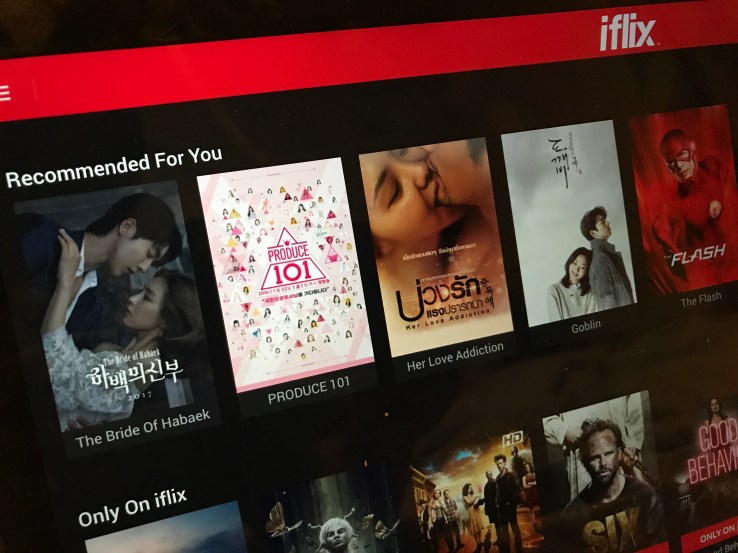

Iflix, an Asia-based startup providing Netflix-like streaming services in emerging markets, has landed $133 million in fresh funding to accelerate its business.

The investment was led by U.S. media conglomerate Hearst, which counts BuzzFeed, Vice and Roku among its investment portfolio. The group was joined by another new backer EDBI — the corporate investment arm of the Singapore Economic Development Board — alongside undisclosed clients of Singapore-based DBS bank. Existing investors joining included Evolution Media, UK broadcaster Sky, Malaysia’s Catcha Group, Liberty Global, Jungle Ventures and PLDT.

Iflix was started in May 2015, initially in selected Asian markets. Today its streaming service is priced around $3 per month and available in 19 countries thanks to expansions into the Middle East and Africa. The business has raised close to $300 million from investors to date. It started out with a $30 million pre-launch round in 2015, before adding $45 million from Sky last year and completing a $90 million raise in March of this year.

That most recent round valued the company at $500 million, but there’s no word on what the valuation following this new financing is. (We’re working on getting that detail.)

Netflix is the most obvious rival to Iflix but, with over 100 million paying subscribers and 5.2 million new additions in the last quarter alone, few can rival the U.S. media giant. In that respect, more regional competition includes Singapore’s HOOQ, which is backed by telecom firm Singtel, and PCCW Media-owned Vuclip, as well as local single-country streaming services are more valid comparisons.

Iflix said it had five million registered users back in March, but it isn’t giving an update on that this time around. It instead hailed “tremendous growth” which it said includes a 3X increase in subscriber numbers and 2X rise in user engagement over the past year. Revenue, it said, is up 230 percent year-on-year, but it is keeping quiet on raw figures.

In an interview with TechCrunch, Iflix CEO Mark…