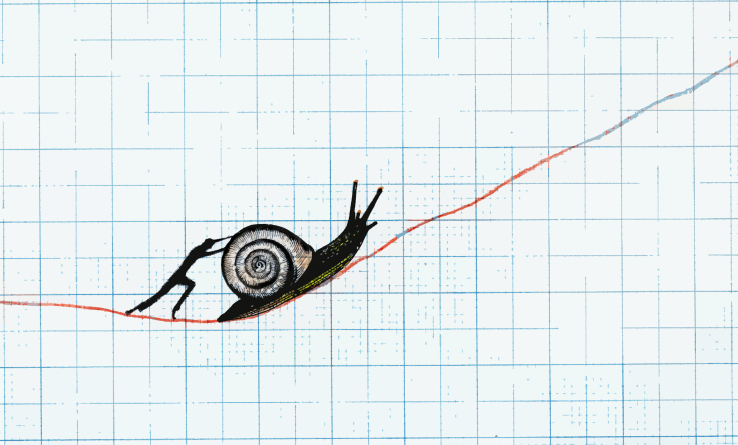

The startup ecosystem has a painful year ahead. Nearly half of Series C fundraising rounds were down or flat in 2016. Series B startups are next in line to feel the pain. [A] flat [round] is the new up [round]. If you really need another venture acronym, call it FITNU.

The market correction will not stop at Series B. If you’ve raised a Series A and need more capital in 2017, what I’m going to share might save your company. If you’re at the seed stage, this article might save you a lot of trouble.

Wait, what happened?

According to some investors, 2017 was supposed to be the turnaround year. Didn’t U.S. venture capital funds raise a record $42 billion in 2016? Didn’t we get past the notorious bubble?

Not quite. The bubble broke in 2015 when the tourist VCs driving unicorns in so-called private IPOs got spooked. They pulled back. This ratcheted down the VC food chain. The system couldn’t support the wild number of seed deals and high valuations. To protect itself, the system concentrated more money into fewer deals.

PitchBook found that the number of U.S. seed rounds declined 43 percent, from 1,537 deals in Q2 2015 to 872 in Q4 2016 — a four-year low. Early-stage financing (Series A and B) followed along. Deal volume tanked from 830 in Q2 2014 to 524 in Q4 2016.

Meanwhile, deal sizes swelled. Indeed, 42 percent of seed rounds were between $1 and $5 million in 2016, the highest proportion PitchBook has recorded over the past 10 years. Almost 50 percent of the early-stage money went into rounds worth $25 million or more in 2016.

Corroborating PitchBook, Redpoint Venture’s Tomasz Tunguz points out that the median seed round tripled, from $272,000 to $750,000 between 2010 and 2016. His analysis of Crunchbase data also shows that the median A round climbed from $3 million to $6.6 million over the same span, and the median B leapt from $10 million to $15 million.

So why the flat rounds?

In the bubble, more startups received seed funding because so many new seed venture firms entered the business. But the number of Series A firms didn’t grow much at all — they just raised bigger funds. Thus, Series A firms started writing bigger checks to meet the needs of their business.

Unfortunately, few seed startups qualify for $10 million to $20 million “Super-Sized” A…