Plum is one of a number of fintech startups reimagining how we manage our finances online, in the form of an AI-driven or ‘smart’ chatbot. However, unlike competitors that exist primarily as standalone apps, the London startup (for now, at least) has decided to bet big on Facebook Messenger.

The thinking, explains co-founder Victor Trokoudes, who was previously an early employee at international money transfer company TransferWise, is that Facebook Messenger is already one of the places that Plum’s millennial target users reside. With the social network expected to launch friend-to-friend payments in Europe soon, he thinks it will increasingly become somewhere they’ll interact with their money too.

“With Facebook introducing payments into Messenger next year, Messenger is set to create a platform to further disrupt banks,” says Trokoudes. “Why use your banking app when you can pay your friends via the app and also add a service like Plum which allows you to take control of all aspects of your financial life?”.

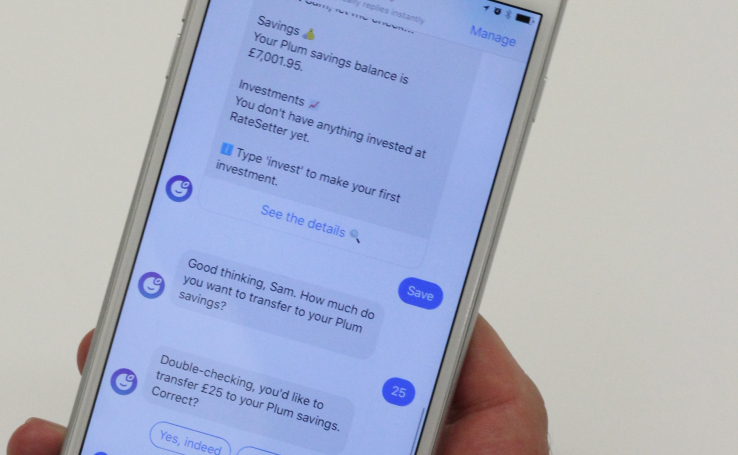

At launch, Plum billed itself as the first Facebook Messenger chatbot that enables you to start saving small amounts of money effortlessly. The chatbot connects to your bank account and Plum’s AI learns your spending habits, allowing it to automatically deposit small amounts of money into your Plum savings account every few days.

It has since partnered with Ratesetter to enable your Plum ‘micro’ savings to actually earn a decent 3% interest rate via the option to invest all or some of it into the peer-to-peer lending platform. A typical…