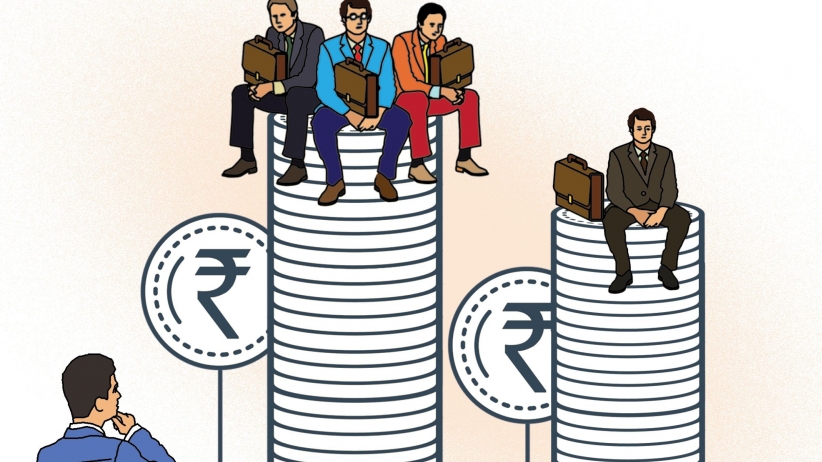

Two years back fear of missing out on a billion dollar idea erased, not blurred, the line between early stage investors and beyond. Birds of all sort of feathers including growth stage venture capitalists (VCs), hedge funds, private equity players, flocked together and nearly spoiled the party for angel investors. But as winter set in, everyone retreated except brave heart angels and angel/seed funds that cautiously kept playing the volume game. Since then, the ball has been into some promising start-ups’ court – to choose between angels and angel/seed funds to raise capital. But, which one should they really pick without doing any maths?

Angels predominantly cut the first cheque for entrepreneurs, globally. The data by India’s largest angel group Indian Angel Network (IAN) suggests that in the US, angels pumped in $26 billion in 50,000 companies against $25 billion bet by its VCs in 5,000 companies in last few years. In India, while the estimate for a corresponding figure is just 10 per cent but the fact remains that the angels invest four-five times more than VCs. But why so is the case, if the glamour and appeal knocks entrepreneurs’ doors with VC money, (which is known for and cherished for creating famous entrepreneurial stories globally)? After all, venture funds are celebrated for having the ability to find and locate the future giants early on. Not just that, as an entrepreneur, you get to leverage the brand name of the fund, and its enormous network too. That’s an offer, too lucrative to ignore. And among all this, what’s most important is the support, followed by the money, to help the start-up hit milestone for its follow on round of capital.

“Both funds and angels help in getting a company from the garage to the road. However, the one thing that a fund offers and an angel doesn’t necessarily, is a structured approach to the company’s life cycle. A fund usually sits with founders and work on metrics to focus on, longterm strategy and in many cases tactical solutions as well,” says Pankaj Jain, former Partner, 500 Startups. A global seed fund and accelerator, 500 Startups has backed over 1,300 technology startups and around 50 start-ups in India.

Among the latest lot of India’s most prolific angels, Dheeraj Jain who also is the managing partner at London and Gurugram-based Redcliffe Capital that does early stage funding underscores similar thought. “If an entrepreneur gets multiple VCs for seed round, it means easy access to funding. Having a big VC also means that the start-up gets a brand name to leverage early on,” says Jain, who has backed around 20 start-ups.

Angel Shouldn’t Try to be a VC, for VC it’s Hard to be an Angel

However, there is always a risk attached to…