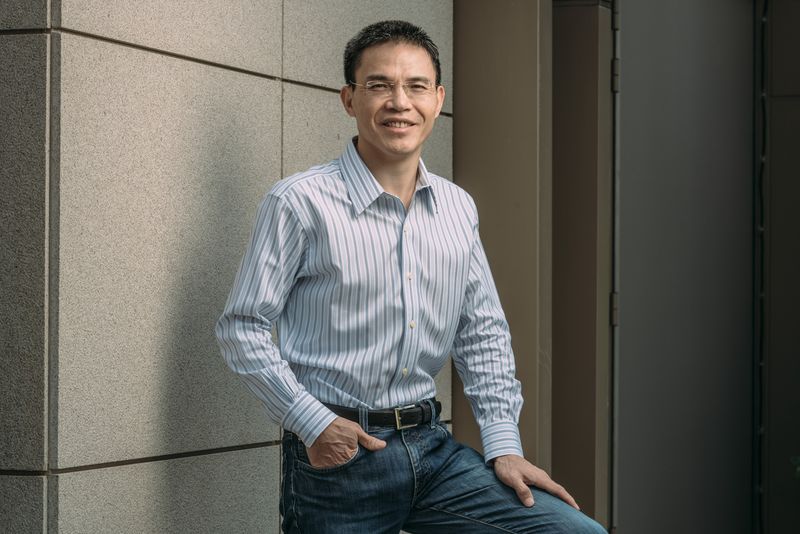

- Richard Peng now steers Genesis Capital’s investment strategy

- Year-old outfit’s $450 million-fund backed by Temasek, IFC

Richard Peng didn’t get to become one of China’s most accomplished deal-makers by pussyfooting around. In 2013, the Tencent acquisitions chief took a shine to a scrappy little ride-hailing app called Didi. He tracked down reluctant founder Cheng Wei and after several conversations lured him into his office. Then he locked the door.

“Buddy, first of all, I know you don’t want our investment,” Peng told him, knowing Cheng once worked for Tencent’s nemesis, Alibaba Group Holding Ltd. “Secondly, I have to invest.”

It took hours, a dramatically sweetened offer and the promise of a meeting with Tencent’s billionaire founder Pony Ma, but Peng sealed the deal that would become his signature investment. Didi Chuxing eventually morphed into the $34 billion behemoth that drove Uber Technologies Inc. out of China.

Peng’s deal-making moxie set the pace for a hard-charging Tencent Holdings Ltd. in its early days. He became one of the most instrumental lieutenants to Ma during a seven-year stint at the $280 billion operator of WeChat, during which he helped define China’s largest social media company by orchestrating about $20 billion of deals through hundreds of investments and transactions.

Now, the 46-year-old is prepping his second act. Peng’s resume helped him get Genesis Capital off the ground in 2015 and amass more than $450 million from backers including Temasek Holdings Pte’s Pavilion Capital and International Finance Corp. His goal remains finding the next billion-dollar startups, typically with a China focus. Genesis already manages about a dozen investments, among them e-commerce startup Xiaohongshu or “Little Red Book” and Uber-for-trucks app Truck Alliance Inc.

But striking out on his own means the stakes are higher. Genesis Capital remains in its infancy, and it’s going up against a stellar roster of like-minded investment houses, from Hillhouse Capital to Sequoia’s Chinese offshoot. While Peng maintains ties with his former employer, he can no longer dangle the prospect of Tencent’s billion-plus users and enormous market clout to entrepreneurs. His war chest is a mere fraction of what he’s accustomed to. And every mistake will count.

“The requirement for return on investment at our new fund is much stricter. We have fewer bullets, so we need to have accuracy and less tolerance for error,” Peng said, speaking in characteristically booming, rapid-fire fashion. “We either make it big or fail miserably.”

Peng’s departure from Tencent continues to befuddle some of his closest friends, but the financier maintains it was a gamble well worth taking. Dressed in baggy jeans one size too big and sporting a backpack, he paced back and forth near a Starbucks on a recent afternoon conducting a conference call. He apologizes a half-hour later for the holdup, an urgent talk with one of his portfolio companies.

Peng’s road-warrior tempo sets the pace for Genesis Capital, which requires companies to sign term-sheets the same day it extends an offer to avoid price manipulation. Two of its most recent deals were signed at midnight. His team of about 10 people get paid based on the entire fund’s performance, to ensure everyone chips in. Abandoning the shotgun-approach he favored at Tencent, Peng today cites the analogy of digging a single well deep enough that it hits water, instead of sprinkling money in batches to hedge against misses.

That doggedness was evident from youth. Peng still speaks with a hint of a lilting Jiangxi accent, reminiscent of a penurious rural origin — he was one of nine children born to a farming family. Giving up vocational school,…