Moneycontrol News

Reliance Nippon Life Asset Management is set to open its initial public offer for subscription on October 25, with a price band of Rs 247-252 per share.

JM Financial Institutional Securities, CLSA India, Nomura Financial Advisory and Securities (India) and Axis Capital are the global co-ordinators and book running lead managers to the issue.

Edelweiss Financial Services, IIFL Holdings, SBI Capital Markets and Yes Securities (India) are the book running lead managers to the offer. Karvy Computershare is the Registrar to the issue.

The company is going to list its equity shares on the National Stock Exchange of India and BSE.

Here are 10 things you should know before subscribing the issue:-

Company Profile

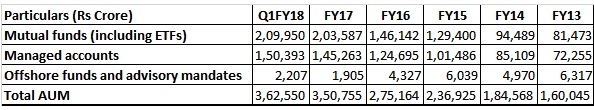

Reliance Nippon Life Asset Management (RNLAM), promoted by Anil Dhirubhai Ambani Group-led Reliance Capital, is involved in managing mutual funds (including exchange traded funds); managed accounts, including portfolio management services, alternative investment funds (AIFs) and pension funds; and offshore funds and advisory mandates.

Its total asset under management (AUM) stood at Rs 3,62,550 crore as of June 30, 2017.

RNLAM started its mutual fund operations in 1995 as the asset manager for Reliance Mutual Fund, managed quarterly average AUM of Rs 2,22,964 crore and 7.01 million investor folios, as of June 2017. The company managed 55 open ended mutual fund schemes including 16 ETFs and 174 closed ended schemes for Reliance Mutual Fund at the end of June quarter.

Issue Details

The initial public offering of up to 6.12 crore equity shares will close on October 27, 2017.

The offer consists of a fresh issue of up to 2,44,80,000 equity shares and an offer for sale of up to 3,67,20,000 equity shares by promoters – Reliance Capital and Nippon Life Insurance Company.

The issue will constitute 10 percent of the post-offer paid-up equity share capital of the company.

Investor can bid for minimum 59 equity shares and in multiples of 59 shares thereafter.

Objects of the Issue

The net proceeds from fresh issue would be utilised for:-

> Setting up new branches and relocating certain existing branches (Rs 38.31 crore);

> Upgrading the IT system (Rs 40.65 crore);

> Advertising, marketing and brand building activities (Rs 72.09 crore);

> Lending to subsidiary (Reliance AIF) for investment as continuing interest in the new AIF…