First-time investments by venture funds plunged last year

Venture capital funds cut back sharply in first-time investments in Israeli startup companies last year, figures released Wednesday by IVC Research Center and the law firm, APM & Company. These investments dropped 23% from 2015 to 341, with the decline led by a 30% drop by Israeli VC funds. Foreign funds also pared back their first investments but by a more modest 15%. Yonatan Altman, APM’s chairman, attributed the decline to investors seeking to reduce the risk involved in putting money into young startups. “2016 was a year of political and social turbulence that were reflected in the markets and affected everyone’s financial decision-making, whether consciously or unconsciously,” he said. The top three first-time investors last year were UpWest Labs, a micro fund with just $9 million under management; Singulariteam, which was $251 million to invest; and the crowd-funding investor OurCrowd, each of which put out money into eight startups over the year. (Eliran Rubin)

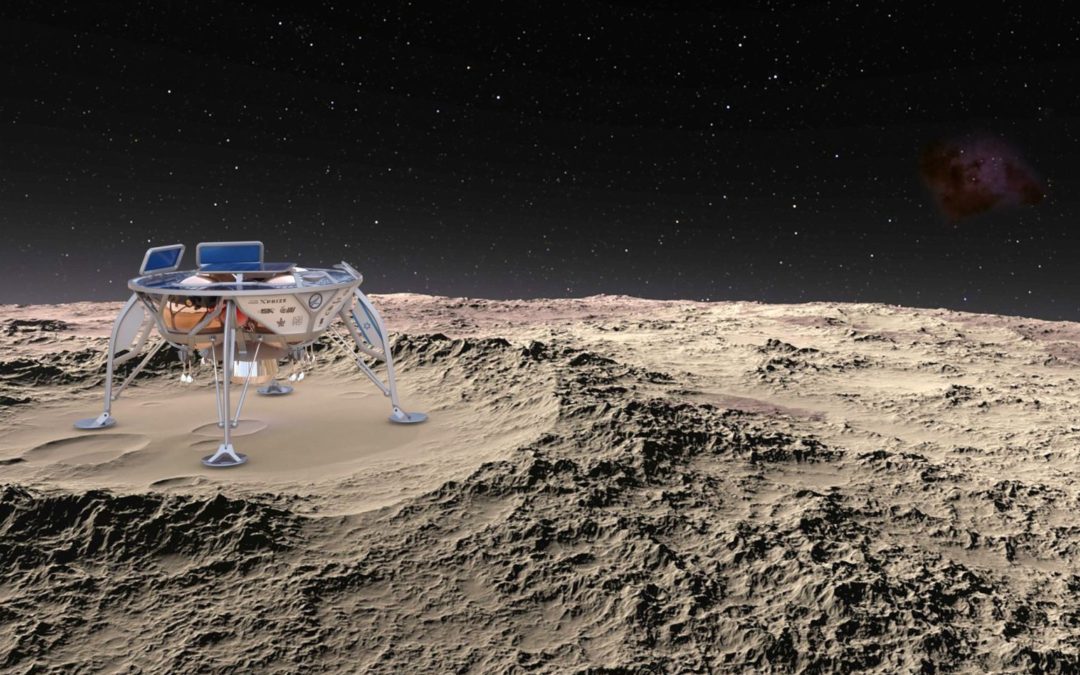

Israel’s SpaceIL one of five finalists in global race to the moon

Israel’s SpaceIL will face four other contenders from the U.S., Japan, India and a consortium of 15 nations in a contest to send the first private spacecraft to the moon. In addition, to SpaceIL, XPRIZE and Google announced on Tuesday that the finalists among 16 entrants were Moon Express of the United States, India’s Team Indus, Japan’s Hakuto and the Synergy Moon consortium. SpaceIL was…