Pharmatech startup MUrgency catches Wipro’s Rishad Premji’s eye, gets funding

Pharmatech startup MUrgency catches Wipro’s Rishad Premji’s eye, gets funding.

MUMBAI: An entrepreneur who almost a decade ago ran the popular ambulance service in Mumbai under the “1298” moniker and then launched a start up billed as the Uber of emergency response with pilot projects in Punjab and Dubai has caught the fancy of some of our biggest tech titans and savviest angel investors.

After Ratan Tata and Infosys cofounders Kris Gopalakrishnan and SD Shibulal, Wipro’s scion Rishad Premji has invested in pharmatech start up MUrgency.

The Silicon Valley-based start-up provides emergency response services by tying up with professionals on location and bills on its portal like Uber or Amazon that act as facilitators to reach a service.

Already present in two regions, it plans to large scale expansion.

The company founder and chief executive Shaffi Mather had earlier started ambulance service popularly known as 1298 Ambulance Service in India around a decade ago.

It was backed by IDFC, HDFC, Acumen Fund and India Value Fund.

Similar to the Uber model a registered care giver can receive the call and will then come to the location of the emergency within the timeframe pointed by the system.

The call response yields a billing of Rs 350, but the additional charge of any medicine or care given on average in the pilot comes to around Rs 3,000 per call, said a person familiar with the pilot.

That is the gap MUrgency is trying to bridge,” said the person.

Fidelity funds high on hot startups

They’re the hottest deals in the venture capital world — startups like Uber and Snapchat owner Snap Inc., whose values soar beyond $1 billion long before going public.

“Mutual funds are interesting in the sense that it’s not just some wealthy family or Saudi prince’s money — it’s our money,” said Lerner, who has tracked the venture capital business for 25 years.

He and two colleagues from other schools evaluated 99 big pre-initial public offering deals from 2009 through 2016, looking at 500 total rounds of financing worth $52 billion.

Lerner and his colleagues concluded that mutual funds contribute about 20 percent of the total funding for unicorn investments, and that mutual funds’ holdings in such companies have increased dramatically, to more than $10 billion in 2016 from $1 billion in 2009.

Companies like Fidelity, T. Rowe, and Wellington “need to participate in these companies while they’re private if they want to be involved in the hyper-growth period,’’ said Kirsten Morin, a senior investment manager in global venture capital at Aberdeen Asset Management in Stamford, Conn.

The flood of money coming from mutual funds, hedge funds, and foreign governments is not always welcome in traditional venture circles.

But hot startups are staying private for longer — more than seven years, on average, Morin said — and often need to seek money from nontraditional investors to keep fueling growth.

Uber, the San Francisco ride-hailing company, for instance, has raised $12.9 billion from a range of investors, including Fidelity and Wellington, according to data compiled by The Wall Street Journal.

He also said mutual funds have to be more concerned with being able to get out of these large private investments if necessary, while venture firms are accustomed to keeping their money locked up for three to seven years.

“After we invest, we treat them like a public company and help them prepare for an eventual IPO.” Leading mutual fund venture deals (2009-16) Fidelity Investments 56 T. Rowe Price 33 Hartford Funds 32 Principal Funds 21 BlackRock 18 SOURCE: Sergey Chernenko, Josh Lerner and Yao Ze Beth Healy can be reached at beth.healy@globe.com.

Six mobile app start-ups raise funds

Six mobile app start-ups raise funds.

New Delhi: Six mobile application start-ups incubated at Bangalore-based Mobile10X Apps Hub have raised Rs9 crore in seed funding in last 10 months, said the Internet and Mobile Association of India (IAMAI) in a statement.

Sponsored by the IAMAI, Mobile10X Apps Hub has incubated 35 start-ups in Bangalore and five start-ups in Hyderabad in its one year of operations.

The mobile apps that have raised funding include digitizing car parking app called Zoyo; SpotPlay that allows users to watch videos without Internet connection; travel mobile app Townista; Highway Delite that makes highway commute cashless; an app for transportation called MyOfficeCab; and digital advertising management software AdCamie.

Launched in September 2015, Mobile10X is an incubating program that was launched by industry body IAMAI in association with Google India and payment services provider Paytm.

The programme was targeted at training 500,000 engineering students in five years to build Android and iOS apps and create five app incubation centers across the country, Mint had reported in 2015.

Arushi Chopra

BSE initial public offer gets 51% bids on Day One

The BSE stock exchange’s Initial Public Offering (IPO) of equity garnered 51 per cent subscription on Monday, first day of the Rs 1,240-crore issue.

BSE on Friday raised Rs 363 crore by allotting 4.6 million shares to anchor investors at Rs 806 each.

The price band for the IPO is Rs 805-806.

Excerpts: India Infoline: “Valuations justified” Improvement in market share in certain products and activities have enhanced FY17 revenue (annualised figure based on H1FY17) by 16.5 per cent year over year.

At the upper end of the issue price, the stock is available at a price-to-earnings (PE) ratio of 20.6 on FY17 annualised earnings.

With India remaining an attractive investment destination, BSE is likely to see decent growth in business.

BSE has sustained the high competition in past many years.

Geojit BNP Paribas: “Diversified revenue mix” Overall financial performance remained healthy, with revenue registering a compound annual growth rate (CAGR) of seven per cent over FY13-16.

Nirmal Bang: “BSE trying to strike first” Due to lag in adoption of derivatives, BSE lost its dominant position to NSE or National Stock Exchange even in the cash segment.

Further, we believe that with cash per share of Rs 512 (64 per cent of issue price) and implied price-to-earnings ratio of 35 times FY16 EPS (earnings per share) compared to 56 times for MCX, the BSE’s IPO is available at reasonable valuation.

Digital mortgage broker ‘habito’ rakes in £5.5Mn in Series A funding

Habito, the UK’s digital mortgage broker, has managed to raise £5.5 million in Series A funding led by Silicon Valley-based Ribbit Capital, with existing investor Mosaic Ventures also participating.

Habito plans to use the new inflow of capital to step up its rapid growth, improve upon the technology behind its award-winning service and change the face of the outdated mortgage industry for millions of homeowners and new buyers across the country.

Making the scores of Britons either overpaying on their mortgage or terrified to even start the application process their target, habito has developed a simple, fast and transparent way to get people the best mortgage possible.

Since launching in April 2016, habito has helped more than 20,000 people better understand their mortgage and has completed £50 million in mortgage applications.

Habito’s success until today is symbolic of a shift in how consumers want to engage with financial services.

Habito has also developed a revolutionary chatbot, Digital Mortgage Adviser, using artificial intelligence, which has succeeded in halving the average amount of time spent on each case.

With access to over 10,000 mortgage products across a wide-range of lenders, they can find the best possible deal for the customer.

Mortgages are the biggest personal debt most people take on in their lifetime, and habito brings a level of transparency that customers value and expect.

I’m confident that Daniel and his team have the right vision to change the mortgage industry for the better.

East London based habito allows customers access to over 60 lenders in real-time, and helps them complete the entire application online, unlike traditional brokers, where the process drags out over several weeks.

Here’s how tech for good startups can maximise their chances of getting funded

But with such strong competition for limited funding, how can you maximise your chance of success?

Problem definition Many applicants struggle to fully explain the nature of the social challenge they’re addressing.

Tangible social change The strongest applications are clear about the social change they intend to bring about, how they will achieve it and how they will demonstrate their effectiveness.

A useful tip at this early stage is to identify in your application what changes you will measure and what measurement tools you will use.

A common pitfall here is reiterating the social problem and the need for solutions.

What investors want is evidence of strong interest in your solution.

Differentiation Applications that appear similar to what investors have already funded, or what already appears to be available, will struggle in very competitive funding processes which prioritise innovation.

With such competitive processes, and to avoid wasting your own time, make sure you meet the programme criteria.

Team expertise Naturally investors evaluate whether applicants have the skills, experience, capacity and contacts to deliver their proposal.

Therefore it is important to use the application process to sell both your idea and your team.

All eyes on Rs 1,243-crore BSE IPO as first Indian bourse raises Rs 373 from anchor investors

BSE Ltd, the owner of the Bombay Stock Exchange, has set the indicative price band for its initial public offering (IPO) at Rs 805-806 per share, looking to raise Rs 1,243 crore at the top end of the price range.

BSE Ltd has already raised Rs 373 crore from anchor investors, including DSP Blackrock, Reliance Capital Trustee Company, Citigroup, Kotak Mutual Fund, Goldman Sachs, Capital World, ICICI Prudential Fund, IDFC Mutual Fund and Kuwait Investment Authority Fund.

Asia’s oldest stock exchange owners’ IPO, which is set for January 23-25, will see some of BSE’s shareholders selling a total of 1.54 crore shares and will value the stock exchange at Rs 4,400 crore at the top end of the price range.

Some of the top BSE shareholders, who will sell their holdings in the offering, include Singapore Exchange Ltd and investment firm Acacia Banyan Partners, and proceeds from the sale will go to those investors.

“With India remaining an attractive investment destination, BSE is likely to see decent growth in business,” Angel Broking said in a note.

“While equity savings in India remains low, with other asset classes becoming less attractive, investor’s acceptance of equity as an investment is gaining the momentum,” it added.

BSE earns revenues from transaction charges, depository charges, corporate fees, data selling and treasury income from clearing and settlement funds.

BSE earns revenues from transaction charges, depository charges, corporate fees, data selling and treasury income from clearing and settlement funds.

Corporate fees includes annual listing fees, which every company needs to pay to remain listed on the exchange, and is an annuity business.

Earlier December, the company started a spree of investor roadshows to attract people to buy into the issue If successful, Bombay Stock Exchange will only be the second exchange, and first stock exchange, to be listed in India.

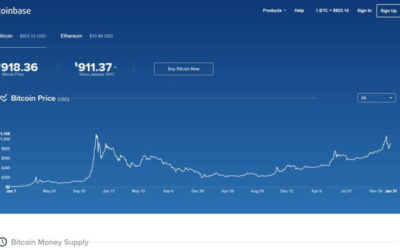

Why Coinbase cofounder Fred Ehrsam is leaving

Five years after co-founding Coinbase, one of the most well-funded Bitcoin ventures, Fred Ehrsam has decided to leave the company.

Last year, Olaf Carlson-Wee, the company’s earliest hire, went off to found a cryptocurrency hedge fund.

In an interview after announcing his planned departure, Ehrsam discussed Coinbase’s battle with the IRS over obtaining information about its customers (he feels confident in the company’s stance) and the growing professionalization of the Bitcoin trading world (he’s all for it).

The reason I feel comfortable leaving now is because the company is doing really dang well.

We’ve accomplished a lot of things in the last six-to-nine months that made us feel like it was a good time.

I’m going to take a little time off.

Like I said, I think this is the first time it’s become viable that you can build some really powerful new ideas on top of the blockchain infrastructure that’s available now.

I’ll take some time off and then start tinkering again.

I believe in his thesis around blockchain-based assets [the currencies native to networks like Bitcoin and Ethereum] becoming a huge thing, especially this idea of tokens.

What are the odds that you’ll return to Goldman Sachs?

Hugo Barra leaves Xiaomi after joining from Google in 2013

Pure Harvest Aims To Overcome Local Climate Challenges And Make Farming High Tech

Foxconn chief: ‘The rise of protectionism is unavoidable’

Foxconn chief: ‘The rise of protectionism is unavoidable’.

TAIPEI (Reuters) – The head of Foxconn, the world’s largest contract manufacturer of electronic goods and a major Apple Inc supplier, said on Sunday that the rise of protectionism is unavoidable.

Terry Gou, chairman of Foxconn, formally known as Hon Hai Precision Industry Co, warned that uncertainties for this year make it tough to have a very clear analysis and outlook, but he said it was clear politics would underpin economic development.

His remarks came after U.S. President Donald Trump pledged to put ‘America First’ in his inauguration speech Friday, reinforcing concerns of a U.S. protectionist agenda that has cast a cloud over the outlook on global trade.

“The rise of protectionism is unavoidable,” Gou said.

“Secondly, the trend of politics serving the economy is clearly defined.” Gou, who did not directly refer to Trump, gave his remarks in a speech to an audience of employees and senior company executives at an annual company event on Sunday.

Taiwan’s tech-dominated manufacturers are nervous about potential U.S. trade policies because Trump has threatened to raise tariffs on imports from some countries, notably China.

Foxconn is one of the biggest employers in China where it operates factories that churn out most of Apple’s iconic iPhones.

In December, Foxconn said it was in preliminary discussions to expand its U.S. operations.

(Reporting by J.R. Wu; Editing by Christian Schmollinger)

Samsung won’t unveil the Galaxy S8 at MWC

Samsung won’t unveil the Galaxy S8 at MWC.

SEOUL (Reuters) – Tech giant Samsung Electronics Co Ltd said on Monday it will not unveil its Galaxy S8 smartphone at the Mobile World Congress (MWC) trade show this year, suggesting the flagship model’s launch may be later in the year than its 2016 version.

Samsung mobile chief Koh Dong-jin said the phone would not get a launch event at the MWC event in Barcelona, which begins on Feb. 27, unlike the previous Galaxy S smartphones.

Koh did not comment on when the company planned to launch the new handset, the first premium model Samsung is due to release since the failure of its Note 7 flagship device in October over safety issues.

The firm showed off the Galaxy S7 on the sidelines of MWC in February 2016, and started selling the phones in March.

(Reporting by Hyunjoo Jin; writing by Se Young Lee; Editing by Stephen Coates)

Tennis legend Andre Agassi’s investment Square Panda blends fun games and digital education

The company has received funding from tennis legend Andre Agassi, who attended CES 2017, the big tech trade show in Las Vegas earlier this month, with company CEO Andy Butler.

Targeted at kids ages two and up, it teaches children phonics and basic learning skills with a multi-sensory system that features sounds, visual aids, and physical toy-like letters.

“I see other companies focus on toys or play and not being curriculum centric,” said Butler.

This is a personal mission of mine to impact the whole area of reading literacy among young children, whether they are dyslexic or not.” About 66 percent of kids aren’t reading fluently by the fourth grade, and those kids rarely catch up to those who are fluent.

The company is made up of game developers and education researchers.

It is focused on kids ages two to seven.

On the iPad, kids can enjoy 10 different learning games that are available to download.

“We start as early as two, as soon as a child developers motor skills, since the company has a platform that is multi-sensory,” Butler said.

In 1994, he started the Agassi Foundation for Education, which has a K-12 charter school in Las Vegas.

Square Panda is his first ed-tech investment, and he is on the company’s board.

Roads? Where we’re going, we don’t need roads.

Roads?

Earlier this week, aerospace giant Airbus confirmed that it plans to test a prototype of a self-piloted flying car by the end of the year, with the ultimate aim of circumventing the growing gridlock on city roads.

The Lilium jet remains a prototype for now, but the company has previously committed to flight testing in early 2017, ahead of commercial production.

Some of the biggest names in technology are looking to a future in which personal flying vehicles are a thing.

Challenges If there are challenges involved in making self-driving cars a reality, the obstacles facing flying cars — autonomous or otherwise — are ten-fold.

Basically, the idea is: “Make flying cars possible, and worry about the other things later.” And that philosophy does make sense.

The technological capabilities are perhaps at a far more advanced stage than many realize, but there is a way to go yet.

A³ CEO Rodin Lyasoff reckons much of the technology is already here, which is why his team is so confident that they’ll be ready to run a test later this year.

“In as little as 10 years, we could have products on the market that revolutionize urban travel for millions of people.” That so many companies are now working toward a future in which “flying cars” are a mainstream transport option makes it easier to imagine a time when this really will be a reality.

Whether that’s in five years, 10 years, or 50 years remains to be seen.

How competitive gaming has to quickly evolve into a mature industry

How competitive gaming has to quickly evolve into a mature industry.

It tallied $892.8 million in revenues in 2016 with over 213.8 million spectators watching the competitive gaming tournaments and matches.

But the landscape has evolved beyond that narrow-minded concern and the market appears to have accepted the reality that competitive gaming is here not only to stay, but thrive.

Another is the interplay between the players, game publishers, and broadcasters.

It increases player engagement, lengthens the longevity of gaming titles, expands the field of franchise awareness, and compounds monetization potential in multiple directions that are continually being optimized and expanded.

All of this, these varied players tailoring their focus directly on esports, will demand a finely woven bureaucratic system to be built and managed to the same degree of depth as we see in traditional sports.

Organizing bodies will have to address standards like minimum pay for players, teams, and support staff like coaches and analysts.

So on a basic level, when it comes to match fixing, illegal or underage betting, doping and other sort of threatening factors, it is crucial that eSports event organizers, game publishers and everyone else in the ecosystem comes together to tackle that.

On a higher level, when it comes to aspects such as player contracts, leagues sharing revenue with teams, player representation and media rights, the industry is facing an explosive growth in all of those areas and it’s only natural individual institutions unite to introduce a level of regulation we can all refer to,” Reichert told me.

Competitive gaming will likely catch up within only a few, and we’ll all watch in awe as it forms into wholes, springs out branches, and develops into increasing influential and highly profitable industry.

Blockchain’s brilliant approach to cybersecurity

However because most implementations of PKI rely on centralized, trusted third party Certificate Authorities (CA) to issue, revoke, and store key pairs for every participant, hackers can compromise them to spoof user identities and crack encrypted communications.

The project, developed at MIT, removes central authorities altogether and uses the blockchain as a distributed ledger of domains and their associated public keys.

CertCoin provides a public and auditable PKI that also doesn’t have a single point of failure.

Protecting data integrity We sign documents and files with private keys so that recipients and users can verify the source of the data they’re handling.

And then we go to great lengths to prove that those keys haven’t been tampered with, which is difficult when the key is meant to be secret in the first place.

The blockchain alternative to document signing replaces secrets with transparency, distributing evidence across many blockchain nodes and making it practically impossible to manipulate data without being caught.

The same applies to data on a blockchain distributed ledger.

KSI stores hashes of original data and files on the blockchain and verifies other copies by running hashing algorithms and comparing the results with what is stored on the blockchain.

“Blockchain technology would help in verifying the integrity of patient data shared across different organizations, create immutable audit trails for data governing health care business processes, and maintain the integrity of data collected in clinical health trials.” 3.

By bringing down the single service that provided Domain Name Services (DNS) for major websites, the attackers were able to cut off access to Twitter, Netflix, PayPal, and other services for several hours, yet another manifestation of the failure of centralized infrastructures.

Everything you need to know about corporate venture capital in Europe

Everything you need to know about corporate venture capital in Europe.

France is the European CVC champion With 67 deals and more than $1.1 billion of capital raised involving corporations in 2016, France leaves Britain (61 deals, $984 million) and Germany (55 deals, $710 million) behind.

Salesforce is focused on investing in scaleups that are an extension of its platform, often marketing tech companies.

Salesforce Ventures was involved in $286 million of investments in Europe last year.

Both Salesforce and Intel made a significant investment in Sigfox, a French provider of Internet of Things connectivity.

The industry that attracted the highest number of CVC investments: FinTech It should be no surprise that FinTech saw the most CVC investments last year, as this is the most funded industry in Europe.

FinTech scaleups received 42 deals worth $499 million from 48 corporate investors.

The European Union aims to make renewable energy 20 percent of its overall energy supply by 2020.

Electricity producers such as German E.ON and French Engie invested in German Thermondo, UK Bboxx, and French IoT scaleup Connit.

Artificial intelligence and data analytics scaleups received $354 million of investment across 41 deals from corporate investors — specifically AdTech (i.e. sales and marketing automation platforms) scaleups using advances algorithms and data.

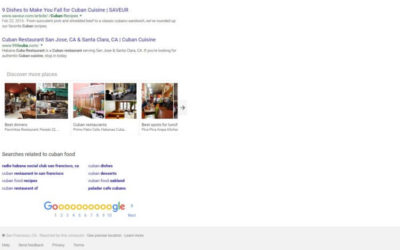

Google Maps’ Explore recommendations come to desktop search results

Google Maps’ Explore recommendations come to desktop search results.

It recently came to desktop Google Search results after arriving first on mobile devices, where the Explore feature made its debut in 2013 as part of Google Maps.

For example, when I search for “fried chicken,” the new feature in search results displays photos and names of restaurants under the categories “Best spots for lunch with kids,” “Chicken and waffles,” “Chicken restaurants,” “American restaurants,” and so on.

Clicking on one of these on desktop takes you to a Google Maps-like interface showing the places in a column on the left and on a big map on the right — from there you can select individual places to see more detail.

But these pages are located at URLs that begin with https://www.google.com/search, as opposed to https://www.google.com/maps.

On the mobile web after tapping one of the categories, you see a stack of cards of places, along with pictures you can swipe through — a stripped down implementation of Explore in the native Google Maps apps.

The feature rolled out to desktop earlier this month after hitting the mobile web in October, and it’s visible for searches about things pertaining to food and drinks for people using U.S. English as their default language, a Google spokesperson told VentureBeat in an email.

“Google is committed to helping people find the most up-to-date, comprehensive, and useful information, so they can make the best decision on where to go.

And we’re always working on new ways to help improve that experience for our users,” the spokesperson wrote.

“Discover more places” typically appears at the bottom of desktop search results and near the bottom on the mobile web; sometimes above it there is other content sourced from Google Maps, such as nearby places plotted on a map and listed immediately below.