SentinelOne, Ashton Kutcher-backed Israeli cyber security startup, raises $70 million

The malware and endpoint protection markets are heating up as companies look to dump oldschool antivirus software Palo Alto-headquartered malware and cyber security SentinelOne announced on Wednesday the close of their Series C funding round, locking down $70 million in new fund.

desktops and mobile, the company aims to provide their clients with real security against malware, a feat that they say traditional products are incapable of providing at this point.

Previous investors Third Point Ventures, Data Collective, Granite Hill Capital Partners, Westly Group, and SineWave Ventures are also reported to have taken part in the funding.

In October 2015, the company came out with their Series B that pulled in $25 million, which was led by Third Point Ventures.

CTO Cohen describes their solution as a dynamic behavioral engine.

“The threat landscape is very dynamic, demanding that the solution be flexible,” he adds, explaining that they can also provide alerts and remediation in the event of an exploit event.

If there is a malware operating from a script or another vector, the system will still detect it in the same way, making it far more flexible than the traditional AV (anti virus) products out there that only cover a more narrow scope of file inspection.

Looking back at the past year, Cohen says that their R&D team alone tripled in size.

Attaining 400% growth over the course of a year feels ambitious, even for a company that has done well over the past year.

“I think that it took some time, but they acknowledge that these solutions don’t work,” says Cohen of the AV products, which he says “used to claim 100% protection for years which was not true.

How To Build A Crowdsourced Company, From the Ground Up

Back in 2012, Ahlborn was part of an online business incubator called that harnessed the power of online communities.

Ahlborn recognized the power of online crowdsourcing platforms like Kickstarter to bring people together, and he wanted to find the best way to harness the wisdom of passionate communities.

Ahlborn thought the project would be a perfect fit to show how a crowdsourcing business model would work and asked Musk for permission to put it on the JumpStartFund platform. “We are a traditional company, we’re just doing it in a different way,” says Dirk Ahlborn, CEO and co-founder of Hyperloop Transportation Technologies.

(Credit: HTT) Today, Hyperloop Transportation Technologies has more than 800 people working as part of its team in 38 countries, with a broader community of over 50,000 people.

It has raised $160 million to date through traditional venture capital.

“My answer is: ‘We are a traditional company, we’re just doing it in a different way.’ ” One of the ways the company is different is that much of its workforce is distributed.

Hyperloop uses crowds in several different ways.

“When you do a traditional job, you’re working on things you have to do 90% of the time,” as opposed to things you want to do, says Ahlborn.

Instead, to tackle tough problems, HTT set up multidisciplinary teams of three to seven people, organized around particular tasks.

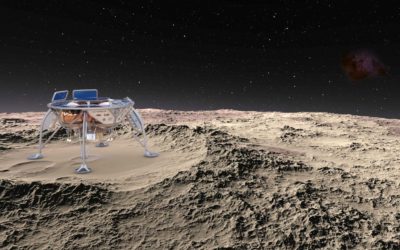

Israel’s SpaceIL One of Five Finalists in Global Race to the Moon

Israel’s SpaceIL One of Five Finalists in Global Race to the Moon.

First-time investments by venture funds plunged last year Venture capital funds cut back sharply in first-time investments in Israeli startup companies last year, figures released Wednesday by IVC Research Center and the law firm, APM & Company.

“2016 was a year of political and social turbulence that were reflected in the markets and affected everyone’s financial decision-making, whether consciously or unconsciously,” he said.

The top three first-time investors last year were UpWest Labs, a micro fund with just $9 million under management; Singulariteam, which was $251 million to invest; and the crowd-funding investor OurCrowd, each of which put out money into eight startups over the year.

(Eliran Rubin) Israel’s SpaceIL one of five finalists in global race to the moon Israel’s SpaceIL will face four other contenders from the U.S., Japan, India and a consortium of 15 nations in a contest to send the first private spacecraft to the moon.

SpaceIL was the first to make it into the final stretch when it secured a position for its Sparrow lunar vehicle on SpaceX’s Falcon 9 rocket in October 2015.

“We took this route because we thought it was the right thing to do – this mission isn’t just ours but for every Israeli who values it,” said Kfir Damari one of the group’s founders.

SentinelOne, founded by CEO Timer Weingarten and Chief Technology Officer Almog Cohen, uses machine learning and behavior analysis to provide threat prevention, detection and response for endpoints and counts Time Incorporated among its customers.

(Eliran Rubin) Secret Double Octopus secures $6 million for cybersecurity Cybersecurity startup Secret Double Octopus, said on Tuesday it had closed a $6 million funding round with Jerusalem Venture Partners, Liberty Media’s Israel Venture Fund, Iris Capital, Benhamou Global Ventures and angel investor Yaniv Tal.

The company got its start in 2015 as an outgrowth of academic research conducted by Shimrit Tzur-David, now chief technology officer, with Prof. Shlomi Dolev of Ben-Gurion University.

Freshii raises $125.35M in initial public offering

Freshii raises $125.35M in initial public offering.

TORONTO — Freshii Inc. says it has raised $125.35 million in its initial public offering.

The Toronto-based restaurant chain says it has filed a final prospectus with securities regulators in Canada for an IPO and secondary offering of 10.9 million class A subordinate voting shares at $11.50 a piece.

The offering will be managed by a syndicate of underwriters, led by CIBC Capital Markets and RBC Capital Markets.

Freshii, which opened its first store in 2005, had 244 stores across 15 countries and in more than 30 states and provinces in North America as of Sept. 25.

The company is known for its health food menu items such as salads, juices and smoothies.

Snapchat Is in Talks for Big Ad Deals Ahead of IPO

Snapchat Is in Talks for Big Ad Deals Ahead of IPO.

As Snap Inc. woos Wall Street ahead of its initial public offering, the parent of the popular messaging app is also spending plenty of time courting another constituency: advertisers on Madison Avenue.

The Venice, Calif. company is in talks with the media-buying arms of several big advertising companies, including WPP PLC, Omnicom Group Inc., Publicis Groupe SA, and Interpublic Group of Cos., and is seeking ad-spending commitments of $100 million to $200 million for 2017 from each firm, according to people familiar with the discussions.

Wall Street will be looking for assurances that Snapchat’s legion of young devotees—it counts more than 150 million daily users—will translate into a giant ad business.

A well-liked executive with ties on Madison Avenue dating back decades, Mr. Lucas has relationships that could help the company attract the big prize it is seeking—a piece of the roughly $70 billion that gets spent on U.S. television ads annually.

“Jeff is old school, he connects with our old-school ad guys and they control billions in TV ad spend,” said one top ad executive.

One ad buyer said that his clients tend to think of Snapchat as a good way to promote a new movie release or product to hard-to-reach young audiences, but not a destination for year-round media buys like Facebook Inc., Alphabet Inc.’s Google or TV.

Sarah Hofstetter, CEO of digital agency 360i, said marketers want to know, “Did it work to build my brand?

Other ad companies spent well under that amount, with one firm spending roughly $30 million, according to people familiar with the matter.

During the Cannes Lions Ad festival in June, for example, when he was still working for Viacom, he helped secure a performance by rapper Flo Rida at a beach party hosted by ad-buying giant Omnicom Media Group.

5 Ways Venture Capital Can Steal Your Dream

Before you consider raising outside capital, here are five things most entrepreneurs don’t realize about the risks associated with raising venture capital: 1.

The worst-case scenario occurs when you invest heavily in ramping up your customer acquisition operation, but the additional sales don’t come fast enough.

Despite the fact that Hsieh had brought the company to $1 billion in revenue and what was reportedly $40 million in EBITDA, his investor forced the sale.

When you’re raising venture capital, then, understand that money is a commodity.

Is the VC able to invest the appropriate amount of time thinking about your company in order to make an impact; or is your company one of 15 boards the VC company sits on?

The quality of your board meetings is directly tied to the culture of your board of directors.

Being a venture capital investor is tough business.

When VCs invest in your company, they structure the investment with preferred stock.

Here’s another example: Your company raised $10 million from a venture investor.

If you hit that grand slam and sell your company for $100 million, you’re in great shape: Your investors will get their $20 million and you’ll get to split $80 million with the rest of the shareholders.

BSE IPO subscribed 17 times on final day

BSE IPO subscribed 17 times on final day.

Mumbai: BSE Ltd., the operator of Asia’s oldest bourse and the nation’s first stock exchange to list, received bids for about 17 times the shares in an initial public offering ending Wednesday.

Bids were placed for 181.5 million shares compared with 10.8 million shares on offer as of 1.45pm local time, according to National Stock Exchange data.

Caldwell India Holdings, Acacia Banyan Partners, Singapore Exchange Ltd. and the Mauritius-based arms of American investor George Soros’ Quantum Fund and foreign fund Atticus Capital were among big investors selling shares in the bourse, according to a draft sale document filed with the regulator in September.

BSE gets about 27 percent of its revenue from transactions, as much as 24 percent from listing, about 42 percent from other sources, and three percent from market data, according to the offer document.

Edelweiss Financial Services Ltd., Axis Capital Ltd., Jefferies India, Nomura Financial Advisory and Securities (India) Pvt, Motilal Oswal Investment Advisors, SBI Capital Markets and SMC Capitals are managing the share sale.

Rival National Stock Exchange of India Ltd. also filed a draft prospectus last month for an initial public offering for about 100 billion rupees ($1.5 billion), pushing ahead with the nation’s biggest listing in more than six years after its top executive resigned.

Bloomberg Santanu Chakraborty

How to Strategize as an Entrepreneur

In this video, Entrepreneur Network partner Patrick Bet-David discusses the importance of strategizing as an entrepreneur and how you can get started.

As an entrepreneur or as a CEO, Bet-David explains, there are four things you are likely doing: working on your next campaign, developing those around you, improving your operating system or doing business development and sales.

Bet-David creates a quadrant for these things and explains the importance of each and their relationships to one another.

When it comes to working on your next innovative campaign, Bet-David means planning ahead.

This will help you beat the competition, too.

Sit with them and help create a roadmap for their success and skill-building over the next months or even years.

From operating systems to business development, there are many ways you can be strategizing as an entrepreneur.

We provide expertise and opportunities to accelerate brand growth and effectively monetize video and audio content distributed across all digital platforms for the business genre.

EN is partnered with hundreds of top YouTube channels in the business vertical and provides partners with distribution on Entrepreneur.com as well as our apps on Amazon Fire, Roku and Apple TV.

Click here to become a part of this growing video network.

A Simple Formula for Mastering SEO the Easy Way

A Simple Formula for Mastering SEO the Easy Way.

If you can master this simple two-step formula, you can master SEO and increase the success and visibility of your content at an ungodly speed.

The first thing you need to focus on to ensure your content ranks highly is relevancy.

Once you have made sure your content is relevant to a search query, the next step is to ensure that the content is high quality.

Get backlinks to your site from authority websites.

Once you have created great content, the next step on your path to SEO greatness is to get links back to that content.

And it all starts with becoming a master of content marketing.

Share your article with them, emphasizing the benefits it will have to their audience and their business, and then request a backlink on their website.

Something that is important to realize is that authoritative sites do not just hand out juicy links.

This will take time, patience and a lot of sweat equity, but if you can master it, you will see your work on the first page of Google in no time.

Join the Perfect LinkedIn Group to Boost Your Bottom Line

From the outside, LinkedIn Groups might appear to be less popular than ever, as recent changes and new restrictions make groups seem smaller and less active.

Sharpen your focus to appeal to a smaller crowd.

Because group members already share a common purpose, the best content creators in any group will attract the most eyeballs and, in turn, the most interested leads.

Data regarding group size, user demographics and the average level of interaction with content will indicate whether a group is worth your time to focus on.

With LinkedIn’s Discover tool, you can easily find some basic statistics about any group and request an invitation, if that’s desired.

Just having a LinkedIn presence makes a company 70 percent more likely to get an unexpected sales appointment.

The stronger your company’s presence on the site becomes, the more that percentage figure increases.

Users can join up to 100 groups on LinkedIn, and you should join every group that seems relevant to your prospects’ interests — especially those where you can provide meaningful content.

One client of ours who owns a software company joined 74 groups that he found relevant to his prospects and started posting content in those forums.

If you can wow them with relevant content, you’ll not only create new leads, but also become a true thought leader in your industry.

No IPO for AppDynamics as Cisco buys it for $3.7 billion

No IPO for AppDynamics as Cisco buys it for $3.7 billion.

Cisco Systems announced late Tuesday that it was buying San Francisco application monitoring company AppDynamics for $3.7 billion in cash and stock, just days ahead of AppDynamics’ planned initial public offering.

CEO David Wadhwani will continue to lead the company as a new business unit within Cisco’s Internet of Things and Applications division.

That division is overseen by Senior Vice President and General Manager Rowan Trollope.

“The combination of Cisco and AppDynamics will allow us to provide end-to-end visibility and intelligence from the network through to the application; which, combined with security and scale, and help (information technology) to drive a new level of business results,” Trollope said in a statement announcing the deal.

Had it sold shares to the public at the middle of that price range, AppDynamics would have been worth $1.6 billion.

The announcement of the acquisition just ahead of AppDynamics’ planned IPO suggests the company may have been running a “dual track” process, in which a company pursues a sale and a public offering simultaneously.

PayPal, after several rounds of talks with eBay, went public in 2002; it sold to eBay for $1.5 billion, a higher price than eBay had proposed in private negotiations, later that year.

More recently, though, it has bought companies and managed them more as stand-alone units, as in its 2015 acquisition of San Francisco’s OpenDNS, an online-security services company, and the 2012 deal to buy Meraki, also of San Francisco, a wireless-networking firm.

Dominic Fracassa is a San Francisco Chronicle staff writer.

5 Ways to Be More Mobile-Friendly in 2017

Look away from your screen for a second.

Maybe it’s time we adjust to this new world, with more mobile-focused efforts.

To keep your company from being left behind in the ever-expanding mobile world, you need to make content accessible to users where they spend most of their time.

Strengthening mobile-focused efforts With so many people consuming mobile content, you need to design in a mobile-friendly way.

Media queries are specialized style sheets that tell a website to recognize what size screen or type of device someone is using to surf the web.

This provides the visual style sheet that’s right for the device accessing it.

These documents are tough to read on mobile and will mostly likely cause users to abandon your site.

Both design and content convey your message to readers, and the nature of mobile content is bite-sized content.

Regardless of what devices or screens your website is being viewed on, responsive design — such as one that turns a carousel of four images into one static image for mobile screens — allows the ideal image size to create a display as bright and professional as possible.

On the flip side of this, even with high-resolution images, you want the lowest file size possible to enable faster load times, reduce costly cloud storage costs and more.

These are the 5 Most Active Acquirers of NYC Startups

These are the 5 Most Active Acquirers of NYC Startups.

Recently, I took a look at 20 NYC Startup Acquisitions in 2016.

In following through with the theme of acquisitions, today I examine some historical data surrounding acquisitions of New York-based startups from our friends at Crunchbase.

Corporations have been active investors in startups recently as excess cash looms on the balance sheet but at what rate are these corporates actually acquiring startups, presenting a path to liquidity.

The following data looks at the 5 most active acquirers of NYC-based startups historically.

For the each acquirer included is the number of acquisitions, the target company, the transaction amount when available, and date of transaction.

As both entrepreneurs and investors, it’s important to know the companies acquiring startups in your market and in your space.

It’s also important to note that this data is set is not exhaustive and that not all acquisition transactions are reported.

There are a number of options to reach this audience of the world’s most innovative organizations and startups at scale including sponsoring a report like this.

Find out more here.

3 Tips to Declutter Your Product Offerings

Conversely, if that same company saw heavy losses, its costs would soar, to a price ceiling.

The lesson here is that while businesses may see feature-heavy products as comprehensive, in fact overly complex products only confuse customers.

A straightforward product, on the other hand, allows businesses to better connect with customers, making it easier for them to sell the product (as well as upsell and cross-sell it).

Having too many frills and features doesn’t mean your product will face legal action (after all, Applied Underwriters was involved in shady behavior), but making your product complex certainly doesn’t do your customers any favors.

Ask yourself and your team the simple question: “What are we good at?” Your firm’s identity gives roots to each product offering and allows products to grow from a focused, recognizable origin.

But if you do offer a hyperspecific product, you’re pigeon-holing yourself, since consumers will believe they can use your product only in a single setting.

Infor then tagged certain functionality building blocks it could adapt, to apply to organic product shelf-life management in one industry or hospital nurse scheduling in another.

Think simple, not small.

As long as you keep your focus on making products and processes simple for the customer, you have the freedom to invent new offerings or reinvent old ones.

Simplifying your product means distilling it to its core purpose and making it easy for customers to understand and use.

Tech startup careers app raises £2.2m funding

His negative job search experience has since resulted in one of the fastest growing recruitment businesses in the UK, with technology and innovation at its core, providing a simple, smart solution that benefits all parties.

This third seed investment is from a combination of venture capital firms and Angel investors including LocalGlobe, London’s leading seed-focused venture capital firm that has backed some of the UK’s biggest success stories, like Zoopla, Graze and TransferWise, Supercell and Playfish backer Initial Capital, Deliveroo investor Entree Capital, and Paul Forster – former CEO & co-founder of Indeed.

Further revolutionising the recruitment process, the app also offers mobile games designed in collaboration with employers to test skills and abilities in candidates or to provide them with insight into the company.

Using these different recruitment features, and having access to data and analytics, companies can reach and hire candidates who may not have been inclined to apply.

Thanks to features such as ‘a day in the life’, students can learn about roles and opportunities they may have never known exist previously.

The investment will also support plans to offer in-app services to school leavers pre-university – another chance to become the game changer for tomorrow’s talent.

Students can often face barriers when it comes to accessing career opportunities – but Debut is breaking these down as all they require is a phone and our free app.

“We are thrilled to have such experienced investors on board to support us on our journey to become the global app for student careers.” Dan Richards, Recruiting Leader at EY commented: “Debut is great for giving us access to an active student market we couldn’t reach in a mobile centric way before.

In just a few months we have made 20 hires, with a further 127 candidates in our selection process.

For recruiters, Debut gives unprecedented access to students who previously they have not been able to access via traditional recruitment methods.

Marketing automation startup Betaout raises investment from East Ventures, others

The software-as-a-service (SaaS) company is also working towards enhancing its mobile offerings and introducing features such as machine learning and live chat plug-ins.

“Indonesia is an important market for us and having the support and domain expertise of East Ventures will help us in executing our vision of enabling e-commerce marketers across South East Asia to retain their customers and drive better return on investment (ROI),” said Ankit Maheshwari, chief executive and co-founder of Betaout, in the statement.

East Ventures, founded in 2010, is an early stage venture capital firm that invests in consumer internet and mobile startups based in Indonesia, Singapore and Tokyo.

Founded in October 2014 by Maheshwari, Raghubir Thakur, Arjun Maheshwari, Nandini Rathi and Mayank Dhingra, Betaout allows customers to build user intelligence databases and provides tools to engage with users through email, live chat and SMS, among other channels.

The round also saw participation from Freshdesk founder and chief executive Girish Mathrubootham, Match Group chief executive Sam Yagan and former chief people officer of Flipkart Mekin Maheshwari.

Betaout was accelerated at the TechStars Chicago 2015 programme, which is run by mentorship-driven startup accelerator TechStars.

It was the second Indian company to be selected by the accelerator, the first being MartMobi, which was acquired by Snapdeal in 2015.

Earlier this month, cloud-based solutions provider SecurAX secured funding from early stage investor Axilor Ventures, Parampara Early Stage Opportunities Fund and a clutch of angel investors.

Like this report?

Sign up for our daily newsletter to get our top reports.

SaaS startup Loyalty Prime raises Series A funding from German investors

SaaS startup Loyalty Prime raises Series A funding from German investors.

Software-as-a-Service (SaaS) platform Loyalty Prime has secured a Series A round of funding from a consortium of investors, including Munich-based early stage fund Senovo, Unternehmertum Venture Capital (UVC) and angel investor Alexander Bruehl, the company said in a statement on Tuesday.

The firm runs the cloud-based loyalty programmes for small, medium and enterprise clients, such as Fraport AG, TRW ZF and Preferred Hotels & Resorts, among others.

Before launching Loyalty Prime, Mohiuddin co-founded NetCarrots Loyalty Services in 2000, which provided loyalty and rewards-related services.

The company has an office in London as well.

“With the funding, Loyalty Prime will be able to accelerate market penetration and is well prepared to become the ‘Salesforce’ of the loyalty industry,” said Jan Boluminski, managing director of Envolved and co-founder of Payback, who is Loyalty Prime’s advisory board member.

The SaaS sector in India has seen a lot of investment interest recently.

SaaS startup Oi Media, a unit of OurInitiative Media Pvt Ltd, a platform for out-of-home (OOH) advertising, raised seed funding from early stage venture capital (VC) fund Quarizon last week.

Early this month, cloud-based solutions provider SecurAX secured funding from early stage investor Axilor Ventures, Parampara Early Stage Opportunities Fund and a clutch of angel investors.

Like this report?

Cisco snatches AppDynamics from IPO market for $3.7B

Cisco has agreed to acquire AppDynamics for $3.7 billion in cash and assumed equity awards, scooping up the application performance management company just days before its expected initial public offering.

The deal, which Cisco announced late Tuesday, is expected to close by the end of April.

AppDynamics was going to be the first tech company to go public in 2017, with its initial offering set for Thursday, January 26.

Tech industry insiders and investors were watching AppDynamics’s IPO closely, because Wall Street investors’ treatment of its business could signal how other companies would fare later in 2017.

That’s important, considering that businesses are often reliant on computerized systems for a variety of key functions.

(For example, a computer problem led to United Airlines putting a two-hour ground stop on all its flights on Monday.)

According to Cisco, AppDynamics will continue to operate as an independent division under the leadership of its current CEO David Wadhwani.

The team will report to Rowan Trollope, Cisco’s senior vice president and general manager for its IoT and Applications business. “The combination of Cisco and AppDynamics will allow us to provide end to end visibility and intelligence from the network through to the application; which, combined with security and scale, and help IT to drive a new level of business results,” Trollope said in a press release.

Cisco is paying a heavy premium.